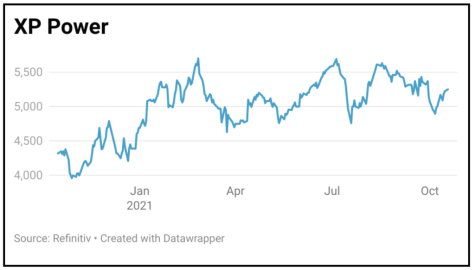

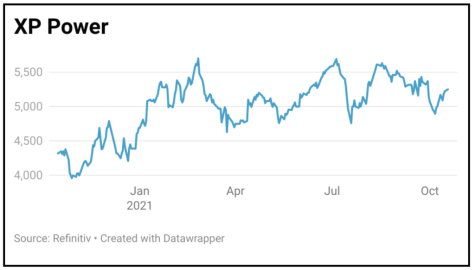

XP POWER (XPP) £52.475

Gain to date: 14.7%

Original entry point: Buy at £45.75, 20 August 2020

Component shortages continue to dog global manufacturing but some companies have navigated the supply chain strain better than others.

Power components designer XP Power (XPP) recently admitted near-term challenges yet analyst at broker Numis came away from a management meeting brimming with confidence for the longer-term. Interestingly, the analysts left 2021 and 2022 forecasts alone and reiterated scope for the share price to hit £60 records over the coming year or so.

Encouragingly, third quarter order wins of £97.3 million, supported by an ongoing industrial technology recovery and stronger demand in healthcare now imply an order backlog of around £186 million – that’s more than 70% of Numis’ £252.5 million 2022 revenue forecast.

Management also see scope to continue pushing operating margins higher from the 19.4% posted in the first half this year, which is still 270 basis points below five-year peak margins, Numis says.

The company sees emerging acquisition opportunities and it has the balance sheet strength to tap into them when ready (net debt to earnings for interest, tax, depreciation and amortisation is just 0.3 times).

SHARES SAYS: XP Power shares remain attractive for longer-term value creation.

‹ Previous2021-10-21Next ›

magazine

magazine