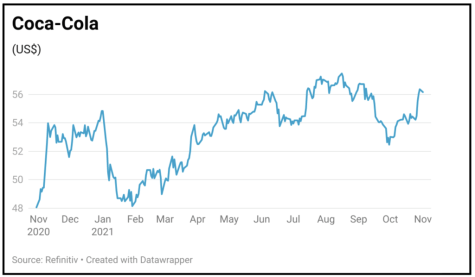

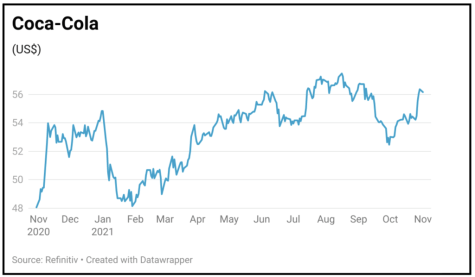

Coca-Cola $56.17

Gain to date: 15.9%

Original entry point: Buy at $48.48, 20 July 2020

Our call to buy Coca-Cola shares last summer continues to look well-timed despite the share price losing some fizz of late.

We think the decision to take full control of sports drink maker Bodyarmor in a $5.6 billion deal, it’s largest ever brand acquisition, could add another string to its bow.

Coke already owned 15% of the business but its decision to take a full stake suggests it is poised to step up the battle with rival PepsiCo, whose Gatorade product is the market leader.

The Bodyarmor deal follows a third quarter earnings update which beat forecasts as the company continued to enjoy robust at-home sales but also saw a recovery in out-of-home sales as Covid restrictions were lifted, at least in some geographies.

Earnings per share came in at 65 cents compared with the 58 cents pencilled in by analysts. Despite the strength of its brand it was notable to see Coke ramp up marketing spend, after slashing its budget in this area in 2020 to shore up cash.

SHARES SAYS: Coke remains an excellent long-term investment.

‹ Previous2021-11-04Next ›

magazine

magazine