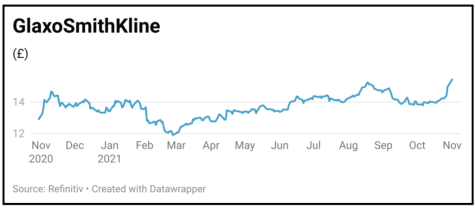

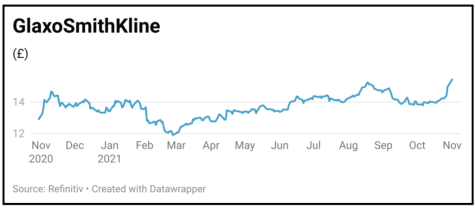

GlaxoSmithKline (GSK) £15.48

Gain to date: 17.2%

Original entry point: Buy at £13.21 on 5 November 2020

Investors have had to be patient, but a combination of self-help and activist pressure finally appears to be having a positive impact on the GlaxoSmithKline (GSK) business and its shares.

Third quarter revenues and adjusted EPS (earnings per share) to 30 September both grew 10% in constant currencies driven by growth across all divisions including consumer healthcare which GSK plans to spin-off around the middle of 2022.

Management consequently upgraded full-year earnings guidance and now expect a decline of between 2%-to-4% compared with a mid-to-high single digit loss previously, excluding contributions from Covid-19 treatments.

The company maintained its full year dividend target of 80p per share and reiterated that it expected a meaningful improvement in revenues and margins in 2022.

GSK recently added more scientific expertise to its board after appointing Harry (Hal) C. Dietz MD, professor of Genetic Medicine at The Johns Hopkins University School of Medicine in the US, as non-executive director.

Increasing scientific expertise to the board was something that activist shareholder Elliot Advisors was pushing for.

The focus now will be on the demerger of the consumer healthcare division in 2022. A recent Bloomberg story highlighted keen interest from private equity at a valuation of around £40 billion.

SHARES SAYS: We remain positive.

‹ Previous2021-11-04Next ›

magazine

magazine