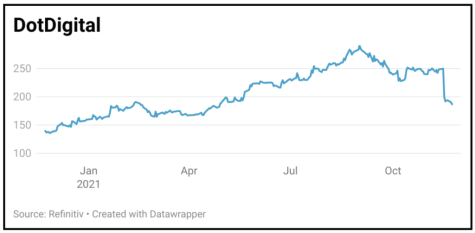

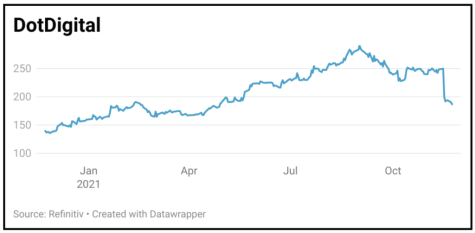

DOTDIGITAL (DOTD:AIM) 187p

Gain to date: 10%

Original entry point: Buy at 170p, 4 March 2021

The marketing technology company took one hell of a hammering last week that left analysts across the board scratching their heads. DotDigital (DOTD:AIM) had already indicated a better-than-expected finish to a record year so when confirmation came in the shape of record revenues, organic growth of 23%, profit and free cash flow helped by the pandemic accelerating the digital switch, the fact the stock plunged 25% was little short of gobsmacking.

‘We think this arose from the company guiding to a more normalised trading environment in full year 2022,’ says Berenberg, trying to apply some rationale to the sharp fall.

There was clear progress with the firm’s three pillars strategy, delivering a 16% rise in average revenue per customer from more users, 22% international revenue growth, and expansion across channels and product modules. Chief executive Milan Patel is particularly keen on adding tools in the loyalty platform space, something to look out for down the line.

SHARES SAYS: DotDigital and the marketing tech space has been a real Covid winner but there remains enormous post-pandemic scope for ongoing growth. Use the sharp sell-off to buy shares at a cheaper price.

‹ Previous2021-11-25Next ›

magazine

magazine