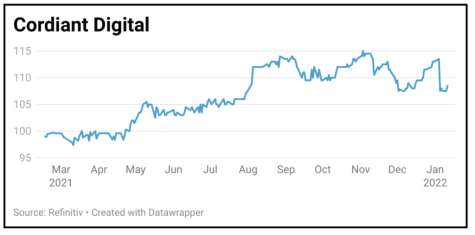

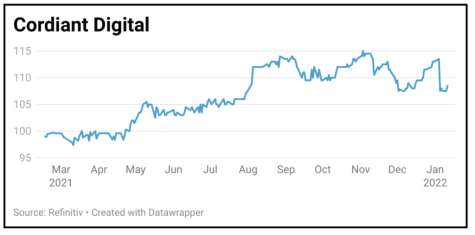

Cordiant Digital Infrastructure (CORD) 108p

Gain to date: 2.9%

Original entry point: Buy at 105p on 13 May 2021

Investor and digital specialist in mid-market data centres, mobile communications, broadcast towers, and fibre optic networks, Cordiant Digital Infrastructure (CORD) delivered a total shareholder return of 9.5% in the first half to 30 September 2021.

The trust finished the period with a net asset value of 102p per ordinary share, which means the shares trade at a premium of around 6%.

The company is targeting a 4p dividend per share for the financial year to 31 March 2023, three years ahead of the schedule communicated at the time of the initial public offering in February.

The trust has now fully deployed its cash following recent purchases of Emitel and DataGryd, a multi-asset Polish platform and a concentrated hub of internet connectivity in New York, respectively.

This means that the C-shares that were created via a £185 million placing in June 2021 will convert into ordinary shares on 20 January.

The company is planning to conduct a £200 million placing at a 6.6% discount to the share price to satisfy a follow-up funding requirement in the portfolio.

SHARES SAYS: The experienced management team is delivering on promises made at the time of the listing.

‹ Previous2022-01-13Next ›

magazine

magazine