After nearly two years of heavy losses, the travel sector is showing serious signs of bouncing back, despite the ongoing drag of the Omicron variant. Increased vaccination rates, pent-up demand and accumulated savings are helping to spur demand for global tourism nations roll back border restrictions.

Organisations from across the travel industry welcomed the UK Government’s decision to ditch pre-departure tests for arrivals into England from 9 January, with Brits returning home also now able to use cheap lateral flow Covid tests rather than booking expensive PCR tests.

‘The removal of pre-departure tests and replacing day two PCRs with more affordable antigen testing will significantly boost the UK tourism sector and help both it and the whole UK economy recover much faster than expected,’ said Julia Simpson, World Travel & Tourism Council chief executive.

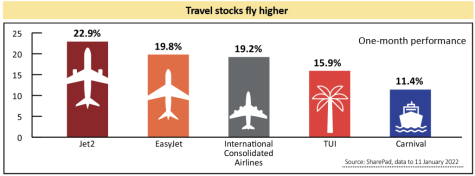

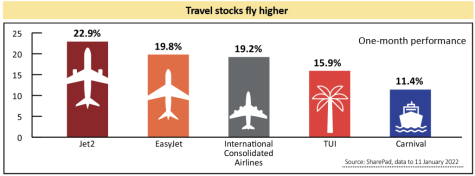

This has spurred demand for airline and holidays stocks, the UK travel sector up more than 3% in the early days of 2022. Yet the travel rally really set in before Christmas. During the past month, shares in BA-owner International Consolidated Airlines (IAG) have jumped 19%.

Budget flyers EasyJet (EZJ) and Wizz Air (WIZZ) have posted similar gains, while Jet2 (JET2:AIM), which provides package holidays and flights to tourists and is one of Shares top picks for 2022, is up 23%.

TUI (TUI), Carnival (CCL) and Saga (SAGA) are all up by double digits too, yet this may be merely the prelude to even greater share price gains across the sector this year.

‘An industry-wide recovery in short-haul leisure travel is expected this summer, reaching pre-Covid levels,’ said analysts at Numis. ‘Many holidaymakers would not have been overseas in three years implying material pent-up demand.’

Last week EasyJet said it saw bookings for some destinations surge 400%, with overall flight demand up 200%, with demand for classic holiday hotspots like the Canary Islands, Alicante and Malaga up sharply.

Numis calculates that the broader sector has underperformed the FTSE All-Share index by 8% since the first quarter of 2020.

‹ Previous2022-01-13Next ›

magazine

magazine