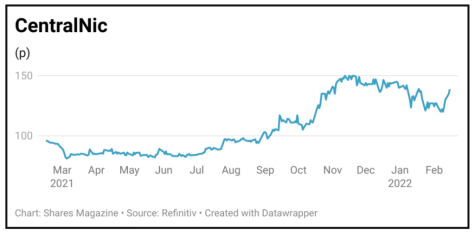

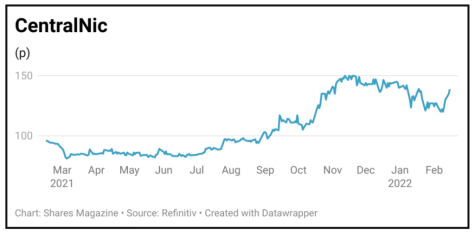

CENTRALNIC (CNIC:AIM) 137.7p

Loss to date: 3.7%

Original entry point: Buy at 143p, 25 November 2021

Internet expert CentralNic (CNIC:AIM) has started 2022 much the same way that it ended 2021, putting up strong growth numbers and continuing its acquisitions push.

That just weeks into its new 2022 financial year CentralNic believes it will beat current forecasts shows just how rampant demand is for online marketing expertise.

Those estimates range between $48 million and $51 million of earnings before interest, tax, depreciation and amortisation on $410 million to $468 million revenue, although Zeus Capital has raised its own estimates by 4% and 15% respectively.

Which makes the shares’ relatively slow progress puzzling and frustrating, for investors and management. CentralNic has been using debt funding for acquisitions rather than risk diluting shareholders at what it believes is a discounted valuation.

The small but strategic purchases of Germany domain name .ruhr and Fireball will bolster its domains business and increase its portfolio of privacy-focused solutions for its growing online marketing customer base and generate extra internet traffic revenue.

‹ Previous2022-02-17Next ›

magazine

magazine