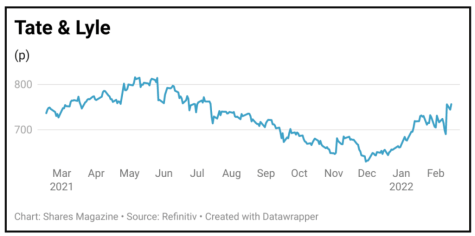

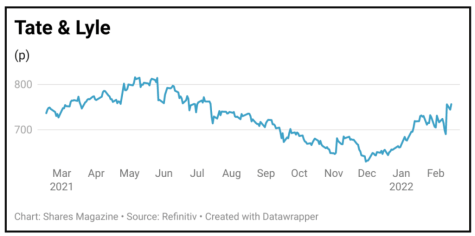

TATE & LYLE (TATE) 747.4p

Gain to date: 14.9%

Original entry point: Buy at 650.6p, 23 December 2021

One of our key stock selections for 2022, shares in Tate & Lyle (TATE) are up 14.9% since we flagged the global sweeteners group’s attractions and they spiked on news (11 Feb) of excellent third quarter trading and reassurance that input and energy cost inflation has been recovered through pricing contracts.

Tate & Lyle confirmed it remains on track to split into two businesses by the end of March. The sale of a controlling stake in its North American Primary Products business will create a higher quality, ‘new’ Tate & Lyle with superior growth prospects and once completed, it intends to return around £500 million to shareholders through a special dividend.

The food producer reported positive momentum for the continuing Food & Beverage Solutions business ahead of the separation and upgraded full year pre-tax profit growth guidance for the new Tate & Lyle from high single digits to low double digits.

Berenberg expects Tate & Lyle to enjoy ‘a material re-rating towards speciality peers, with growth supported by the structural growth enjoyed by the Food & Beverage Solutions unit’.

‹ Previous2022-02-17Next ›

magazine

magazine