Prices of everything from oil and wheat to nickel are surging amid forecasts that supplies from Russia and Ukraine will be disrupted. This threatens to hurt corporate earnings and curb business investment, and at the same time cause consumers to scale back their spending, both leading to economic weakness.

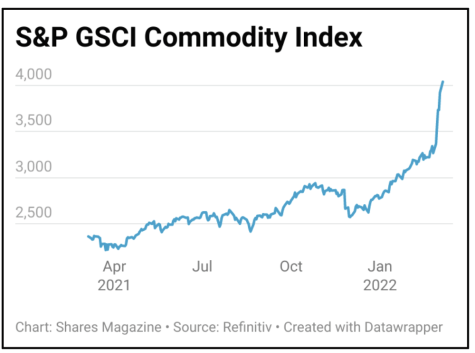

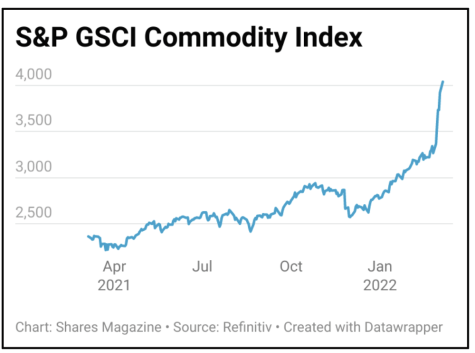

The S&P GSCI Commodity index, made up of a basket of commodities across the spectrum from agricultural products to hydrocarbons, metals and livestock, is up 44.5% year-to-date and 23.8% since Russia invaded Ukraine on 24 February.

According to estimates from Liberum, Russia exports between 10% and 45% globally of key commodities like oil, gas, platinum group metals, aluminium and nickel, while Russia and Ukraine account for a combined 30% or so of global wheat supply.

Speculation over a ban on Russian oil imports briefly threatened to take oil above its previous 2008 record high of $147 per barrel while nickel, a key component in electric vehicles, hit an all-time high of $100,000 per tonne on 8 March. Gas prices have surged with the Kremlin threatening to cut off Europe’s supply.

Wheat prices are also soaring, a development which could have geopolitical consequences given the potential for populations in the developing world to go hungry.

Some of the heat was taken out of these commodities as European leaders cast doubt on an outright ban on Russian gas and oil, after the idea was apparently floated in Washington, presumably on the basis the pain for their economies and populations would be too acute to bear.

The fallout from the invasion is leading to comparisons with the 1970s when cuts by producers’ cartel OPEC to oil production shook Western economies. UK think-tank the Resolution Foundation is warning of the biggest decline in UK disposable incomes since the mid-1970s.

Liberum analyst Tom Price makes the same comparison. He says: ‘Given the potentially large scale/duration of this conflict, we now believe that the global economy is exposed to an energy-related supply-side shock that resembles those OPEC-led oil production cuts of the 1970s.’

The big risk is that we are headed for an extended period of stagflation or recession accompanied by rising prices. This creates an extremely tricky backdrop for central banks – with the US Federal Reserve expected to introduce the first post-pandemic rate hike on 16 March.

Ordinarily central banks would try to cushion the impact on consumers and businesses by cutting rates or introducing financial stimulus for the economy, but they are constrained thanks to already loose monetary policy and the prospect of inflation running further out of control.

‹ Previous2022-03-10Next ›

magazine

magazine