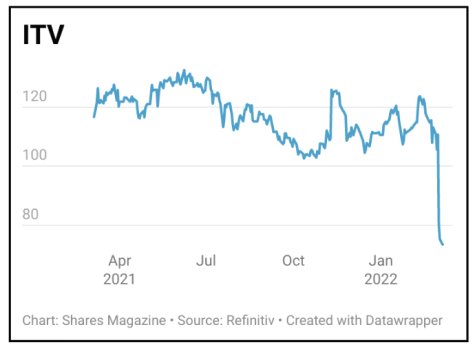

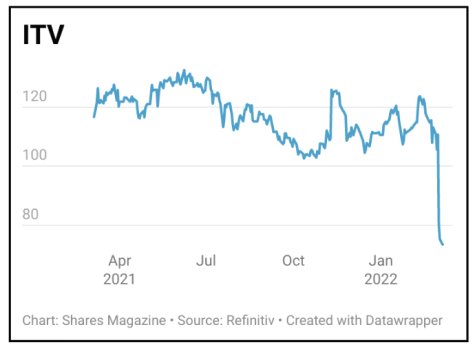

Shares in free-to-air broadcaster ITV (ITV), slumped by nearly 30% on 3 March, despite the group announcing better than expected results.

Investors were shocked by the marked increase in content spend, and questioned the viability of ITV’s new streaming platform ITVX.

Despite being in lockdown for the first three months of the year, a resurgence in advertising spend enabled the company to report a 24% increase in revenue to £3.4 billion.

Meanwhile, pre-tax profit improved from £325 million to £408 million, and the board proposed a final dividend of 3.3p, bringing the full year pay-out to 5p a share.

The market took fright though over the viability and associated costs of the group’s attempt to supercharge its streaming operations, by launching a new platform ITVX.

ITVX is in essence offering viewers the chance to see some of its programmes before they are broadcast on linear TV, as well as its back catalogue of shows.

The service will be free to watch with ads. However, there will be an optional subscription tier that will offer a premiere each week, and 15,000 hours of content. ITV will replace both ITV Hub and ITV Hub+ when it launches later this year.

Investors have been alarmed by the firm’s plans to increase spending on content production. ITV intends to invest £1.23 billion in programmes this year, and a further £1.35 billion next year.

JUSTIFIABLE CONCERNS

There are justifiable investor concerns at the extent of the new investment being made in ITVX, given both the crowded nature of the streaming market, and the negative long-term trends in linear television and the lack of meaningful changes from the existing ITV Hub platform evident in what has so far been announced about ITVX.

In 2021 viewers watched 15.1 billion hours on ITV Hub and its linear channels. This marked a decline of 9% from 2020. Arguably ITV is being forced to invest more in content because it is losing viewers.

Fewer people are sitting down to watch live TV. Increasingly they are switching to the plethora of alternatives including Netflix, Amazon Prime Video, Disney+, Peacock and YouTube.

An additional challenge facing ITV is the vast financial resources of its streaming competitors.

This is likely to further escalate the cost of quality content moving forward. Viewers will always be attracted to companies that can continually provide access to new, innovative and exciting content.

Given the higher content costs, consensus forecasts for operating profit in 2022 have fallen from £800 million to £600 million, or earnings per share of 15.1p.

This places the stock on a forward price earnings multiple of 5.3 times, with a dividend yield of 6%. This valuation may explain why institutional investor Artemis has moved to acquire a 5.1% stake in ITV.

‹ Previous2022-03-10Next ›

magazine

magazine