Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

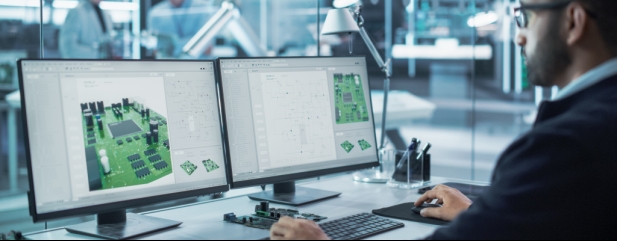

Weakness in the chip industry could spell trouble for the whole tech sector

Given its historic reputation as an indicator of general risk appetite, investors may be wondering why the Philadelphia Semiconductor index, or the SOX as it is known, is falling while the broader US stock market is rising on hopes of a ‘soft landing’ for the economy.

The reason for the weakness is the current chaos in the $160 billion memory-chip industry, which is struggling with an inventory glut at the same time as demand for some cheaper-end memory products is falling.

The chip sector is notorious for swinging from boom to bust almost at the drop of a hat as the economic cycle changes, product cycles shift and manufacturers over-invest in new capacity.

Total worldwide semiconductor sales hit nearly $530 billion in 2021 as customers rushed to stock up after supplies dropped in response to Covid, but the shortfall in chips has been reduced at the same time as supply chain bottlenecks have eased.

The result is customers are cutting future orders as they already have enough stock to work with, sending chip prices tumbling.

Also, sales of some high-volume products which use lots of chips are slowing.

Take smartphones, where South Korean firms such as Samsung Electronics (005935:KRX) and LG Electronics (066570:KRX) are major players.

Both firms delivered disastrous quarterly numbers last month and warned of falling demand for phones, televisions and home appliances.

Consumer and investor favourite Apple (AAPL:NASDAQ) is due to report as Shares goes to press, but an educated guess would suggest iPhone sales won’t be immune from a broader slowdown.

Sales of personal computers and tablets are also falling, with volume shipments this year expected to be around 270 million against 286 million last year and 340 million in 2021 according to Gartner.

In retrospect, it is clear higher spending during the pandemic, fueled by working from home and stimulus (or furlough) payments, simply brought sales of these items forward and now the consumer electronics industry is facing a cliff-edge in demand.

In December 2022, chipmaker Micron (MU:NASDAQ) reported a 38% drop in its previous quarter’s revenues, together with a collapse in its gross margin, and warned the industry’s profitability would be ‘challenged throughout 2023’.

On 26 January its rival Intel (INTC:NASDAQ) reported a 32% drop in fourth-quarter sales and predicted an even bigger fall of 40% for the first quarter of 2023 due to weaker end-markets and falling prices.

As more companies report bad news, there is a risk negative sentiment starts to spread outside of semiconductors to other highly operationally-geared and capital-intensive areas of the technology sector leading to some of the biggest names being pulled down in sympathy.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

- Terry Smith reveals one of his biggest mistakes with Fundsmith Equity Fund

- China versus India: What you need to know before you invest

- Why bonds are back, how to invest in them and our best pick

- Does Royal Mail owner International Distributions Services hold a 'hidden store of value’?

- Paying the bills: How to get £1,500 post-tax monthly income in retirement

Great Ideas

News

- Why Caterpillar's results are better news for wider economy than itself

- Why Alphabet should be afraid of Microsoft’s $10 billion investment into ChatGPT

- New boss has his say as Rolls-Royce stages big share price recovery

- Weakness in the chip industry could spell trouble for the whole tech sector

- Why British American Tobacco has run out of puff

magazine

magazine