Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why investors should access the high-quality growth on offer at Judges Scientific

Judges Scientific (JDG:AIM) £98.82

Market cap: £655 million

Science kit manufacturer Judges Scientific (JDG:AIM) has built up a loyal fan base over the years, both ordinary and professional investors. We continue to see the stock as a core smaller company growth holding that will gradually build value for portfolios, while letting you sleep comfortably at night.

Over the past 10 years, the stock has recorded a 16.2% total return yearly. In other words, £1,000 invested in 2014 would be worth nearly £4,500 today including dividends.

A FOCUSED AND HIGH-QUALITY COMPANY

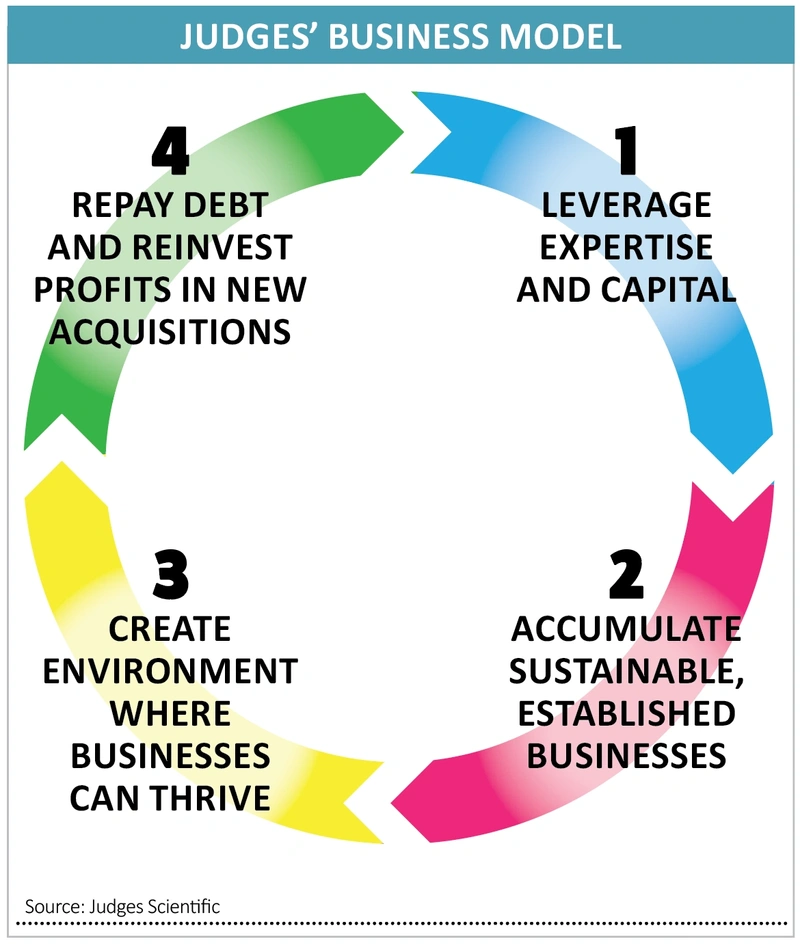

Judges is a focused and high-quality company that runs a portfolio of niche science-based businesses. It has often been seen as a smaller version of Halma (HLMA), the FTSE 100 health, safety, and environmental equipment designer, which is high praise. In a similar vein to its larger peer, Judges likes to hand its portfolio businesses a level of independence, letting local management operate with a certain level of autonomy.

Its activities span a range of interests tapping engineering, technology and advanced sciences that are helping to create the modern world around us, such as nanotechnology, chemical engineering, fibre optic testing, advanced materials research, LED and x-ray technology, and much else. It has won multiple Queens’ Awards for innovation.

What each portfolio business has in common are established products, international customers and scope for sustainable growth, profits, and cash flows. Targets tend to be small, sometimes underfunded specialists well known to the Judges team, which helps de-risk integration and lays a firm foundation for future growth potential without losing entrepreneurial spirit culture, a crucial element of its success over the years.

AN EYE FOR A BARGAIN

Judges’ eye for a bargain also means it seldom pays large premiums for target companies, which are typically funded from existing cash resources or borrowings, which means shareholder dilution is minimal. Equally important, the company is not afraid to walk away from negotiations if the deal is not right, which can lead to occasional dry years for acquisitions.

Higher interest rates over the past couple of years has increased borrowing costs yet there is no question of the company overstretching its balance sheet. ‘Based on its covenant structures, we estimate Judges has £80 million of firepower for full year 2024 (to 31 Dec), affording it significant M&A optionality’, Berenberg analysts recently wrote in a note to clients.

Berenberg’s detailed analysis of various M&A strategies Judges could employ leads it to see potential for an extra 20p per share of earnings being added to current forecasts for 2025.

The underlying business continues to grow organically, with the backcloth becoming more encouraging. In the first half of 2023, Judges posted organic revenue growth of 16.5%, with organic orders up 14%. Organic revenue excludes contributions from all acquisitions in the 12 months before the start of the period under review, so going back to January 2022 in its 2023 first half.

Profit and cash flow continue to impress. Pre-tax profit adjusted for recent acquisitions, jumped 33% to £12 8 million in the half year, while cash thrown off by the business was up 40% at £11.5 million. Net debt for the full year is expected to be about £44 million, barely 40% of shareholders’ equity.

A growing stream of income remains a key part of the package and first half dividends were upped 23% in June to 27p per share. Berenberg is estimating about 93p per share for the full year, so the dividend yield is limited at around 1%.

THREATS COULD EMERGE

Potential threats could emerge with Brexit making life less easy for trade with Europe, while a significantly stronger pound might crimp demand. M&A opportunities could also dry up, in theory. That seems unlikely given the vast fragmentation of its target markets, while a mainly fixed cost base is something that the company can control.

Helped by the firm’s already widespread revenue sources, when rate cuts do eventually come, potentially in the second half of this year, we would expect it help provide a meaningful catalyst for the company.

Judges’ shares have frequently traded on a price-to-earnings (PE) multiple of above 20 to 25, sometimes higher, and a 2024 PE of 25 is in line with larger peer Halma. That said, the valuation factors in no M&A. This leads us to believe that estimates will prove low as the year ticks by, and we would expect the share price to steadily track higher as 2024 progresses.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Funds

Great Ideas

News

- Big banks expected to report largely benign fourth quarter earnings

- Shares in specialty chemical maker Victrex hit fresh multi-year lows

- Global data services specialist Experian continues to deliver positive news

- Consolidation in commercial property market shows no signs of slowing

- S&P 500 surpasses 5,000 milestone and chip design firm ARM almost doubles in a week

magazine

magazine