Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The copper age: Metal driving mining M&A has critical role in energy transition

Copper is already one of the most important materials underpinning human civilisation, and the energy transition is only likely to see demand for the industrial metal build in the years to come.

Limits and pressures on supply and this growing demand profile are already seeing copper prices mount a charge and recent M&A activity – with BHP’s (BHP) unsuccessful (for now) attempt to take over Anglo American (AAL) – is being driven by a need to capture copper supply.

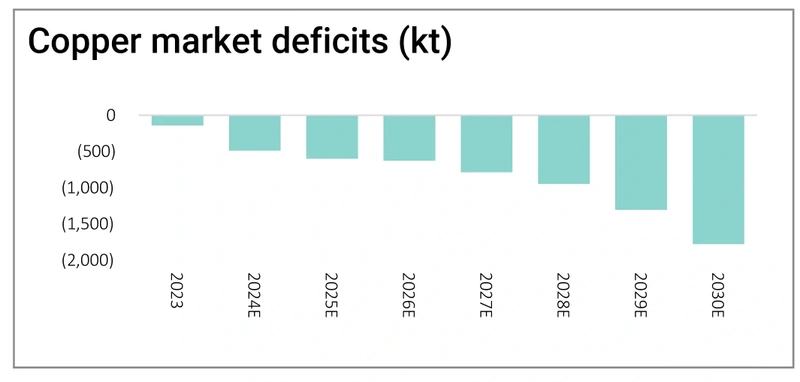

The chief executive of miner and commodities trader Glencore (GLEN), Gary Nagle, warned last year of a ‘massive copper deficit’ coming down the road.

In this article we’ll discuss the copper market in detail, just why the metal is so important and look at ways to play potential further upside in prices.

DR COPPER

Copper’s reputation as a reliable barometer of the health of the global economy has earned it the nickname ‘Dr Copper’. The red metal is used in a very broad variety of different industries and products including electronics, homes and infrastructure.

SUPPLY AND DEMAND DYNAMICS

The roll-out of electric vehicles and renewable energy are both heavily reliant on copper thanks to its role as a critical component in electrical systems. Copper is a highly-conductive metal which transports electricity more efficiently than almost all alternatives, is resistant to corrosion and has high thermal resistance which prevents overheating.

A base-case estimate from consultancy Wood Mackenzie suggests the share of global copper demand coming from green sectors will double over the next decade from 8% to 16% while copper consumption across the world will increase by 24% between 2023 and 2033 hitting 32 million tonnes.

In the short term, economic uncertainty means copper demand could be unpredictable. Like other industrial metals, demand from major commodities consumer China will play a crucial role. There have already been signs of a slowdown in electric vehicle sales as consumers cut back on buying big-ticket items.

Wood Mackenzie notes at the beginning of 2023 production from copper mines was forecast to grow 6% year-on-year in 2024 – by the end of last year that forecast had dropped to 3.9% reflecting cuts in production announced during the final quarter of the year. Over the last few years, drought conditions in Chile – dubbed in some quarters the ‘Saudi Arabia’ of copper thanks to its dominant position in global copper production – have affected output.

SNAPSHOT OF THE COPPER SUPPLY CHAIN

Copper is typically extracted from two types of ore. Sulphide ores contain higher concentrations of the metal but are less abundant and costly to process. Oxide ores are more abundant and found closer to the surface but tend to be lower-grade.

The copper ores are processed through a series of physical steps using high temperatures to extract and purify the copper. These include froth flotation, thickening, smelting and electrolysis.

The metal can then be turned into wire, plates, tubes and other copper products.

WHAT ARE MINING GRADES

Mining grades refer to the concentration of a mineral or metal within an ore (i.e., the rock which contains the mineral or metal) and is typically measured as a percentage or sometimes per tonne. Ores are extracted from the earth through mining and then refined to extract the mineral.

There is a grade below which it is not profitable to mine a mineral even though it is still present in the ore. If the material has already been mined there is also a grade at which it does not make economic sense to refine or process it. The minimum grades vary on a project-by-project basis.

A good copper grade, for example, is anywhere around 1% although some mines are economic at grades of 0.5%.

In some countries, regulation and governmental intervention have had an impact. One notable example is First Quantum Minerals’ (FQM:TSE) Cobre Panama mine which was shut in 2023 by the outgoing administration in Panama after public protests about the environmental impact of mining in the Central American state.

Copper mining grades have also been dropping and bringing new mines on stream is a lengthy and complicated process, typically taking at least a decade from the point of discovery and three to four years from when development has been green-lit.

Mining has also become increasingly capital-intensive. Olivia Markham, co-manager of sector investment trust BlackRock World Mining (BRWM) says: ‘Margins haven’t changed drastically but what has changed significantly is capital intensity. You often see substantial uplift in capital costs from when projects initially get approved and sanctioned and initial decisions are made and that’s quite challenging for companies.’

In this context it is no surprise management teams might be more comfortable pursuing acquisitions instead. BHP’s $39 billion all-share bid for Anglo American would have added four copper mines – Los Bronces, El Soldado, and Collahuasi in Chile, and the Quellaveco mine in Peru – at a stroke without using lots of cash. If a big surge in copper demand and prices is coming then BHP would also have got in ahead of the boom.

Berenberg analyst Richard Hatch says: ‘In our view, the crux of the deal was copper, as the transaction would increase BHP’s copper exposure by around 46% over 2025 to 2030.’

However, dealmaking of this sort will do nothing to increase the global supply of copper, which begs the question, what price is required to incentivise new copper developments?

WHAT COULD HAPPEN NEXT WITH ANGLO AMERICAN?

BHP’s two rebuffed all-share approaches for Anglo American valued the company at £25.08 per share and £27.53 per share – a 14% and 25% premium respectively to the undisturbed share price. When the first bid was made Berenberg pitched BHP’s absolute limit at £29 per share – arguing if it was pushed above this level the company would walk away. Anglo American has mounted a defence – announcing plans to sell off its diamond, platinum and coal mining assets in a bid to improve shareholder returns. Given other companies are looking to grow their copper production, it’s possible another heavyweight joins the fight for Anglo American or a bid comes from China. BHP has until 22 May to put up or shut up.

Work by investment bank Jefferies suggests a price of at least $5 per pound (approaching $11,000 per tonne) is needed, which is around the all-time highs seen in March 2022, and analyst Christoper LaFemina observes the price would need to stay above this threshold for an extended period for large greenfield projects to be sanctioned. This compares with a current price of $4.71 per pound and $9,875 per tonne.

Technologies like coarse particle recovery, sulphide leaching and process optimisation with machine learning could also help address the supply deficit by increasing the amount of copper extracted from the ore.

SUBSTITUTION RISK

It is often said the cure for high prices is high prices, and if copper does spike then it could hit demand and lead end-users to look for alternatives. The main substitute for copper is aluminium. Aluminium is much more abundant and therefore cheaper than copper. It is also more lightweight, but it only has around 60% of the red metal’s conductivity, and mining bauxite – the common ore from which aluminium is sourced – is highly energy intensive.

BlackRock’s Markham says: ‘We always have substitution and aluminium for copper is an obvious one although there are technical limitations. There is a level of pricing where you would see demand destruction and we’re realistic about that.’

Technology and innovation will play a role here – Wood Mackenzie cites the example of Tesla’s (TSLA:NASDAQ) Cybertruck. ‘Tesla moved from 12 volts to 48 volts for the low-voltage wiring, from a distributed to a zonal loop-based architecture for the communication wiring, and from 400 volts to 800 volts for the high voltage wiring. These measures, along with a possible application of aluminium high voltage busbars have, according to Tesla, significantly reduced the vehicle’s copper requirements.’

It will be worth watching developments here closely for signs of meaningful progress which could affect demand for copper over the longer term.

WHO DOMINATES COPPER MINING?

According to the International Trade Administration, Chile accounts for 24% of global production and state operator Codelco makes up a good chunk of that production. Other major producers of copper include Arizona-headquartered Freeport-McMoRan (FCX:NYSE), which also operates the world’s largest gold mine, BHP, Glencore, Mexico’s Southern Copper (SCCO:NYSE), Rio Tinto (RIO), Anglo American and Antofagasta (ANTO).

Over recent months these companies have started to price in the strength of the copper market. However, Markham at BlackRock says there is ‘frustration’ at the lack of movement in the valuation of the broader sector despite the greater capital discipline it has shown in recent years and companies’ improved financial performance. She attributes this in part to the ‘carbon intensity of the sector’.

‘We talk about a brown-to-green transition, and we think the sector is very committed to reducing its carbon intensity and demonstrating real progress,’ she adds.

HOW TO INVEST

You can gain pure exposure to the copper price through exchange-traded product Wisdomtree Copper (COPA) which has an ongoing charge of 0.49%.

A consideration when buying this type of vehicle, which applies particularly to long-term investors, is the impact of the futures market phenomena ‘contango’ and ‘backwardation’. Over time these can have a material impact on returns. Over one year this product has generated a return of 19% compared with a 23% rise in the price of copper.

Investing in copper miners, while it comes with operational risk, also allows you to potentially secure income from dividends and enjoy outsized gains if they can deliver growth. Broad-based mining funds will have material exposure to copper producers and therefore the copper price and will also offer diversification.

In terms of actively-managed funds, BlackRock World Mining has been increasing its exposure to copper and, while its one-year performance is poor reflecting some headwinds for key holdings, over three and five years it has comfortably outperformed the benchmark with annualised returns of 17% and 8.7% respectively. It offers a dividend yield of 5.5%, trades at a 2.2% discount to net asset value and has an ongoing charge of 0.91%.

A lower-cost alternative is tracker fund Van Eck Global Mining ETF (GIGB), which has ongoing charges of 0.5% and tracks a basket of global mining firms.

For investors interested in individual miners, we think Rio Tinto is an interesting option. Currently heavily dependent on iron ore for revenue and profit, it is expanding its exposure to copper with copper output from its Oyu Tolgoi mine in Mongolia set to grow to half a million tonnes a year by 2028 making it the fourth-largest copper mine in the world. Additionally, the company has a newly-developed process being trialed by its Nuton unit which it says can increase the amount of copper it can extract.

Rio’s current chief executive Jakob Stausholm had to address some serious ESG (environmental, social and governance) failings early in his tenure and this means the company may well be ahead of the curve on an issue which is growing in relevance for the sector.

In the small-cap space, Central Asia Metals (CAML:AIM) has a copper operation in Kazakhstan (Kounrad) alongside a zinc-lead mine in Macedonia.

Commenting on the company, Berenberg’s Richard Hatch says: ‘We think there is further upside for this cashed-up, high-yielding producer, underpinned by two consistent operations in the lowest quartile of their respective cost curves. With net cash of $57 million as of December 2023 (zero debt) and a FCF (free cash flow) yield that is set to rise from around 8% in 2023 to a three-year forward average of circa 14%, we envisage upside in additional shareholder returns beyond the current 6% dividend yield.’

Investors looking for development upside, albeit with significantly more risk attached, could look at Anglo Asian Mining (AAZ:AIM). It has a target to produce 36,000 tonnes per year of copper by 2028 as it develops new projects in Azerbaijan.

The company has been hit by lower production from its Gedabek gold mine in the country as the government restricted the use of the existing tailings dam (containing the waste material from mining operations) which lies downstream of the Gedabek town and mine. This has put pressure on the share price but management are hopeful of a resolution soon.

CONTANGO AND BACKWARDATION EXPLAINED

Most commodities are traded using futures contracts, which entail the purchase or sale of a commodity agreed at a fixed price for delivery on a specified date - typically either one month, three months or six months ahead.

This facilitates the buying and selling of the respective commodity without anyone having to take physical delivery of a tonne of copper (or barrel of oil or bushel of corn, say). Only a tiny fraction of these contracts are actually settled through deliveries, with the bulk instead ‘rolled over’ to the next month and the pattern repeated.

Contango refers to the market condition whereby the price of a futures contract in a commodity is above the spot price (the current market price). The resulting futures ‘curve’ would be upward sloping with prices for dates further in the future trading at ever higher levels.

Backwardation describes the reverse - where futures are trading below the spot price – often because of short-term tightness in the underlying market. Arguably contango is a more natural state as it reflects costs of ownership such as storage and insurance.

Because contracts are rolled over to avoid taking delivery of the physical asset, contango sees returns diminished, a phenomenon known as ‘negative roll yield’. Meanwhile, backwardation sees returns enhanced due to a ‘positive roll yield’.

It is worth pointing out these phenomena are more pronounced and prevalent in energy markets than they are in the metals market, but they can and do occur.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- ITV up 30% as streaming platform proves its worth

- UK IPO market hots-up after Shein accelerates plans for London listing

- UK takeovers and premiums back to record levels of 2018

- Intel dealt Huawei blow by US government

- Bruised Palo Alto investors praying for improvement

- Sky-high expectations leave no room for earnings disappointment

magazine

magazine