Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Come back Sir John Barnard, all is forgiven

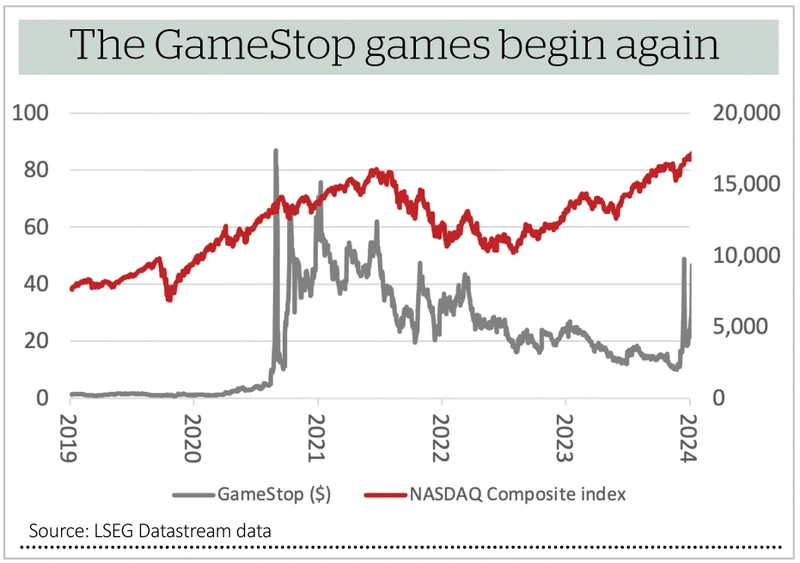

Here we go again. Shares in GameStop (GME:NYSE) are surging, US equity markets are setting new highs and a lowly reading on the VIX index suggests investors are confident that volatility will remain low and equity markets buoyant.

This is all barely three years after the year GameStop melt-up (and, lest it be forgotten, subsequent melt-down), which also saw social media influencers and commentators stir interest in a range of meme stocks, including AMC Entertainment (AMC:NYSE) and even silver (which seems to now be doing rather well despite the Reddit crowd’s apparent loss of interest in the commodity). The last meme stock surge did not last long and, it could be argued, presaged 2021-22’s nasty correction in risk assets.

DEVIL MAY CARE

Benjamin Graham, Warren Buffett’s mentor, argued that the best long-term investment returns were reaped by realists who bought from pessimists and sold to optimists. You can argue that the short squeezers are at least buying from pessimists when it comes to GameStop but may be that more than a few optimists are piling in now, hoping to ride the share price momentum to a quick gain.

Such a devil-may-care attitude to risk can lead to trouble and the precedents are clear to see in the overheated markets seen in the late 1920s and late 1990s and (to a lesser degree) the mid part of the first decade of this century. They all ended in tears and big market setbacks which hurt a lot of investors, traders and ultimately did damage to the wider economy, as money was misallocated and squandered.

Perhaps we should therefore all be heeding the warning of economist (and stock market investor) John Maynard Keynes when he said, ‘When the capital development of a country becomes the by-product of a casino the job is likely to be ill-done.’

TRIGGER MORTIS

Quite what the plan of the latest round of GameStop buyers is remains to be seen, but previous efforts to squeeze short sellers in this stock ultimately failed and it is hard to push around the price of a security or asset on a sustained basis, for three reasons.

The best cure for high prices is high prices. In the end some traders somewhere are going to want to take a profit on GameStop and someone is going to left holding the bag – at least one unfortunate person must have paid the top tick in GameStop at around $470 and be sitting on a loss.

All short squeezes or ramps have an element of a pyramid scheme about them as they need new money coming in to maintain the upward price momentum (and also give early movers a chance to book their profits and move on), so ultimately you start to run out of (other people’s) money.

If none of that works, the regulator can take umbrage and get involved. This is what happened when the Bunker Hunt brothers tried to corner the silver market in the last 1970s, although the authorities only tend to get involved once the bubble has burst, and heavy losses, financial distress or wider market or economic turmoil have resulted.

The collapse of the South Sea Bubble in 1720 eventually germinated Sir John Barnard’s Act in 1734, which outlawed both short selling and the use of derivatives products such as futures and options (and was only repealed over 200 years later). Similar responses followed the 1929 Wall Street Crash, in the form of the Glass-Steagall Act, and the 2007-09 Great Financial Crisis, with Wall Street Reform and Consumer Protection Act (or Dodd-Frank, as it is more commonly known). The theme across all three acts was limits to use of derivatives and leverage.

FOREVER AND A DAY

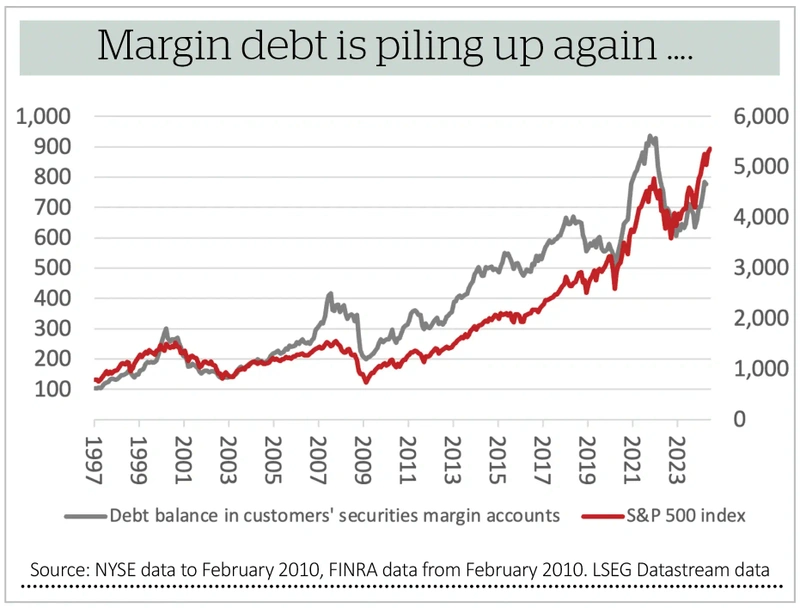

However, the use of margin debt continues to flourish in the US, even if overall levels are still slightly below their record highs.

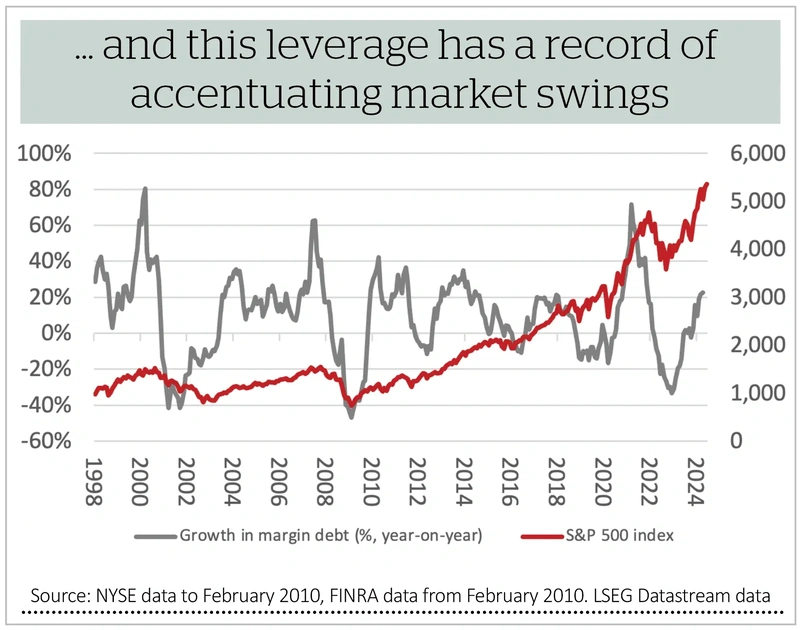

That could be helping to fuel markets now, but history shows that confidence soon evaporates if the market stumbles and history suggests the liquidation (forced or voluntary) of positions bought on margin accentuate any subsequent market decline.

It is here that the greatest dangers may lie today, in these over-the-counter, lightly regulated, trillion-dollar markets which are funded by leverage. Financial innovation, coupled with central-bank provided liquidity, is creating trouble and eroding the stability of financial markets, which have blundered from one crisis to the next with ever-greater regularity in the last 30 years – from Orange County to the Tequila Sunset to Barings to the Asian currency crisis to the Russian debt crisis and LTCM to the tech bubble to the mortgage securities bubble and the Big Short and beyond.

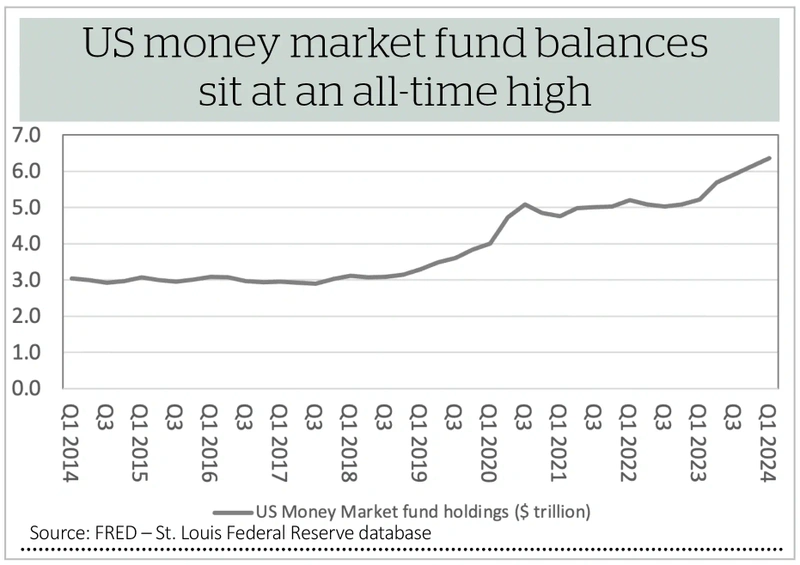

Central banks have a very difficult balancing act ahead of them, as they try to what they feel is right for the real economy without handing out too much rocket fuel to financial markets. It can be argued that fifteen years of zero interest rates and quantitative easing (plus surging house, stock, bond and asset prices) mean the economy is excessively liquid, and the prospect of the Fed cutting interest rates when there is $6.4 trillion sitting in US money market funds, ready to look for a new home, may just have students of stock market bubbles reaching for their history books.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

Great Ideas

News

- Indivior shares give up gains ahead of move to the US

- Character Group in the pink as it predicts full-year profit beat

- European markets nervous as French president Emmanuel Macron calls snap election

- Moderna in prime position to offer first combined flu/Covid shot

- Raspberry Pi float off to great start, can it reinvigorate UK-listed tech sector?

magazine

magazine