Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Is AI creating a tech bubble? Find out what the experts think

That chip designer Nvidia (NVDA:NASDAQ) is now vying for the position of the world’s largest company is arguably less startling than the ‘blink and you’ve missed it’ manner in which it has happened. It took Apple (AAPL:NASDAQ) five years to bridge the $1 trillion to $3 trillion market cap gap, Microsoft (MSFT:NASDAQ) about the same. Nvidia did it in barely a year.

At the beginning of 2023 Nvidia was worth just $360 billion, and it was recently valued at $3.34 trillion, vaulting the other members of the $3 trillion club.

Such a rapid rise in market valuation is bound to set investor tongues wagging and talk of an AI (artificial intelligence) bubble is being increasingly pondered by decision-makers at top funds just as it is by retail investors over a pint in the pub.

IS THIS AN AI BUBBLE?

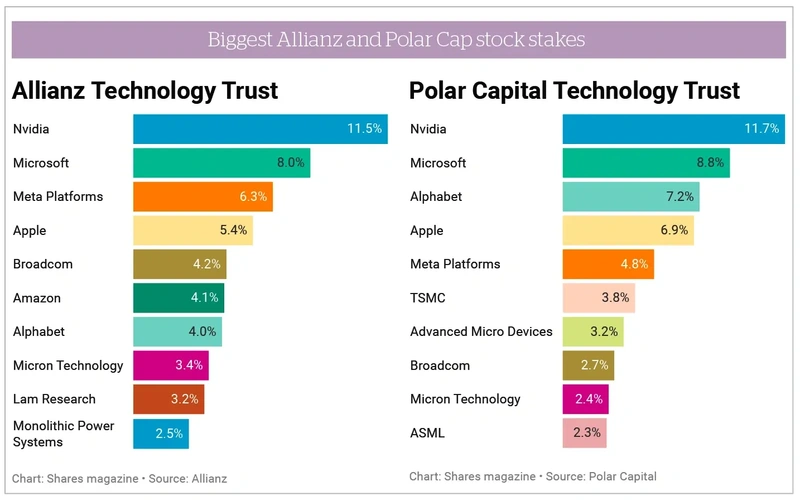

‘I’ve seen a lot of technology hype in my 20-plus years’, says Mike Seidenberg, who runs the Allianz Technology Trust (ATT), a hugely popular choice among UK retail investors. He believes that AI is not hype, but a ‘secular’ theme capable of creating ‘budgetary dollars for the beneficiaries’, even if revenue and profits is likely to ‘zig and zag’ depending on the varied pace of implementation cycles.

Jean Boivin, head of the BlackRock Investment Institute, agrees. ‘The AI rally is supported by earnings and has more room to run, in our view,’ he says. ‘We don’t see an AI bubble.’

While Seidenberg accepts that there may be a ‘little bit of froth in the market’, the power of the solutions today suggest we are just at the beginning of a secular trend, he believes, highlighting AI-powered products from the likes of workflow management platform ServiceNow (NOW:NYSE) and Microsoft’s Copilot.

‘We try to focus on large market opportunities rather than exciting niche applications,’ says Ben Rogoff, manager of the other main closed-ended technology fund in the UK – Polar Capital Technology Trust (PCT). ‘Our philosophy is that returns within tech are generally generated by a few companies, so it’s critical for us to participate in their success.’

This hints at a crucial point made by Seidenberg, who often reminds his team that their job is not to identify the best technologies, but to focus on the opportunities best able to monetise technology developments for the benefit of shareholders, be it in AI, cloud computing, chip design, cybersecurity or whatever.

WHY ORGANISATIONS BUY TECH

There are three reasons why firms buy tech, according to the Allianz fund manager – grow revenues, save costs, and improve customer service. ‘I remind myself of that very often,’ says Seidenberg. He breaks it down into ‘enablers’, such the software firms mentioned previously, and ‘picks and shovels’, or facilitators of AI.

What does AI mean for a datacentre? Seidenberg asks rhetorically. This is an area where Oracle (ORCL:NASDAQ) has been attracting a lot of attention through its cloud infrastructure arm this year. ‘These are the kinds of questions we think about when we find these big secular themes,’ he says.

In theory, new generative AI features will let businesses craft sales pitches using Salesforce (CRM:NYSE), summarise your employees’ skills in Workday (WDAY:NASDAQ), create images from prompts in Adobe’s (ADBE:NASDAQ) Photoshop, and automatically draft responses to IT requests in ServiceNow.

We might not be there yet, but these are the types of companies, with clear routes to generating new revenues and cash flows, that investors should be thinking about.

Tech companies have pricing power, and if AI is as productive as Polar Capital Tech’s Rogoff thinks it will be, there’s going to be a lot of pricing capture in companies that can deliver productivity, perhaps at the cost of other sectors.

‘There are going to be winners and losers and we have clearly seen AI companies taking budgetary dollars from other sectors,’ says Seidenberg. Rogoff agrees. ‘If you’ve invested in advertising businesses or retailers alongside tech over the past 20 years, you haven’t been caught off guard by e-commerce and advertising companies, such as Alphabet’s (GOOG:NASDAQ) Google or Amazon (AMZN:NASDAQ).’

IS TECH AS PRICEY AS YOU THINK?

Yet most investors think technology stocks are expensive (and they frequently are relative to other parts of the market) and that makes many nervous about investing in the sector. ‘Ultimately, if a business doesn’t create superior cash flows and scale, it’s not a very interesting business to us,’ says Allianz’s Seidenberg.

Sustainably above average growth is what the technology sector typically provides and, as Seidenberg says, when you look at many no-tech businesses and their limited growth prospects versus valuations, technology remains attractive from an investment point of view.

‘Campbell Soup (CPB:NYSE) might be a great product but the company isn’t growing very fast,’ he says. Stockopedia data shows Campbell Soup has a compound average growth rate of 7.2% in recent years, and a forward PE (price to earnings) multiple of 14. Compare that to Microsoft, which trades on a PE of 33 but has generated 13.9% CAGR over the same six-year period, while producing vastly superior operating margins, and returns on capital and equity.

Using forecast data from Koyfin, Campbell Soup’s PE will have reduced to 12.9 based on full year 2026 earnings projections, whereas Microsoft’s will have fallen to 28.

Put another way, the relative PEG ratios (price to earnings growth), a metric designed to reflect valuation versus growth rates where the nearer to one the better, stand at 3.4 and 3.0 for Campbell Soup and Microsoft respectively, and readers might ask themselves which they would rather invest in today.

This is not meant as an analysis of either business or stock, it’s merely an illustration, but if it encourages you to think about your perceptions of valuation, then it will have been useful.

‘What it boils down to is, what does the margin structure look like at scale, what do we think the long-term growth rate is, and what are the barriers to entry,’ says Seidenberg. Answering these seemingly simply yet ultimately complex questions is why many retail investors may feel that having help from a proven expert fund manager is the best way to gain exposure to this fascinating and increasingly crucial, if sometimes volatile, investment space.

DISCLAIMER: The author of this article (Steven Frazer) has a personal interest in Allianz Technology Trust and Polar Capital Technology Trust.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine