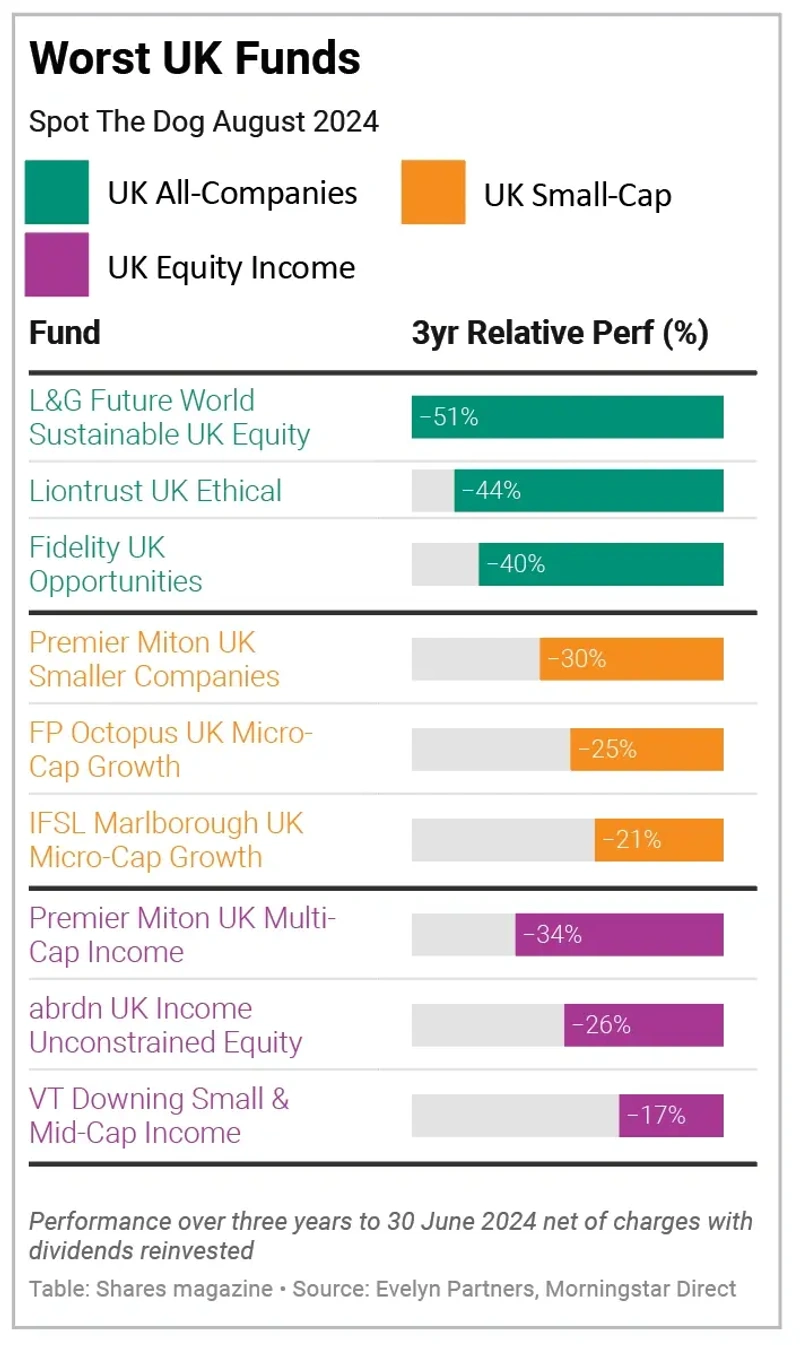

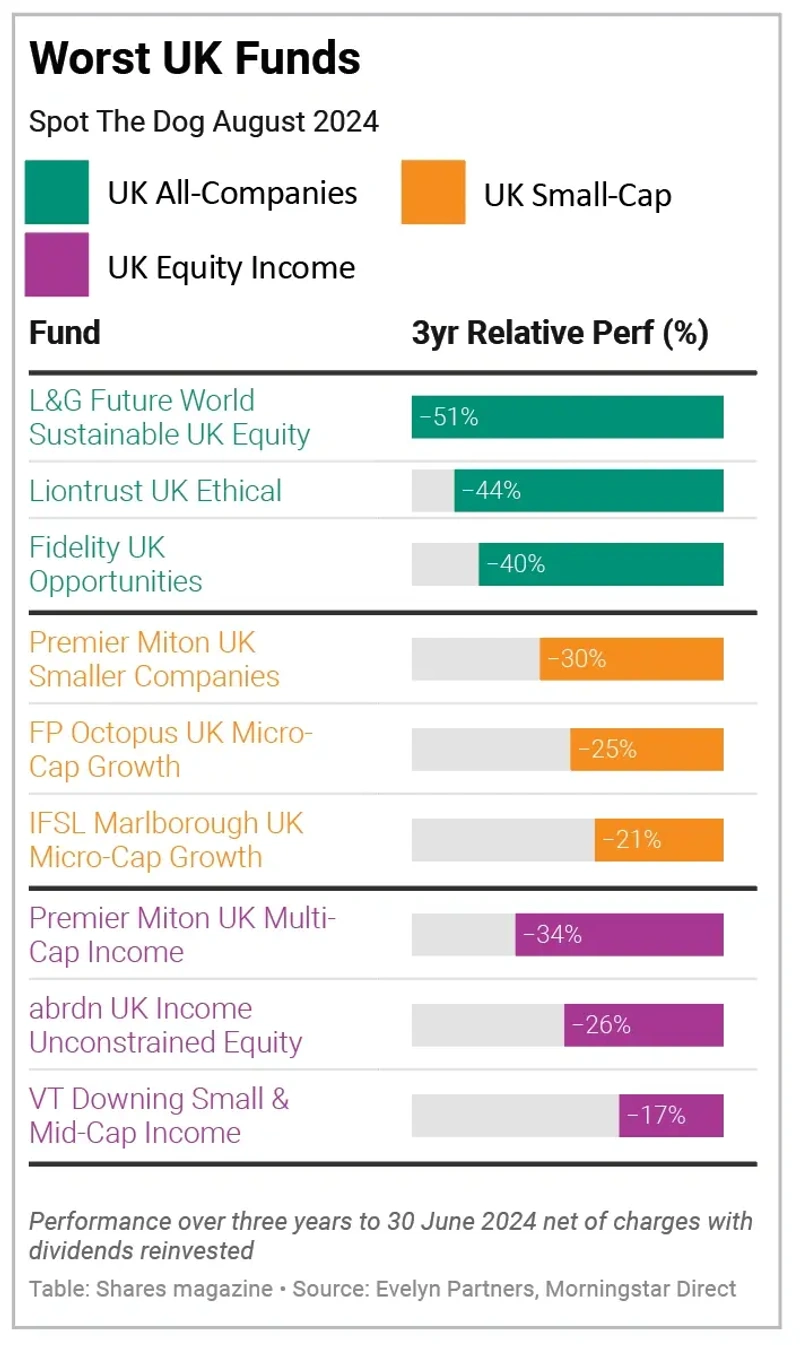

It’s that time of year again when Evelyn Partners releases the summer edition of its ‘Spot The Dog’ report detailing the investment funds which continually deliver poor returns for their investors.

As the authors point out, funds don’t make the list because their sectors are out of favour but because they have underperformed their benchmark for three consecutive 12-month periods and by 5% or more over that time frame.

The total number of funds ‘in the doghouse’ has fallen slightly from the January edition, from 151 to 137, but that is still significantly higher than the 56 funds in last summer’s report, and some ‘high-profile pooches’ have made the list.

Granted, global market performance has been dominated by a tiny group of US mega-cap tech stocks so any fund manager who has been underweight, either due to investment style or valuation worries, will have lagged the benchmark, so it’s not a huge surprise that 44 of the 137 funds on the list invest in global equities.

That tech dominance hasn’t been an issue for UK managers, however, so it’s more surprising to see the same number of UK equity funds (44) on the naughty list compared with just 12 in last summer’s edition.

One common feature among the UK and global equity ‘woofers’ is the high proportion of ESG (environmental, social and governance) and ethical funds on the list.

High oil and gas prices have boosted energy stocks, and funds focused on ‘green’ and ESG themes have missed out by not owning them.

That has been particularly tough for UK ethical and sustainable funds as oil and gas stocks make up a large part of the index.

At the same time, defence companies – which are also shunned by ethical funds – have been some of the best performers of the last 12 months due to rising geopolitical tensions.

There is good news for shareholders in two of the UK’s most popular funds, though – both Fundsmith Equity (B41YBW7) and WS Lindsell Train UK Equity (B18B9X7) have managed to dodge the list this time round, no doubt also to the relief of their high-profile managers.

Disclaimer: The author (Ian Conway) owns shares in Fundsmith Equity.

‹ Previous2024-08-22Next ›

magazine

magazine