Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why chip stocks need to keep cooking

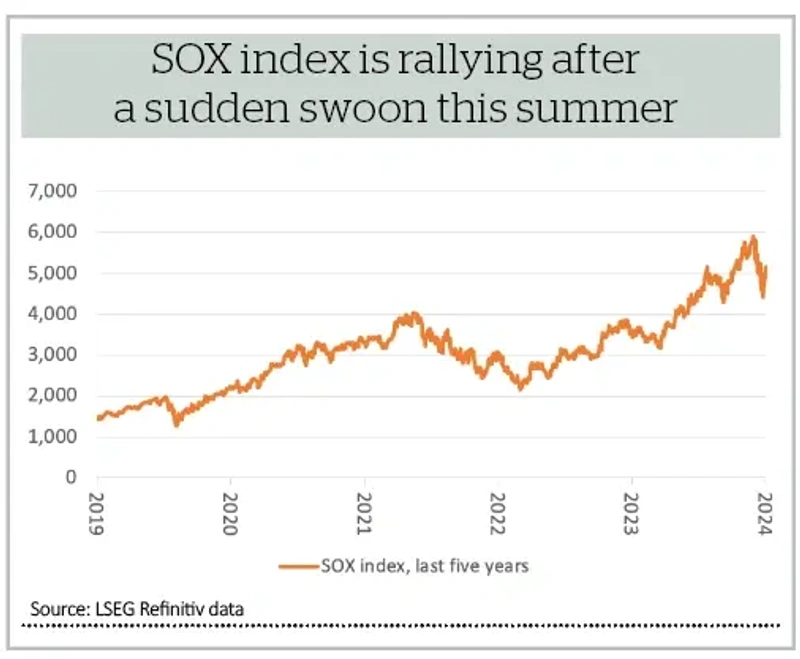

Regular readers of this column will be well aware of its faith in the Philadelphia Semiconductor index, or SOX, as a valuable indicator to follow and after the summer stock market stumble the 30-stock benchmark is well and truly in the headlines. At its early-August low, the SOX had lost 25% of its value in just a month. It has since rebounded by a sixth. Given the SOX’s importance as both a guide to global activity and equity investors’ risk appetite it should be worth keeping an eye on the index, as whether it rises or droops could have a major bearing on where stock markets go from here.

GROWTH INDUSTRY

For those less familiar with the SOX, which comprises makers and designers of both silicon chips and semiconductor production equipment (SPE), it has a market following for two reasons.

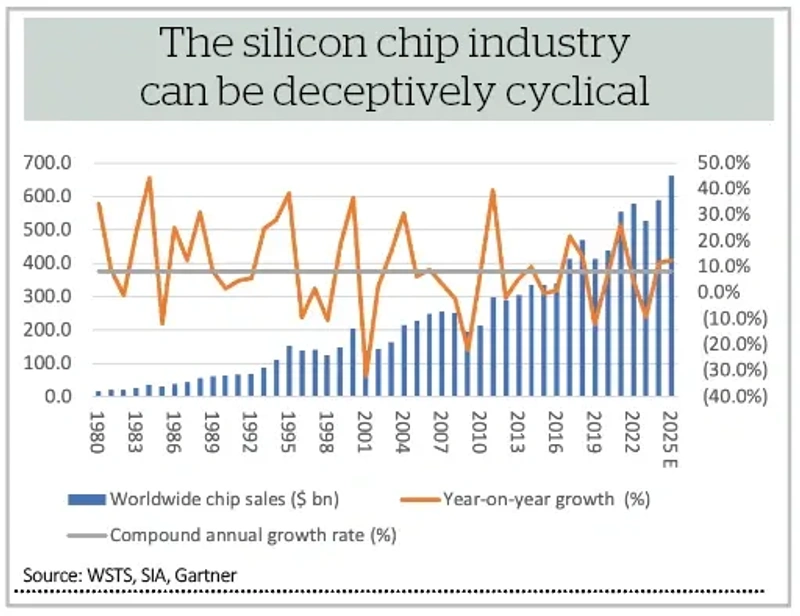

First, by dint of their ubiquity, silicon chips offer a good insight to global economic activity. Worldwide sales are expected to reach nearly $600 billion in 2024 and semiconductors are everywhere, from tablets to laptops, cars to robots, smartphones to servers and smart meters to medical equipment.

Second, the SOX has a decent history as a proxy for global risk appetite in financial markets. Chip and chip-making equipment firms are generally traded as momentum stocks, surging as earnings estimates rise and recoiling if they fall, thanks to how operationally geared they are: even a small percentage changes in sales leads to a much bigger percentage change in profits, thanks to the fixed costs associated with research and development and, in some cases, the hugely capital-intensive nature of the business (a state-of-the-art semiconductor fabrication facility, or fab, now costs billions of dollars).

The SOX has received an extra kicker of late from both investors’ enthusiasm for artificial intelligence and companies’ scramble to invest in this new technology, in chipsets and data servers and centres. This can be seen most clearly, perhaps, in the form of Nvidia (NVDA:NASDAQ) and TSMC (2330:TPE), two of the world’s 10 largest companies by stock market value. Nvidia designs its chipsets and then outsources their production to its Taiwanese manufacturing partner. If anything goes well, or amiss, at either, investors in AI and AI-related names will well take note, whether they have exposure directly to those, or related names, or indirectly through index-trackers, given their lofty weightings in leading benchmarks.

BOOM AND BUST

Global silicon chip sales have shown an impressive 8% compound annual growth rate over the past 40-odd years, a figure which easily surpasses trend worldwide GDP growth. However, the industry is notoriously boom-and-bust.

This is due to either, or a combination of:

1. the rise and fall of new product cycles (such as mainframes, minicomputers, personal computers, mobile phones, smart phones, tablets, data servers, electric vehicles and so on);

2. the vagaries of the economic cycle and increases and decreases in consumer and corporate demand for gadgets and productivity-generating technology;

3. surges in supply as chipmakers over-invest in fresh capacity (and given the long lead times involved in fab construction it is very, very, very hard to calibrate increases in output).

CHIP AND PIN

The good news is industry bodies such as the WSTS and SIA are forecasting 12% sales growth for the industry in 2024 and a similar rate of progress in 2025, to take industry revenues to a new all-time high, thanks in part to the AI boom, hopes for iPhone 16 and ongoing economic growth. A ‘hard’ landing, or unexpected economic slowdown, could upend those forecasts, as could any equally unforeseen slowdown in AI-related investment.

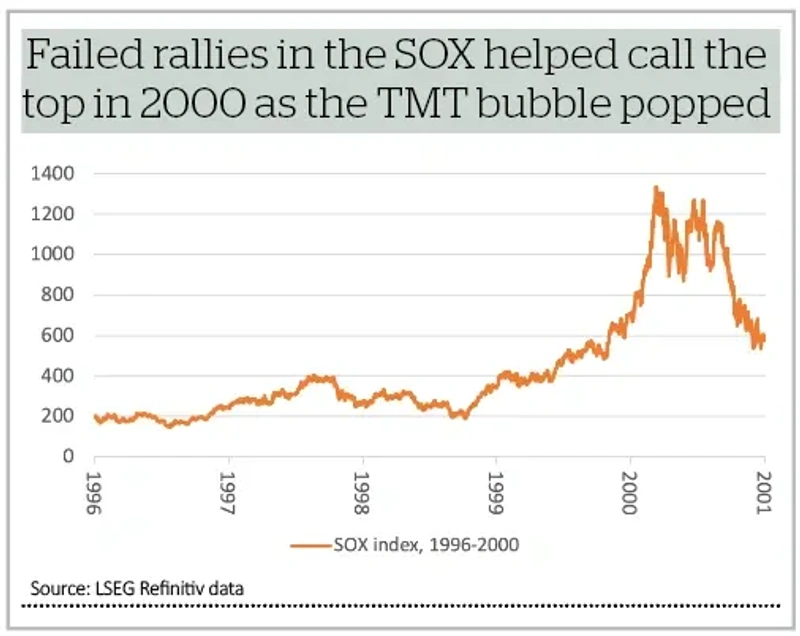

Such a reverse seems unlikely now - but it is not without precedent. Those with long memories will remember the tech, media and telecoms bubble of 1998-2000, which was largely driven by 3G mobile technology, the internet and improved broadband technology and increased data capacity.

The internet and 3G delivered far more than anyone dared dream at the time, but the bubble still burst in 2000-02 when an investment boom turned into a near-term investment bust, as the initial scramble for supply turned into a pause as buyers digested what they had bought and sought to make a return on it.

Stocks like Cisco (CSCO:NASDAQ), Microsoft (MSFT:NASDAQ), Intel (INTC:NASDAQ), Apple (AAPL:NASDAQ) and Oracle (ORCL:NASDAQ), ‘good’ companies with a strong narrative and market leading positions, plunged by anywhere between 65% and 90% as their lofty valuations proved unsustainable – and they were firms whose business models proved robust. Those whose were not inflicted even greater pain on their shareholders.

The past is no guarantee for the future, but this is something even the most bullish investors should at least consider, especially when they look at some the valuations that currently prevail and the growth forecasts they imply over a very long period of time. And the SOX, again, could be a guide. Note the current market action in the index, in the form of the summer pullback and rebound and compare it to the five-year period of 1996-2000 and how the index saw two or three major failed rallies before gravity took hold. Bulls will want to see new peaks reached quickly. Bears will be waiting for a sequence of lower peaks as their sign that the times may be changing.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Great Ideas

News

- ‘Spot The Dog’ survey shows sharp increase in poorly-performing UK funds

- Gooch & Housego outlook clouded by ‘prolonged’ customer de-stocking

- Why Bakkavor is making investors lots of dough

- Find out what the top US investors have been buying and selling

- Pressure on Nvidia ahead of fiscal 2025 second quarter amid Blackwell delays

magazine

magazine