Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

An Ageing World

It’s said there are only two certainties in life – death and taxes – and as it stands the world is steadily getting older, with not enough births or young people coming through to offset the increasing ranks of the middle-aged and old-aged.

Moreover, according to the United Nations’ latest World Populations Prospects study which came out earlier this year, the global population is likely to peak this century with one in four people already living in a country whose population has peaked in size.

So, what are the implications for say the UK in terms of the economy, government spending and the consumption of goods and services, and how should investors think about these factors in terms of their portfolio?

WHAT ARE THE BIG TRENDS?

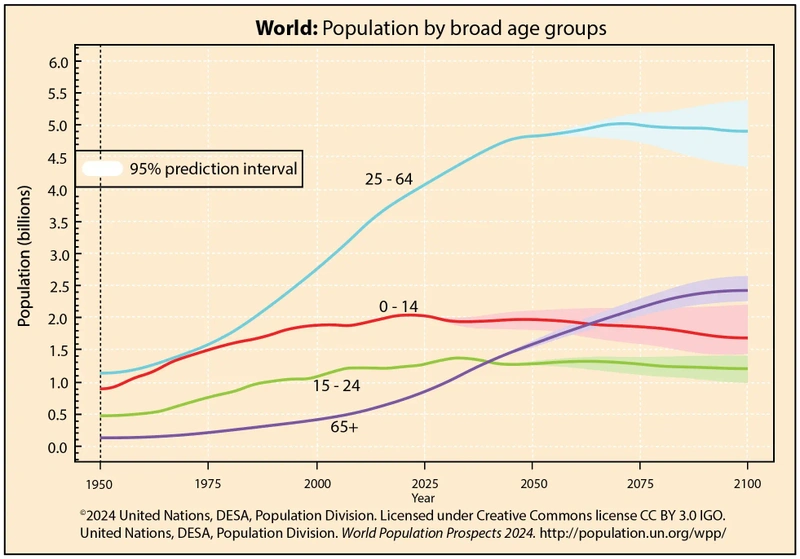

One of the tricky aspects of studying demographics is it is constantly changing – for example, a decade ago the probability of the global population peaking this century was only 30%, but rapid fertility declines in populous countries mean in just 10 years that probability has risen to 80%, while in 63 countries, containing 28% of the world’s population, the size of the population has already peaked.

Women today bear one child fewer than they did on average in 1990, with more than half of countries and areas having a fertility rate below 2.1 which is the level needed to maintain a constant population size without migration.

On the other hand, we are all living longer as global life expectancy has already returned to pre-Covid levels is expected to reach around 77 years by 2054 compared with just over 73 years today.

In about 100 countries or regions the working-age population (20 to 64) will grow over the next three decades, offering a window of opportunity known as ‘the demographic dividend’, but the UN cautions these countries need to invest in education, health and infrastructure in order to capitalise on this opportunity.

WHAT ARE THE TRENDS IN THE UK?

Since 1950, the UK population has grown from just under 50 million to just under 69 million as of 1 July last year, with women slightly outnumbering men (34.9 million against 33.8 million).

The median age of the population is just under 40, and average life expectancy from birth has risen from 68.6 years in 1950 to 81.3 years with women generally outliving men by around four years (83.2 years versus 79.4 years).

Over the same period, life expectancy from the age of 65 – and this is key when we come to consider peoples’ need to save for their retirement as well as things like demands on the NHS – has risen from 13.2 years to over 20 years, with women once again outliving men (20.9 years against 18.9 years).

The other good news is the natural change in terms of births minus deaths is 35,000 per year, so for now the population is replenishing itself slowly but steadily.

Looking forward to 2054, the UN forecasts the UK population will rise to 75.8 million, which is more or less the peak, before steadily declining through the end of the century.

The median age will have crept up to around 44, but more importantly, the rate of natural change, ie births minus deaths, will have turned negative to the tune of 125,000 people per year.

Life expectancy at birth will have crept up to 85.6 years, with women still outliving men by more than two years on average, while life expectancy at age 65 will have risen to over 23 years meaning those approaching retirement will need to make their pensions and savings stretch that bit further than if they were retiring today.

Finally, while the data applies to ‘more developed countries’ in Europe rather than just the UK, the proportion of working age people (24 to 64) to those in retirement (65-plus) is set to swing from 53.5%/20.5% to 53.7%/29.5% so income tax and other taxes will probably have to rise in order to fund the pensions of those no longer in work.

WHAT ARE THE IMPLICATIONS?

The most obvious consequence of more people living to a greater age and a population which is ageing in general is the need for those in work now to make sure they have enough put aside to live on once they are no longer getting a salary.

That means greater demand for pensions and savings products, which is good news for providers like Aviva (AV.), Phoenix Group (PHNX) and Just Group (JUST).

Aviva is the largest UK provider of individual annuities and of workplace pensions and manages the largest book of equity release mortgages, making it a major beneficiary of the potential increase in demand for savings and retirement products.

In its report ‘Five Steps To Better Pensions’, the PLSA (Pension and Lifetime Savings Association) argues over the next decade contributions into workplace pensions need to rise from 8% to 12%, with employees putting in an extra 1% and companies putting in an extra 3% so both sides contribute 6% each and sharing the burden equally.

Obviously, this is just a recommendation from a trade body rather than government policy but were something similar ever implemented it would substantially increase the financial burden on companies and could eat into their spending in other areas like marketing or R&D (research and development).

THE HEALTHCARE BURDEN

According to the ONS (Office for National Statistics), over the next 25 the fastest-growing age segment will be the over-75s, who are expected to make up almost half the increase in headcount (3.6 million out of roughly 8 million) and account for 13% of the UK population against less than 9.5% today.

An ageing population will need more medication and more replacement knees and hips, as well as glasses and hearing aids, so makers of pharmaceuticals and medical products are onto a winner in the long term.

In terms of care, however, the NHS was already struggling well before the pandemic, and although the new government has made cutting waiting times a priority the job is going to be that much harder with a larger cohort of elderly, infirm patients.

Adding to this burden, diseases such as dementia are much more prevalent in the over-75s (86% of all sufferers according to the NHS), with the number of cases diagnosed each year set to rise from around 900,000 in 2020 to 1.23 million in 2030 using projections from the Alzheimer’s Society.

Care homes are a critical and growing part of the health infrastructure as they provide a better environment for frail and elderly patients who don’t need intensive medical care than hospital wards, and they are cheaper.

There are currently around 13,000 patients in hospital simply because they aren’t being offered care in the community such as step-down, nursing or residential homes, and half of this number have been in hospital for more than three weeks.

Investment trusts such as Impact Healthcare REIT (IHR) are an essential stopgap for the NHS, and demand for residential care is only going to grow over the next couple of decades.

THE TECH EDGE FOR A HEALTHIER, HAPPIER AGING POPULATION

Technological advances can provide many tools that can help us to combat common problems that older people are likely to encounter. If we can match technology with the needs and wants of seniors, improvements can be made to individuals’ lives and society.

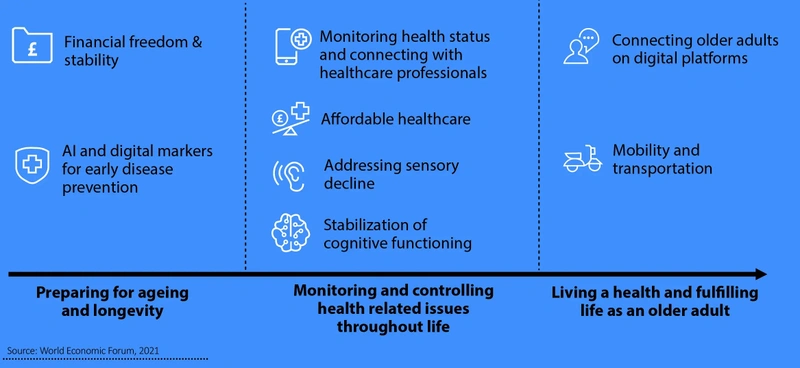

A World Economic Forum report in 2021 explored the topic of tech assisted aging by combining recent academic research on innovation in healthy ageing, splitting their findings into eight segments based on their areas of impact in the human ‘healthspan’ and then split across three categories representing the stages of the ageing process as the graphic shows.

‘Digital tools and services can play critical roles in and enabling healthy and active ageing by promoting independence, enabling social participation, and ensuring healthcare access’, the report said.

According to the WEF, the global technology market for older adults’ care increased from approximately $5.6 billion to an estimated $13.6 billion in 2022 but this is merely scratching the surface of what will likely be required in the future.

A healthier, more independent, and more content older adult population represents ‘a huge market opportunity to create products and services to support the increased life expectancy and empower older adults, ’ the report said.

Imagine a scenario. A 75-year-old has checked in to hospital to receive some minor surgery, but the surgeon is miles away from the theatre. No problem, they connect remotely, and a robotic surgical system conducts the procedure. The patient is then sent home via a self-driving taxi, helped into their home by a humanoid home help, who settles you into your favourite chair to begin recuperation, managing the daily chores (preparing a meal, washing up) for you.

Their ongoing well being is being remotely monitored by an automated healthcare assistant via internal and external sensors, while a recovery physiotherapy programme is administered by your humanoid home help. In the meantime, a robotic exoskeleton suit allows them to move more easily around, while a home hub allows them to stay in touch with friends and family while they rest, entertainment and intellectual stimuli provided by a series of apps help keep boredom at bay while they are confined at home.

This might all sound fanciful right now, much like watching your favourite TV shows on the go or checking your blood-sugar levels with your mobile phone did a couple of decades ago did. Yet it is the sort of connected and automated care system that is already making strides through advancements from companies like Intuitive Surgical (ISRG:NASDAQ), Uber (UBER:NYSE), Tesla (TSLA:NASDAQ), DexCom (DXCM:NASDAQ), Amazon (AMZN:NASDAQ), Keyence (6861:TYO), Cyberdyne (7779:TYO) and many others. [SF]

THE LIFE OF RILEY

Assuming we are fortunate enough still to have all our faculties by the time we reach 75, we may feel like spending our hard-earned wealth and enjoying our golden years.

Travel and leisure has seen a huge boom since lockdowns were eased, but far from ‘normalising’ as many expected demand continues to grow and the industry has homed in on the wealthy retired segment of the market in a big way.

It is virtually impossible to turn on the TV of an evening and not see at least one advert for a cruise: even Antarctica, the seventh continent and the world’s largest wilderness, is no longer beyond the reach of thrill-seeking septuagenarians.

Tour operators, hotel companies and holiday rental portals all stand to gain as wealthy ‘seniors’ take to spending on experiences rather than things like the rest of us – as the saying goes, you can’t take it with you.

AN ETF TO TAP INTO THE AGEING POPULATION THEME

An obvious way to invest to benefit from shifting demographic dynamics is through a dedicated exchange-traded fund which offers a combination of low charges and diversification benefits. The main option is iShares Ageing Population (AGES). This is comfortably the largest and most liquid product and it has relatively modest ongoing charges for a specialist ETF of 0.4%.

Its performance has been relatively uninspiring – with an annualised total return of 4.3% over five years. But over one year it has achieved a 10.2% total return and, given the trends it is looking to tap into are likely to accelerate, there is scope for performance to pick up.

Looking at the names within the ETF is an interesting exercise and could provide some ideas if you want to go down the road of buying individual stocks. The top 10 is a balance between health care and pharmaceutical names and financial institutions selling pensions, life insurance and other retirement-related savings products. Together the financial and health care sectors account for nearly 90% of the portfolio.

Beyond this there are names like Ventas REIT (VTR:NYSE) – which owns and rents out research, medicine and health care facilities – as well as Expedia (EXPE:NASDAQ), to tap into travel demand among an older cohort, and RV (recreational vehicle) manufacturer Thor Industries (THO:NYSE). [TS]

TWO HEALTH CARE PICKS WITH DEMOGRAPHIC DRIVERS

International Biotechnology Trust (IBT) 686.9p

Market cap: £253 million

Demographic trends represent a structural tailwind for the healthcare sector. Ageing populations are richer and sicker which drives increasing demand for healthcare services.

Although undeniably a good thing, living longer exposes humans to more disease as wear-and-tear begins to take its toll on the body, requiring a higher consumption of healthcare services over time.

One caveat to be aware of in this otherwise rosy prognosis for healthcare is the increasing demands on healthcare systems and government budgets, potentially putting pressure on drug prices, but this is nothing new.

While some investors might be comfortable researching and choosing the companies most likely to benefit from these trends, for many the prospects look akin to searching for the proverbial needle in a haystack.

A lower risk option is to invest in a diversified, actively managed portfolio run by seasoned investors.

Portfolio managers Ailsa Craig and Marek Poszepczyski, portfolio managers at International Biotechnology Trust (IBT) believe demographic trends underpin a particularly strong growth story in biotechnological innovation.

More clinical trials are being registered than ever before with nearly 40,000 in 2023, a new annual record. Many of the new drugs are being discovered by biotechnology companies rather than in the research and development departments of large pharmaceutical companies.

This means big pharma is often on the hunt for innovative biotechnology firms to fill their innovation pipelines. Mergers and acquisitions have picked up significantly in recent months and the trust has seen several investee companies taken over at premium prices.

Craig and Poszepczyski believe selective investments in biotech businesses which focus on high unmet medical needs, with attractive valuations and strong earnings potential are key to unlocking outperformance in the years ahead.

The trust trades at an underserved 10% discount to NAV (net asset value) and unusually, pays a dividend of 4% a year paid out of NAV. The trust has outperformed the Nasdaq Biotechnology index over the last five and 10 years and delivered a smoother return.

This is due to the team’s risk mitigation policy and the wide diversification achieved by investing across different therapeutic areas and stages of drug development.

The managers also reduce risk by trading around binary events such as the results of clinical trials, reducing weightings ahead of an event and topping up once the results are known, if appropriate.

The trust focuses on therapeutic areas which have strong pricing power such as cancer and orphan drugs. It has a relatively high ongoing charge of 1.44% a year compared with a 1.16% sector average.

Danaher DHR:NYSE $267.87

Market cap: $194.5 billion

US-listed Danaher (DNR:NYSE) is an unusual company in that the business as it exists today has been pieced together by strategic acquisitions.

Technically it is a holding company with three divisions or franchises comprising diagnostics (40% of sales), biotechnology (30% of sales) with life sciences accounting for the rest.

Danaher was established by the reclusive Rales brothers in the 1980s who envisioned building a company with a focus on continuous improvement and customer satisfaction.

Today they call this DBH (Danaher Business System) and it is inspired by the Japanese business philosophy of Kaizen which means change for the better.

From the 1990s the company started to focus on science and technology and built leadership positions in fast growing end markets with secular growth drivers.

With a keen focus on innovation and improvement, we believe the company is well positioned to benefit from changing demographics.

The company has impressive financial metrics, having converted more than 100% of net profit into free cash flow for the last 32 consecutive years.

Disclaimer: The author (Ian Conway) owns shares in Phoenix Group.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Great Ideas

Investment Trusts

News

- Why investors have dumped Dollar General stock

- Burberry exits FTSE 100 after 15 years but EasyJet looks to have dodged relegation

- Shares in maritime artificial intelligence company Windward are flying

- Gym Group raises outlook ahead of first-half results

- Investors bet on Rolls-Royce recovery after engine trouble sparks sharp sell-off

- US non-farm payrolls in the spotlight after Jackson Hole speech

- Oracle facing growth acceleration acid test

magazine

magazine