Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

TRUMP vs HARRIS

With just over a month to go until the US presidential elections, Shares takes stock of where the two candidates stand in the polls and what the implications of a Democrat or Republican victory would mean for investors.

There is no question the televised debate earlier this month was negative for Donald Trump, to the extent he refused to schedule a re-match.

Yet, despite his poor performance, voting in the seven key states which hold the key to winning the race to the White House is still close, so although Kamala Harris may be polling ahead in the popular vote – as Hilary Clinton was in the 2016 election – the Republican party could still carry the day.

Crucially, investors need to separate popular perceptions of each candidate from the reality of their policies and the potential impact on US businesses, consumers and financial markets.

Finally, we will look at the market’s likely behaviour leading up to the election and in the weeks which follow using historical data to guide our insights.

DEBATES AND DONORS

‘The debate achieved its goal by providing a decisive edge to one of the candidates in what has been an exceptionally close race,’ says Charu Chanana, Saxo Bank’s global markets strategist.

‘The stark contrast to the previous debate in June, which led to Biden’s withdrawal and Harris’s endorsement as the new Democratic nominee, was evident. Harris demonstrated a clear advantage over Trump, with her odds of winning increasing on PredictIt to 56%, up from 53% before the debate. Her strong performance, particularly on tariffs and race issues, highlighted the effectiveness of her arguments and critiques.’

Harris showed her political astuteness, regularly baiting Trump, diverting him from talking about his policies, and giving him free rein to rant about migrants eating pets on the streets of Ohio.

Debates aren’t everything in American politics, far from it, but they do matter to swing voters in as much as they help them decide who they don’t want to vote for. Then it’s up to the campaign managers and advertisers to encourage them to go out and vote for who they do want to win.

Debates also matter to donors, who are crucial to a candidate’s success, and in the 24 hours after the event the Harris campaign reportedly raised $47 million, reinforcing its lead, while the New York Times reported Trump’s rambling, claims aggravated a good many of his rich supporters.

Yes, Trump raised tens of millions in donations after he was convicted in May and after the attempt on his life in July, but last month alone Harris raised $360 million including a $40 million ‘bump’ from the Democratic National Convention, nearly three times the amount received by the Trump camp.

Still, a lot can happen in the next few weeks, and while money can buy ads and boost the candidates it can only do so much, although random events such as an endorsement by megastar Taylor Swift will have done the Harris ticket no harm.

PERCEPTIONS VERSUS REALITY

The current view is a Harris win would be bad for US companies due to her campaign pledge to raise corporate taxes from 21% to 28% and preference for greater regulation, while a Trump win could lead to lower taxes and support for the fossil-fuel industry in particular given his donor base.

‘Harris’ rising prominence could have notable effects across various sectors,’ notes Chanana.

‘Crypto and energy stocks might face headwinds as market sentiment adjusts to the shifting political dynamics. Many of the other Trump Trades such as a weaker Chinese yuan or traction in defence stocks could take a backseat as Harris gains momentum.

‘While a Harris Trade is still challenging to price in, given the complexities of the Senate limiting the prospects of a Democratic clean sweep, a split Congress could mean restrained fiscal spending, keeping the risk of a recession alive for 2025.’

Some Biden policies, such as big spending on infrastructure, are likely to remain in place whoever wins, but there are concerns big tech companies could face a rough ride as both candidates have called for them to be reined in, for different reasons.

Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Fund (BCLYMF3), believes regulation of tech companies is already complex but is unlikely to be made worse whoever wins the election.

‘I can’t see much of a difference between Trump and Harris. Tech is too important to the US economy,’ says Smit. He also points to the fact US companies lead the world in technology and ‘they are the job creators’, so burdening them down with more regulation would be counterproductive.

While the common perception is the US stock market would respond better to a Trump win, investors really need to take on board the full implications of him regaining the White House and in particular his plan to impose stringent tariffs on imports.

As Bloomberg columnist John Authers says, most of the time when Donald Trump is making policy pronouncements he should be taken ‘seriously, but not literally’.

During his first administration, Trump imposed overall tariffs of 2% on imports, but this time as part of his ‘America First’ philosophy he is proposing tariffs of 17% which would represent the highest level since The Great Depression and one of the biggest tax hikes in history according to economists at Barclays.

‘Even after the US imposed an average of 19% tariffs on imports from China, data from the USTR (Office of the United States Trade Representative) show the trade-weighted tariff on all US goods imports was only 2%, with nearly half of all imports currently free from any tariffs. Substitution effects allowed US importers to offset much of the effect of China tariffs. This time would likely be different. The former president plans for a blanket 10% tariff on all US imports, in addition to 60% on China, say the analysts.

In other words, due to the size of their home market it was possible for US companies to find domestic suppliers to substitute for Chinese imports under the previous tariff regime, but as the analysts say this time it would be different.

If Trump is to be taken literally, ‘Once put into effect, this trade policy would force a total revision of the expectation that interest rates are heading lower,’ warns Authers.

‘It would also shake the assumption that the US will continue to grow faster than other economies. And — unlike his ideas on tax, or many of the more market-unfriendly policies backed by Kamala Harris — the president has wide authority to impose tariffs without approval from Congress.’

Not only would tariffs on this scale damage the US economy, implemented in full they would cut eurozone GDP by 0.7% and Chinese GDP by up to 2%.

‘Tariffs are not a zero-sum game with winners and losers. In a global trade war, everyone loses,’ says Barclays’ Ajay Rajadhyaksha.

WHAT WOULD IT MEAN FOR MARKETS?

If Trump wins, and actually implements across-the-board tariffs, it is likely the dollar would spike, which is something the former president explicitly doesn’t want.

Inflation would also likely spike, which could force the Federal Reserve not just to stop cutting rates, as Authers suggests, but actually to raise rates, which in turn would push the dollar higher, putting the central bank on a collision course with the White House.

The equity market – and even more so the bond market – would likely take a very dim view of proceedings and volatility could return with a vengeance as investors cut and run.

Of course, there is no more than a 50% chance Trump wins, so these fears may prove unfounded, and if history is any guide there are reasons to believe whoever wins in November the markets may simply take things in their stride.

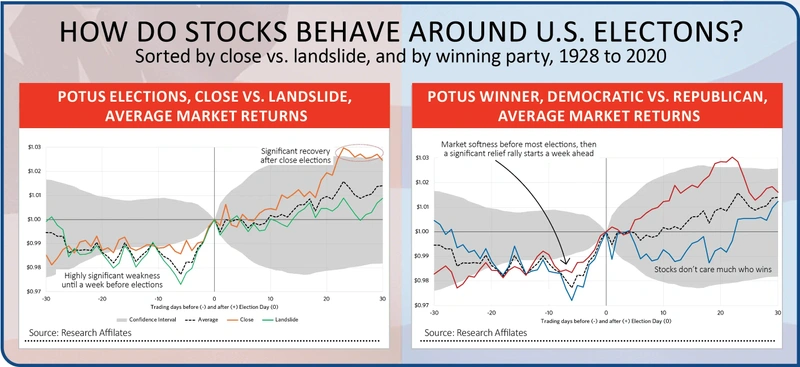

According to a study by Research Affiliates which examines daily stock price movements before and after all 24 US presidential elections since 1928, the politics of the winner has less bearing on how markets respond than whether the election is close and contentious, which would appear to be the case this time round.

‘Why would liberal versus conservative matter less than whether the election is tight and the electorate polarised? Because if each side views losing as a disaster, their partisans will invest accordingly,’ suggest the study’s authors.

‘Investors tend to be risk-off in the run-up to the election, but once the election is over and the uncertainty dissipates those on the winning side are relieved by the outcome and return to risk-on positions.

‘Those on the losing side will no doubt be despondent, but they are already risk-off so their portfolios already reflect those fears. Both sides sell in the weeks before the election. One side buys in its aftermath.’

According to the data, stocks overall tend to fall in the run-up to a close election, then surge in the final week of the campaign as the likely result becomes clearer and less alarming to voters, before continuing their upswing, albeit with greater volatility, post-election day.

The study finds that in the lead-up to an election, growth and value stocks tend to exhibit similar performance. After the election, however, value stocks tend to rebound when Republicans win the White House while growth stocks tend to rebound when Democrats take office.

Finally, small-caps tend to lag the market in the run-up to elections, except in cases where the outcome is expected to be close, when they perform similarly to large-cap stocks in the run-up but outperform by a couple of percentage points in the following weeks reflecting the return of risk appetite.

INVESTORS LIKE CONTINUITY

It is also worth noting, as we flagged some time ago, that markets tend to like continuity, so a second term for the Democrats may not be a bad outcome in the long run.

Research from US asset manager T. Rowe Price finds that, over the past 96 years, markets have proved more resilient and less volatile when incumbents are re-elected, and one of the key factors in their re-election is the state of the economy, which at the moment is holding up reasonably well although Americans have had to endure a period of high inflation.

As Bill Clinton’s chief strategist James Carville famously replied in the 1992 election campaign when asked what matters most to voters: it’s the economy, stupid.

FUND MANAGER VIEWS

At a presentation earlier this week hosted by the AIC (Association of Investment Companies), fund managers were asked their views on the elections and on the risks and opportunities in investing in US stocks.

What impact will the election have on the market, and what result would be best for the markets?

Jeremiah Buckley, manager of the North American Income Trust (NAIT), believes the election result could cause some market volatility over the short-term but won’t have a meaningful impact on the medium- to long-term outlook for US equities.

‘When we look at history, there hasn’t been a material difference in the performance of the US equity market whichever party has the presidency and there are numerous examples of strong performance when each party has held the top office.

‘The best outcome might be if we have a split government where neither party has control of all three branches, making it harder to push through new legislation and forcing the parties to compromise, potentially creating less uncertainty around policy and limiting any dramatic shifts.’

David Zhao, co-manager of the BlackRock Sustainable American Income Trust (BRSA), agreed elections tend to ‘create volatility and add additional noise to the market, especially more tightly contested ones as market participants struggle to price in outcomes’.

‘While you cannot discount the importance of elections, we believe as fundamental investors that by focusing on identifying high quality companies that can drive earnings through a business cycle, we can mitigate short term risks associated with election outcomes and drive long term performance,’ added Zhao.

What are the main risks facing investors in the US at the moment?

Buckley argues the two largest risks for investors in the US are whether companies get a solid return on all the capital being invested in generative AI and whether the job market can maintain its current level of growth.

‘On AI-related capex, since it is such a transformational technology with substantial potential, companies are spending rapidly to make sure they participate in this paradigm shift. There is a risk the returns on this spending don’t materialise as expected which could lead to a rationalisation period of capital and R&D (research and development) spending in the US which could lead to a material slowing in the economy.’

On the jobs front, the hospitality, healthcare and construction industries have contributed the vast majority of private-sector job gains in recent months, says Buckley.

‘Hospitality and healthcare are close to fully recovering from the pandemic pullback and there are signs leading indicators for the construction sector are weakening. Therefore, we need more sectors to start contributing to job gains in a material way for the healthy job market we are currently seeing to continue.’

For Zhao, one of the biggest risks is the historically high level of concentration in broad US indexes: ‘Due to the narrow leadership from US mega-cap stocks, indices like the S&P 500 have moved to extreme levels of concentration in both the weightings of the largest stocks and style exposure within the indexes.’

As of the end of August, the six largest S&P 500 tech companies accounted for nearly 30% of the index, and the index itself is overweight to the growth style at 43% exposure.

‘This phenomenon can lead to unintended risks and much greater drawdown potential if the market rotates away from growth, which has historically been more volatile than the other styles,’ warns the manager.

Where are the best stock picking opportunities?

‘We continue to think there are attractive opportunities in the technology sector as the demand for infrastructure to support the substantial demand for generative AI will continue for years, which makes us still want to be overweight semiconductors,’ says Buckley.

‘We also believe there will be a number of attractive applications using AI which make significant progress in the marketplace over the coming years so we continue to be overweight software and IT services.’

Aside from technology, the fund is finding attractive opportunities in healthcare and REITs (real estate investment trusts). ‘In healthcare, we continue to find attractive ideas that are both defensive and offensive. We believe these businesses will hold up well if we see a greater than expected economic slowdown. At the same time, with the impressive level of innovation in biotech and medical devices right now, we should see attractive relative earnings growth even in a stronger economy.’

Given the underperformance of REITs over the last couple of years and the prospects for lower interest rates, the sector offers very attractive income opportunities says the manager.

More broadly, Buckley is encouraged by the innovation and productivity gains US companies continue to drive through capital and R&D spending.

‘The investments required to stay relevant and prosper in the new digital economy are significant and therefore favour the largest companies which lead their industries. Having large amounts of data which can inform strategy and execution has become critical.’

Zhao argues concentrating on a handful of communication and technology companies when looking for growth in the US market made sense when investors were nervous about the outcome for the economy, but with a soft landing looking increasingly likely investors should be starting to broaden their focus and look to other, fresher growth themes including healthcare.

‘The US healthcare sector has been supported by long-term demographic trends. Ageing populations around the world have created additional demand for medicines, while rising costs facilitates a need for increased efficiency within the healthcare ecosystem.’

The number of Americans aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050, and for many European countries populations are ageing even faster.

‘There is also significant innovation in the healthcare sector. Breakthrough drugs in obesity, cancer and gene therapy could be a game-changer for a number of the pharmaceutical giants. In 2023, GLP1 drugs, designed to tackle obesity and diabetes, proved to be blockbusters, and the growth prospects for some of those new products remain very strong,’ adds the manager.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Surprise jumbo rate cut sends stocks and gold to new all-time highs

- Oxford Metrics slumps to six-year low after profit warning

- Communications kit designer Filtronic receives boost from SpaceX

- Investment trust sector celebrates ‘leap forward’ on cost disclosure

- Microsoft, BlackRock, Nvidia back enormous new AI datacentre fund

magazine

magazine