Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

AI goes nuclear: Why the energy source is in big demand

There was a certain degree of investor bemusement last month when shares in US electricity generation company Constellation Energy (CEG:NASDAQ) soared on news technology giant Microsoft (MSFT:NASDAQ) had signed a 20-year power purchase agreement.

This was no ordinary deal, however, as it paves the way for the restart of Three Mile Island 1 – not the reactor which famously melted down in 1979, but another 835 MW nuclear plant on the same Pennsylvania site which had operated at industry-leading levels of safety and reliability before being shut down in 2019.

Under the agreement, Microsoft will buy carbon-free, nuclear-powered energy from Constellation to power some of its AI (artificial intelligence) data centres with the software giant calling the deal ‘a major milestone’ in its effort to decarbonise its business.

As Deutsche Bank’s research team observed, it looks as if the first industry AI will disrupt isn’t technology, but energy.

A NEW ‘SPACE RACE’

Ever since AI (artificial intelligence) became mainstream with the unveiling of ChatGPT, two things have become apparent.

First, the data centres needed to process AI tasks will have to be much bigger and will be much more expensive than those which have been built to date (the term being used to describe them is ‘hyperscale’).

Second, they are going to use much more energy, not just because they are bigger but because AI queries need a lot more power to process the vast amounts of data being managed – some estimates put the energy ‘draw’ at up to 300 times the amount needed for a simple web search.

The companies at the heart of the AI revolution – cloud service providers like Amazon (AMZN:NASDAQ), Alphabet (GOOG:NASDAQ), Meta Platforms (META:NASDAQ) and Microsoft – already own more than half the world’s AI-ready data centre capacity, but, because of supply constraints, they are having to partner with co-location providers.

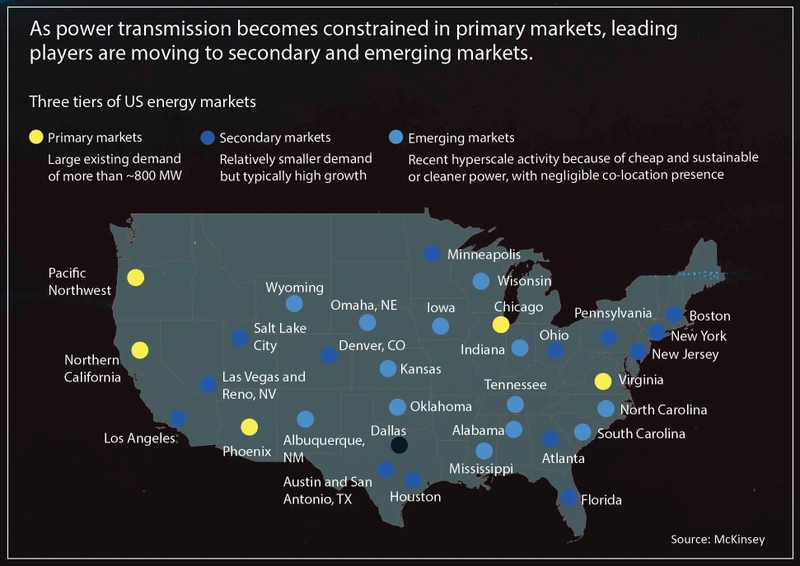

According to McKinsey, the prices charged by co-location providers (or ‘colos’) for available data centre capacity in the US fell between 2014 and 2020 but then rose by an average of 35% from 2020 to 2023.

Meanwhile, new capacity due to come online in the next two to three years has already been leased out, and in Northern Virginia – dubbed the ‘data capital of the world’ due to the high number of data centres located there – the vacancy rate was less than 1% at the start of this year.

On Oracle’s (ORCL:NYSE) conference call last month, chief executive Larry Ellison gave some idea of the costs involved just for his firm to be a part of the data centre revolution.

‘The entry price is around $100 billion. Let me repeat that, around $100 billion. That’s over the next four, five years, for anyone who wants to play in that game. That’s a lot of money, and it doesn’t get easier.’

A NEW (NUCLEAR) ARMS RACE

As well as space, cloud providers are involved in a race to secure as much power as they can as quickly as possible, with as small a carbon footprint as possible.

Given nuclear power is more reliable than solar or wind generation and less polluting than fossil fuels, it has become the energy source of choice.

All data centres are power-hungry, but AI-ready ones are especially demanding because of the energy consumption of servers in the racks.

McKinsey estimates average power densities have more than doubled in just two years from eight kW (kilowatts) to 17 kW per rack and are expected to rise to as high as 30 kW by 2027 as AI workloads increase.

Training models like ChatGPT can consume more than 80 kW per rack, while Nvidia’s latest chip, the GB200, combined with its servers, may require rack densities of up to 120 kW.

Oracle is already building an 800 mW (megawatt) centre with ‘acres’ of Nvidia GPU clusters to train its largest Generative AI model, and it has plans for a site which will need over one gW (gigawatt) of power.

Late last month, Amazon signed an agreement to invest in advanced nuclear technology to meet its growing energy demand, including the construction of several new Small Modular Reactors or SMRs, an advanced kind of reactor with a smaller footprint which can be built in factories and assembled on site close to the electricity grid.

In Washington state, the company has agreed to develop four SMRs which will be built, owned and operated by Energy Northwest, a consortium of public utilities, to generate 320 mW of capacity in the first phase of the project, with the option to increase to 960 mW in total.

The firm also took a direct stake in X-energy, the private developer of SMRs whose designs will be used in the Energy Northwest project.

In Virginia, Amazon signed a deal with electricity supplier Dominion Energy (D:NYSE) to explore the possibility of building an SMR to bring at least 300 mW of capacity to an area where power demand is forecast to rise by 85% in the next decade and a half.

Not to be outdone, Google has ordered six to seven SMRs from privately-owned Kairos power with a total of 500 mW of capacity, with the first plant expected to come online by 2030 and the rest by 2035.

‘We feel nuclear can play an important role in helping us meet our demand cleanly and round the clock,’ said Google’s senior director of energy and climate Michael Terrell.

ARE SMRs THE FUTURE?

Small modular reactors typically have a capacity of up to 300 mW against over 700 mW for a traditional nuclear power plant but being smaller and modular they are easier to build and many of the components can be built and assembled in a factory and then the whole unit can be transported to where it is needed.

Being smaller also means there are more potential locations for them, including in rural areas where there is limited coverage by the grid or there are no clean-energy alternatives like wind or solar, and economies of scale in their manufacture means they are affordable even to companies, so as power demand rises more units can be built and installed where they are needed.

SMRs are considered safer than traditional nuclear plants as their design includes ‘passive safety features which rely on the natural laws of physics to shut down and cool the reactor during abnormal conditions, which significantly lowers the risk of unsafe releases of radioactivity’, according to analysts at Berenberg.

Given all these advantages, surprisingly there are only three SMRs operating globally at the moment although almost 100 are at various stages awaiting build approval.

That doesn’t mean they will appear overnight, however – the best guess at present is global deployment will happen at some point between 2030 and 2035.

COULD FUSION BECOME A REALITY?

The other big development in nuclear technology is fusion. All current nuclear power plants work on fission technology, which is the splitting of atomic nuclei to generate energy.

Fusion, on the other hand, is the process by which two light atomic nuclei combine to form a single heavier one while releasing massive amounts of energy – essentially the process which powers the sun.

The International Atomic Energy Agency explains: ‘To fuse in the sun, nuclei need to collide with each other at extremely high temperatures, around ten million degrees Celsius.

‘The high temperature provides them with enough energy so that once the nuclei come within a very close range of each other, the attractive nuclear force between them will outweigh the electrical repulsion and allow them to fuse.

‘For this to happen, the nuclei must be confined within a small space to increase the chances of collision. In the sun, the extreme pressure produced by its immense gravity creates the conditions for fusion.’

Ever since the theory of fusion began to spread in the 1930s, scientists have dreamed of recreating the same reaction here on Earth to produce unlimited, safe, on-demand, clean energy.

It is estimated fusion could generate four times more energy per kilo of fuel than fission and nearly four million times more energy than burning coal or gas, but the physics required to recreate this process is so difficult the standing joke in the industry is fusion is ‘always 30 years away’.

Now, however, US start-up company Helion Energy, whose backers include tech billionaires Sam Altman, the founder and chief executive of OpenAI, LinkedIn co-founder Reid Hoffman and Facebook co-founder Dustin Moskowitz, claims it will have a commercial-scale nuclear fusion power plant up and running by 2028.

Not only that, but Microsoft has signed up as the first user of the electricity, which will be sold and distributed by Constellation Energy with the long-term goal of being to deliver power at one cent per kWh or half the price of the cheapest onshore wind generation anywhere in the world.

HOW CAN YOU INVEST IN NUCLEAR POWER?

Unfortunately for UK investors, nuclear isn’t a big theme here or in Europe – with the exception of France’s national energy company EDF, no European utilities are planning to build a new nuclear reactor within the next decade and investment is limited to extending the useful life of existing reactors.

UK utility Centrica (CNA) has a 20% stake in EDF’s UK nuclear plants, but most of them are set to close, except for Sizewell B, which will contribute to earnings although not materially.

In the US, we have already mentioned Constellation Energy, whose shares are up 130% year-to-date, but we should also flag Texas-based Vistra (VST:NYSE), which is the best-performing stock in the S&P 500 this year, up 232%, beating even Nvidia (NVDA:NASDAQ).

For those wanting to play the nuclear theme through the utilities sector, there are a couple of ETFs (exchange-traded funds) such as the iShares S&P 500 Utilities ETF (IUSU), which has an ongoing charge of 0.15%, and the XTrackers MSCI World Utilities ETF (XWUS), which has a 0.25% annual charge.

In terms of nuclear technology, Santa Clara, California-based Oklo (OKLO:NYSE) – which boasts Open AI’s Sam Altman as chairman – has seen its shares soar 115% this year, yet it is still a development-stage company with no revenue and is running losses.

Oregon-based NuScale Power (SMR:NYSE), which designs and builds SMRs, has seen its shares rocket 580% this year but is also running losses and is tiny by US standards, while Nano Nuclear (NNE:NASDAQ) – whose shares are up 300% this year – is even smaller.

In fairness, UK firm Rolls-Royce (RR.) co-owns a business which designs advanced SMRs, but for now it remains a small part of the group.

For an ongoing charge of 0.55% VanEck Uranium and Nuclear Technologies UCITS ETF (NUCL) tracks a basket of firms with nuclear technology expertise as well as the feedstock of nuclear power plants: uranium.

GETTING DIRECT EXPOSURE TO URANIUM

It may not enjoy a great reputation with the public, but given there are few direct ways to play the nuclear renaissance in Europe uranium is the obvious route for those wanting exposure to the theme.

By way of background, the world’s top producer is Kazakhstan, which accounts for more than 40% of global supply, followed by Australia, Namibia, and Canada at 13%, 11%, and 8%, respectively.

The uranium market was disrupted in 2022 by Russia’s invasion of Ukraine: Kyiv, which has 15 nuclear power reactors, depended heavily on Russian uranium so it rushed to sign a 12-year supply agreement with Canada, which sent prices surging to over $100 per pound at the start of 2023.

Prices have fallen back, but due to the lack of investment in new supply and low inventories the market is in deficit meaning there is already competition to buy uranium to meet existing power demand.

According to the World Nuclear Association, demand for uranium in nuclear reactors is expected to nearly double by 2040 as governments ramp up nuclear power capacity to meet zero-carbon targets.

Add to that the potential demand from hundreds of new SMRs to power AI-ready data centres and uranium prices are going to keep rising over the next five years unless new mines are started.

Investors in the US have already twigged this, with shares in Canadian producer Cameco (CCJ:NYSE) rising 30% this year, although that is still modest compared to the gains in the electric power and nuclear engineering stocks.

There are two UK stocks which are worth looking at, Yellow Cake (YCA), which buys and holds physical uranium, and Geiger Counter (GCL), an investment trust which buys stakes in companies exploring, developing and producing uranium [see box below].

Yellow Cake buys most of its uranium from Kazatomprom, the world’s largest producer, and holds it in storage in North America, making it a straight play on the commodity price.

There are also passive products which track the uranium mining industry including Global X Uranium UCITS ETF (URNU) which has an ongoing charge of 0.65%.

Geiger Counter Limited (GCL)

Price: 45p

Market Cap: £64 million

DISCOUNT TO NAV: 20%

Launched almost two decades ago, this trust is a prime way to gain access to companies involved in extracting, processing and developing uranium.

Co-manager Keith Watson, who is vastly experienced in analysing raw materials companies, believes sentiment towards uranium has improved ‘considerably’ since Microsoft announced its deal with Constellation Energy.

The trust’s NAV (net asset value) jumped 9.5% in September, beating the rise in the uranium price, as its holdings performed well after recent lacklustre interest.

Rather than just replicate the make-up of the uranium pure-play indices, Watson looks for the stocks with the most upside in terms of discount to fair value.

For that reason, top holding Nexgen Energy (NXE:NYSE) is preferred to index heavyweight Cameco – not only have Nexgen shares risen just 10% year-to-date against Cameco’s 30%, but the company has the lowest global cost of production and the most to gain from higher uranium prices.

As Watson points out, Cameco trades at a premium to NAV despite the fact it has forward sold all its production for the next five years at $80 per pound, so there is no upside once prices exceed that level.

With the market already in deficit, and nuclear plants needing two years’ worth of supply – because it takes up to two years to turn the raw material into fuel rods – the entry of the US tech ‘hyperscalers’ means there will be a scramble to secure enough uranium to meet everyone’s power needs for the next five years and beyond. Ongoing charges are high at 2.36% reflecting the trust’s modest scale and specialist nature.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Is Berkshire Hathaway’s record cash pile telling investors to be cautious?

- Markets eye further rate cuts ahead of inflation and consumer price data

- ‘Magnificent Seven’ hand markets the good, the bad and the ugly

- Market rallies as Trump secures clear victory in US presidential election

- Why the investment trust consolidation trend is set to continue

magazine

magazine