Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Can education media group Pearson win the AI battle?

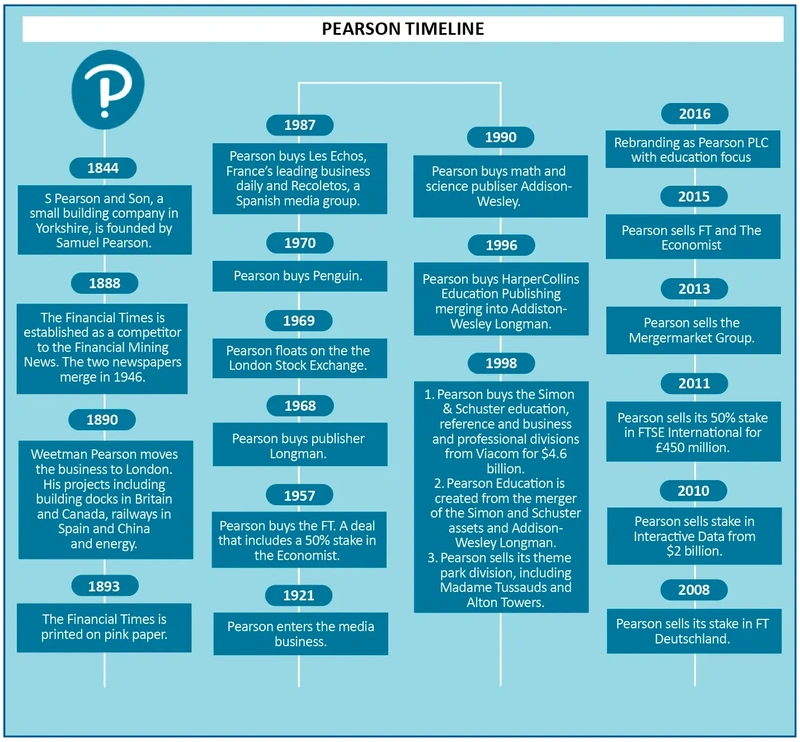

Publisher Pearson (PSON) has gone through many incarnations during its 180-year history from starting out as a civil engineering business to the owner of The Financial Times to its current focus on education.

The company is going through change once again with the appointment of new CEO Omar Abbosh in January this year and the early signs are good with the company recently announcing a positive set of third-quarter results. Abbosh’s previous employee was US tech giant Microsoft (MSFT:NASDAQ) and the company is hoping to accelerate its ‘digital first’ strategy set out first by Abbosh’s predecessor Andy Bird in 2020.

Abbosh is expected to ramp up Pearson’s efforts to embrace generative artificial intelligence by bringing his 30 years’ worth of experience in the field of enterprise technology. All this makes it an excellent time to sit down with Pearson’s finance chief Sally Johnson.

PEARSON THIRD QUARTER TRADING UPDATE (29 OCTOBER) - A SNAPSHOT

- Total underlying sales growth of 5%.

- Virtual Learning sales up due to 4% growth in Virtual Schools.

- Higher Education on track to grow for the full year.

- Workforce Skills sales up 6% for the third quarter.

- English Language Learning sales up 2%.

- Group underlying sales growth, adjusted operating profit, interest and tax outlook for 2024 remain in line with market expectations.

‘Pearson is delivering on the three priorities for 2024 that I identified at the start of the year. First, our focus on operational and financial performance has driven growth across all divisions this quarter and we are on track to meet full-year expectations.

‘Second, we are accelerating our AI capabilities across the business and starting to see the commercial benefit. Third, expanded enterprise relationships with companies such as ServiceNow demonstrate progress on our intention to expand in workforce learning,’ said Omar Abbosh, Pearson’s chief executive.

REVIVAL OF FORTUNES

Can management succeed in lifting the prospects of the education media group? Over the past 12 years Pearson has issued 10 profit warnings but the company has seen an improvement since the start of the pandemic. Pearson’s share price has more than doubled due to the uptake in digital learning and assessments.

Pearson announced earlier in 2024 a 6% hike in full year dividend to 22.7p and an extension to its £300 million share buyback programme. Abbosh told shareholders on 29 July that the company was once ‘a holding company with a set of loosely held assets’ but now it has ‘moved in and out of different markets’.

He added that the company is now ‘a unified operating company with very clear, higher growth addressable markets with a capital allocation approached focused on assessments and verification, early careers, and enterprise skills. The analogue publishing business is a very small part of our current and future business.’

CURATING AND CREATING CONTENT

‘Pearson makes money by creating and curating content, distributing this digitally and assessing and verifying peoples’ skills across five key segments,’ says CFO Johnson.

The company’s customers range from employers, employees, teachers, students (K-12) and institutions.

The company’s segments include assessment & qualifications – which encompasses professional certifications – Pearson Vue and clinical assessment, assessments on cognitive ability, for example, dyslexia, K12 (primary and secondary education, comprising both US school assessments and UK GCSE and A Levels).

Also under the Pearson umbrella is virtual learning through virtual schools, higher education (which is a predominantly digital product supporting students at college in the US), English language learning – which helps people learn and become certified in English through their institutional business and direct to consumers through their language learning app Mondly and workforce skills (which offers vocational qualifications, for example, BTECs).

In the first half of 2024, underlying growth for assessment & qualifications division rose 2% with growth across Pearson Vue and UK & international qualifications. English language learning was up 11% to £188 million due to strong growth in institutional as well as growth in Mondly and workforce skills was up 6% to £143 million with strong performances in vocational qualifications, GED (general educational development) – academic and subject tests in the US and Canada – and digital credential network Credly.

Underlying growth for virtual learning fell 8% in the first half of 2024 to £254 million and virtual schools’ sales fell 1%. This division was particularly strong during the Covid pandemic. Pearson’s online learning sales rose 25% in the first three months of 2021.

For the 2023/2024 academic year, Pearson+ – the company’s college learning app – launched on 30 July 2021 – had five million registered users as of June 2024 an increase of 300,000 compared to the 2022/2023 academic year (4.7 million registered users).

Pearson+ had 1.1 million cumulative paid subscriptions for the 2023/2024 academic year compared to 938,000 in the 2022/2023 academic year.

WHAT IS THE COMPANY’S STRATEGY

Johnson says the FTSE 100 company reset its strategy in the first half of 2024.

‘It was an evolution not a revolution,’ says Johnson. ‘We recognised two key trends [which we hope to make part of Pearson’s strategy going forward]: demographics. So, what is happening to baby boomers who are leaving the workforce? [As they leave] this leaves a skills gap. There is a real need for this skills gap to be filled. So, there is a reskilling and upskilling requirement and [that is where] AI [can be harnessed].’

The company hopes to achieve mid-single digit revenue growth in the medium-term and free cash flow of between 90-100%.

INTEGRATION OF AI

Johnson says the company’s future strategy involves the integration of AI across all business segments.

‘Pearson is the global market leader in digital learning and market assessments are the company’s secret sauce. We have invested in an AI tutor which helps children with their homework, and we have developed an assessment tool for teachers to help them with lesson plans,’ says Johnson.

At the end of July this year, the company confirmed that 70,000 students have already started using Pearson’s AI study tools.

Pearson are also adding three new AI tools to Pearson+ and its video platform Channels.

‘Students will now be able to upload their syllabus and generate personalised learning experiences. There is also a new AI instructor tool which will help teachers build assignments which will be added to 25 business, maths, science, and nursing titles in the US,’ says Johnson.

Johnson views AI as a help rather than a hindrance to the company, a sentiment echoed by analysts at Shore Capital: ‘Focusing on AI, we note that management has identified scope to improve customer service, content generation, product design processes and data tools.

‘As part of this process, we see a particularly interesting opportunity for generative tech to help add value to end users by simplifying and personalising the way in which they interact with the proprietary learning content.’

WHAT ANALYSTS ARE SAYING

US investment bank Goldman Sachs (GS:NYSE) views the education publisher as being in a ‘solid’ position citing ‘reiterated full year 2024-2025 guidance and a new medium-term outlook from 2026 (as part of its strategy update) to deliver mid-single digit organic growth and an average of plus 40 bps (basis points) year-on-year margin expansion while maintaining FCF (free cash flow) conversion of 90-100%.

‘Pearson highlighted it is well-positioned to capitalise on an $80 billion addressable market opportunity which is growing at a 5% CAGR (compound annualised growth rate) and will look to unlock revenue synergies across the group (for example, through product bundling/development) as well as several tech-enabled cost efficiencies. We continue to view the risk/reward as attractive given the improved growth and margin profile.’

Shore Capital analysts believe the education media group is ‘modestly valued’ relative to its financial outlook and ‘fundamental attractions’ and sees ‘good scope for a continuation of positive share price performance.’

In March 2022, the company rejected an offer of 884p (equivalent to £7 billion) from US private equity firm Apollo (APO:NYSE) saying that it ‘significantly undervalued the company.’

Prior to this Apollo had made an all-cash offer of 800p in November 2021.

AHEAD OF THE COMPETITION

Johnson believes that Pearson doesn’t have an exact like-for-like competitor, however ‘we do have competitors in each segment we operate in. For example, in the field of GCSEs and A Levels and the professional certifications space’.

‘There are traditional competitors like US publisher of educational content, software and services McGraw Hill Education owned by Apollo. But no one has the diversity within the educational assets that we have which is great from a commercial point of view.

‘The revolution for Pearson was the shift from analogue to digital that is the same for the print media and consumer publishing. AI is a tool within the technology environment which can be used to enhance personalisation. Of course, we have competitors who are trying to do the same, however we focus our products on being the very best that they can be.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Is Berkshire Hathaway’s record cash pile telling investors to be cautious?

- Markets eye further rate cuts ahead of inflation and consumer price data

- ‘Magnificent Seven’ hand markets the good, the bad and the ugly

- Market rallies as Trump secures clear victory in US presidential election

- Why the investment trust consolidation trend is set to continue

magazine

magazine