Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Four groups who should consider a Lifetime ISA

The Treasury Committee made a recent call for evidence on the future of the Lifetime ISA, which has got everyone talking. They’re asking big questions, like whether the account needs a bit of a makeover, some tweaks, or even if it should be scrapped entirely.

With more than 750,000 people putting nearly £1.9 billion into Lifetime ISAs in the 2022/23 tax year, it’s clear this account is popular. Let’s look at four groups who could really make the most of a Lifetime ISA.

SELF-EMPLOYED AND SAVING FOR RETIREMENT

If you’re self-employed, pensions can be tricky. There’s no employer to top up your contributions, so you’re on your own. That’s where the Lifetime ISA comes in. For basic-rate taxpayers, it’s a solid option. You get a 25% government bonus on your contributions, up to £4,000 a year. That’s like getting the same tax relief you’d get on a pension – but with added flexibility.

Here’s a quick example: If you’re saving £4,000 a year from age 18 to 50, you’ll earn £32,000 in government bonuses. With a 4% annual growth rate, your pot could grow to £326,000 by age 60. Now, if you’re taking money out of a pension at age 60, you’ll pay tax on anything over 25% of your pot. With a Lifetime ISA, though, your withdrawals are completely tax-free.

Based on today’s tax rates, someone who took an ad-hoc lump sum of £20,000 from their pension at age 60 would pay £486 in tax (assuming they had no other taxable earnings). The same investor would pay no tax at all on their Lifetime ISA withdrawals.

The difference in tax paid expands as the withdrawals get bigger. If the entire £326,000 fund was withdrawn at once (not an advisable retirement strategy in most cases), the pension investor would pay a whopping £96,228 in income tax, whereas the Lifetime ISA saver would pay nothing.

FIRST-TIME HOUSEBUYERS

Saving for a first home? The Lifetime ISA is pretty unbeatable. The 25% bonus gives your deposit savings a huge boost. If you save the maximum £4,000 a year, you’ll get a £1,000 bonus straight from the government. And because it’s added almost immediately, you’ll get any interest or investment growth on top of that, which will compound over time.

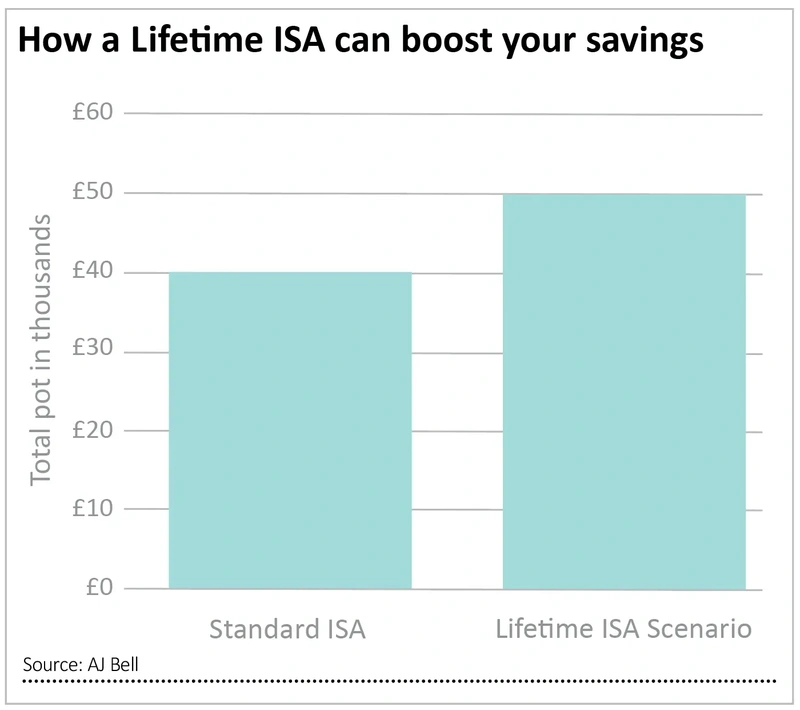

If you had saved £4,000 into a Lifetime ISA for each of the past nine tax years since the account was launched and had seen 5% investment growth a year, you’d have a pot worth £50,000. However, if you’d saved that same amount of money in a standard ISA, still earning 5% return a year, you’d have a pot worth just over £40,000. That means by shunning a Lifetime ISA you’d be £10,000 worse off.

The downside? The Lifetime ISA has a £450,000 property price cap, and that hasn’t changed since 2017. If you’re in an area where house prices are soaring, you might find yourself priced out. It’s something to think about before committing.

IF YOU’RE NEARING 40 DON’T MISS OUT

If you’re approaching your 40th birthday, you should think about opening an account and funding it, to have the option of using it in the future. Once you hit 40, you can’t open a Lifetime ISA. But if you open one now – even with a small contribution – you’ll keep the door open for future savings. You can contribute and get the government bonus until you’re 50. After that, the account can stay invested until you’re 60, when you can withdraw the money tax-free.

You might not even need it right now. Maybe you’ve already bought a home or have a solid pension through work. But life’s unpredictable and having a Lifetime ISA ready to go could come in handy down the line. It’s a simple way to keep your options open.

HELP TO BUY ISA HOLDERS

Still holding onto a Help to Buy ISA? For some savers it might be wise to think about switching accounts. Firstly, the property limit. With the Help to Buy ISA, you can use it on a property worth up to £450,000 in London, but only on property worth up to £250,000 outside London. This has proved a problem for some outside of London. With the Lifetime ISA there is a limit of £450,000 regardless of what area of the UK you’re buying in. So, if you’re priced out of the Help to Buy ISA, you could transfer to a Lifetime ISA.

Second, the maximum government bonus. Both the Help to Buy ISA and Lifetime ISA get the same 25% government bonus, but with the Help to Buy ISA this is limited to the first £12,000 saved – meaning a maximum bonus of £3,000. With the Lifetime ISA you can get up to £1,000 a year in government bonus, up until the age of 50. If you opened a Lifetime ISA at age 18, that is a maximum government bonus of £32,000. If you’ve maxed out your Help to Buy ISA bonus and still have more to save, you could switch to a Lifetime ISA.

However, any transfers from your Help to Buy ISA count towards your Lifetime ISA annual limit of £4,000 – so if you have a chunky amount in your Help to Buy ISA, you’ll have to transfer it over multiple tax years. But with the new tax year looming you could move £4,000 now and another £4,000 in a few months’ time.

Lifetime ISA explained

A Lifetime ISA is designed to help savers save for their first home or retirement. For every £4 you put in, the government adds £1 of free money up to a maximum contribution of £4,000 a year and government bonus of £1,000 a year. You must have had your account open for at least 12 months before using it to purchase a property if you want to use the government bonus.

You can open one between the ages of 18-39 and continue to contribute until you turn 50. You may face an early access withdrawal charge of 25% if you withdraw from your Lifetime ISA prior to buying your first home or before age 60.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Money Matters

News

- IG Design shares hit two-year low after major US customer re-enters Chapter 11

- FTSE 100 hits all-time high on easing inflation and year-low in sterling

- Trustpilot shares soar 61% over the past six months

- Trump promises a ‘golden age of America’ at the expense of trade partners

- Will Royal Caribbean Cruises continue to benefit from robust demand and pricing trends?

- Cloud growth, AI appetite and margins crucial for big tech earnings

magazine

magazine