Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Quantum computing - Should you believe the hype and how can you get involved?

Quantum computing has been setting the investment world on fire in recent months, and late last year, a handful of specialist stocks hit escape velocity.

Between mid-November and the start of January, companies like Rigetti Computing (RGTI:NASDAQ) and D-Wave Quantum (QBTS:NYSE), two of the most traded stocks among AJ Bell platform users, saw their share prices surge 1,400% and 600% respectively.

Headlines such as, ‘Google unveils “mind-boggling” quantum computing chip’, and ‘SAP CEO backs quantum computing as near-term game changer’, have grabbed investors’ attention, and Microsoft (MSFT:NASDAQ) wrote, ‘2025: The year to become quantum-ready’, in a recent blog post (14 January).

That Nvidia (NVDA:NASDAQ) CEO Jensen Huang and Meta Platforms (META:NASDAQ) chief Mark Zuckerberg have both said useful quantum computers are decades away, has been largely brushed off by investors eager to get in early to hoped-for upside.

You can see the allure. Invest, say £1,000, in a stock today, and who knows, 10 years from now that stake could be worth £1 million – we’ve seen it happen before, a 1,000% return is roughly what Apple (AAPL:NASDAQ) has done since late 2014, while Nvidia’s 10 year return is 26,500%.

Just as easily that £1,000 could be worth a fraction of that intial investment if things don’t play out of planned.

Those are the potential risks and rewards of getting in early.

FUNDING FLOODING IN

Governments and tech firms all over the world are racing to develop quantum computers in a bid to shake up medicine, AI (artificial intelligence), finance and much else. It promises to transform multiple industries and tackle challenges that classical computers cannot solve.

For example, in December, Alphabet’s (GOOG:NASDAQ) Google unveiled a new chip, called Willow, which it claims takes five minutes to solve a problem that would currently take the world’s fastest super computers 10 septillion years to complete. For the record, 10 septillion is a one followed by 25 zeros and looks like this: 10,000,000,000,000,000,000,000,000.

Even the man behind the Willow project has said a chip able to perform commercial applications would not appear before the end of this decade.

Making errors within quantum systems less likely to occur, and, when they do, making them easier to detect and correct, is key to the development of quantum computers.

The qubit systems we have today are a tremendous scientific achievement, but they take us no closer to having a quantum computer that can solve a problem that anybody cares about

Nonetheless, if things work out, quantum computing would have enormous ramifications for us all, and there is the potential for supercharged returns from the right investments.

To paint a picture, in 2023, the global quantum computing market’s estimated worth was a little more than $800 million, according to Maximise Market Research. By 2040, that could increase to $173 billion, predicts McKinsey, flowing through to between $900 billion to $2 trillion worth of worldwide economic benefits.

WHAT IS QUANTUM COMPUTING

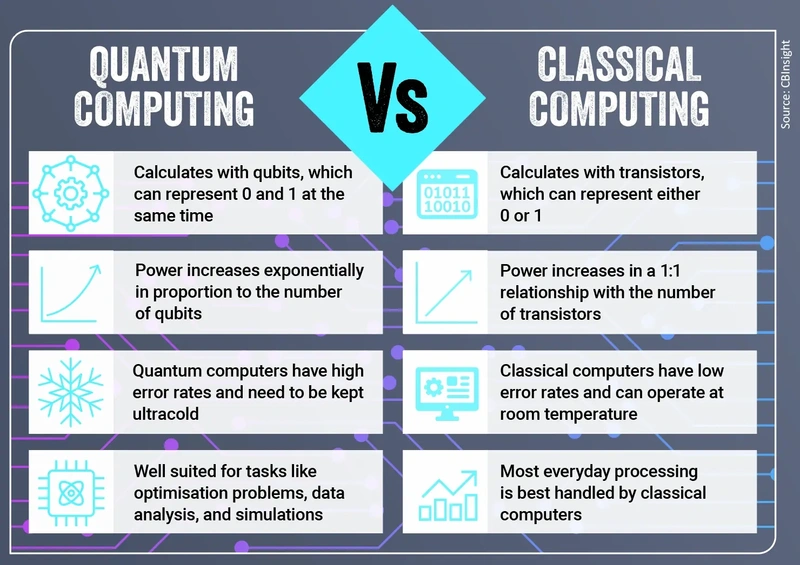

Quantum computing is a new approach founded on quantum mechanics principles to perform calculations. Unlike classical computers, which store information in bits (the binary language of 0s and 1s), quantum computers use quantum bits or ‘qubits’ that can exist in multiple states simultaneously, or ‘entanglement’.

Today’s computers work on a linear basis, or in other words, they solve one problem before moving on to the next. The physics properties of qubits allows quantum computers to perform multiple calculations at once, making them exponentially faster and more powerful than traditional computing systems.

But there are significant technical challenges that need to be overcome before the technology becomes useful, such as quantum-error correction and the qubits systems currently available.

‘The qubit systems we have today are a tremendous scientific achievement, but they take us no closer to having a quantum computer that can solve a problem that anybody cares about,’ says Sankar Das Sarma, the Richard E. Prange chair in physics and professor at the University of Maryland.

‘It is akin to trying to make today’s best smartphones using vacuum tubes from the early 1900s. You can put 100 tubes together and establish the principle that if you could somehow get 10 billion of them to work together in a coherent, seamless manner, you could achieve all kinds of miracles. What, however, is missing is the breakthrough of integrated circuits and CPUs (central processing units) leading to smartphones. It took 60 years of very difficult engineering to go from the invention of transistors to the smartphone with no new physics involved in the process.’

We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10

But if these obstacles are overcome, quantum computing will have a far-reaching impact on any number of different sectors. That’s why it’s important for investors to be patient and to separate reality from hype. As Bill Gates once said: ‘We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.’

With that in mind, let’s look at some of the long-term ways you can gain exposure to the booming quantum computing market.

PURE-PLAYS IN QUANTUM COMPUTING

None of these businesses are making money from quantum computing today, and they and they probably won’t be anytime soon. While there’s been huge progress in quantum computing, remember the technology is still in its infancy.

IONQ (IONQ:NYSE) $41.55

The Maryland-based firm focuses on trapped-ion quantum computing, with systems available via all major cloud providers. It currently has one computer in operation but plans to build a network of machines that are accessible via the cloud.

It is funding this process with the proceeds from its 2021 SPAC (special purpose acquisition company), which saw it become the first listed pure-play quantum computing stock. The listing helped the company raise more than $600 million in funding at a $2 billion valuation. The stock has seen some significant volatility since and is currently valued at $9 billion.

RIGETTI COMPUTING (RGTI:NASDAQ) $11.24

The Berkeley, California firm develops superconducting quantum processors and has recently created a modular qubit architecture.

The company is also developing a cloud-based platform called Forest that enables programmers to write quantum algorithms. Currently valued at $2.7 billion.

QUANTUM COMPUTING (QUBT:NASDAQ) $10.88

Founded in New Jersey in 2021, the $1.4 billion company specialises in room-temperature quantum systems and marketable applications in the fields of logistics, bioinformatics, life and physical sciences, quantitative finance and electronic design automation.

Quantum Computing is also now facing claims by Capybara Research, alleging the company has engaged in issuing misleading press releases to artificially inflate its stock price.

D-WAVE QUANTUM (QBTS:NYSE) $5.81

D-Wave Quantum is a pioneer in ‘quantum entanglement’ technology, and provides a quantum cloud system for its customers.

The $1.6 billion company uses annealing technology, a heat treatment process that changes a material’s properties by altering its microstructure, that is already commercially useful and gaining traction with a growing number of customers.

QUANTUM COMPUTING EXPOSURE

US big tech firms like IBM (IBM:NYSE), Microsoft, Amazon (AMZN:NASDAQ), and Alphabet – as well as those in China-based firms like Baidu (BIDU:NASDAQ) and Alibaba (BABA:NYSE) – are all investing heavily in a race to build reliable quantum computers.

Microsoft’s Azure has released quantum tools, as have Google and Amazon’s cloud platforms. But of the bunch, IBM is arguably the current leader in quantum computing. The firm was one of the pioneers in the field and already has 28 nascent quantum computers deployed, the largest fleet of devices designed for commercial and scientific use.

No matter which firm wins the race toward quantum supremacy, they’re all going to be ploughing lots of money into the physical hardware necessary to make this a reality. So, another route into quantum computing is to invest in the ‘picks and shovels’ manufacturers of crucial components.

Honeywell (HON:NASDAQ), and Keysight Technologies (KEYS:NYSE) and the UK’s Oxford Instruments (OXIG) are among the companies that design quantum computer components.

The advent of quantum computing will speed up the machine-learning algorithms that analyse both existing and new data sets, which will increase that data’s value in the long term. The shift will benefit companies already adept at managing data, along with the firms that supply them with data-gathering hardware: think Splunk (SPLK:NASDAQ), Palantir Technologies (PLTR:NASDAQ), Analog Devices (ADI:NASDAQ), Elastic (ESTC:NYSE), and Alteryx (AYX:NYSE).

ETFs would present a broadly spread and cost-effective way to invest in quantum computing but there are currently no specialist thematic options available to UK but hopefully that will change in time as interest from investors builds.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Money Matters

News

- IG Design shares hit two-year low after major US customer re-enters Chapter 11

- FTSE 100 hits all-time high on easing inflation and year-low in sterling

- Trustpilot shares soar 61% over the past six months

- Trump promises a ‘golden age of America’ at the expense of trade partners

- Will Royal Caribbean Cruises continue to benefit from robust demand and pricing trends?

- Cloud growth, AI appetite and margins crucial for big tech earnings

magazine

magazine