Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

You would have thought that sitting on a gold mine would be a path to instant riches, especially when the precious metal’s price is trading near its all-time high, so shareholders can be forgiven for being frustrated by the latest profit warning from Centamin. Production difficulties at the Sukari mine in Egypt – and management’s completely appropriate decision to put staff and investment in their safety first – mean that production will undershoot and production costs exceed expectations in 2020 and now 2021 as well.

As a result, output of 415,000 ounces in 2021 – the mid-point of management’s guidance – means that production could come in lower than it did in 2015 while the all-in-sustaining cost (AISC) of finding and extracting an ounce of gold will exceed $1,200.

Source: Company accounts. *Costs not directly comparable: based on operating cash cost 2010-2014, All-in-Sustaining Cost post-2015. **Based on mid-point of management guidance given on 21 October. For direct comparisons, operating cash costs forecast mid-point is $765 for 2020E and $912.5 for 2021E.

With gold still trading above $1,900 an ounce, Centamin still has every chance to make healthy profit margins, especially as the FTSE 250 firm’s balance sheet is net cash so there are no net interest bills to pay, but the outcome could have been so much better.

Source: Company accounts

Difficulties at an open pit mine at the Sukari site are a reminder that mining for gold (or any commodity) is not as easy as it looks and investors could be forgiven for thinking that gold miners are almost more trouble than they are worth. Over the past year, gold is up 29% in sterling terms and Centamin is up by 25%, but the point behind owning miners is the operational leverage they bring to the metal’s price: if all goes well, their profits should rise so much more quickly than the price of the commodity, as the bulk of their costs are relatively fixed – unless something goes wrong.

Investors could therefore make it easier for themselves and pick and active or a passive fund that provides them with exposure to a basket of gold miners, to help them spread their risk and manage their downside while providing scope for upside, should the metal’s price continue to advance.

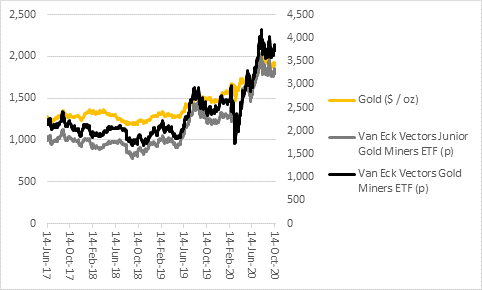

Options here could include BlackRock Gold and General as an actively-managed fund, while passive funds to research could be Van Eck Vectors Gold Miners ETF, which is designed to track the performance of 53 predominantly large- and mid-cap precious metal miners, or the Van Eck Vectors Junior Gold Miners ETF, which aims to deliver the performance of a basket of 80 mainly mid-to-small cap gold miners and explorers.

Both ETFs began trading in London, in dollar- or sterling-priced form, in June 2017.

The former may be better suited to gold bulls who are a little more conservatively inclined, the latter to more aggressive investors, although neither instrument is likely to shine should the price of gold start to retreat.

Source: Refinitiv data

For those intrepid investors who would rather pick their own mining stocks, there is a checklist that they can follow to help them do their research. Key factors to study include:

- The miner’s status. Some miners are producing gold, some are exploring a site and some are prospectors that may have no more than a licence to mine and are still doing preliminary geological work. The more mature the miner, the less risky it will be. Although the greater gains could be had among the juniors if one makes a big discovery or starts to ramp-up production the risks here are enormous and the scope for something going wrong and share price losses considerable. Investors also need to assess the miner’s management team and whether it has the right skills and local connections and a decent track record.

- Geopolitical risk. Resource nationalism” can be an issue, should a local government decide it wishes to keep more of its mineral riches for itself and impose higher taxes or take away a licence.

- Operational risk. Mines rarely run smoothly and their location – in the desert, the jungle or mountains – and issues such as local labour skills and availability and even the weather must be taken into account.

- Financial risk. Many miners take on a lot of debt when they first develop a mine. If something then goes wrong, or the gold price falls, this can then potentially put them into financial difficulty. Equally, if the gold price soars, profits could fly and cash flow mushroom so paying down the debt adds to earnings growth via lower interest payments.

- Cost base. This will be a reflection of the factors above and investors need to focus on the all-in sustaining cost (AISC) of a miner or mine’s gold production per ounce, not the cash cost, especially as this takes into account the payment of interest on any debt. The lower the AISC the better as this offers more upside when gold prices rise and more downside protection if gold prices fall.

- Valuation. During the gold price boom at the start of this decade, analysts would typically value explorers and developers at 0.5 times to 1.0 times net asset value (NAV) per share. They would value emerging producers at 1.0 times to 1.5 times NAV; and 1.5 times to 2.0 times NAV for mid and large-cap producers. Some analysts will use a blend of NAV and earnings multiples, using price/earnings (PE) and EV/EBITDA (enterprise value to earnings before interest taxes depreciation and amortisation) ratios, based on near-term earnings forecasts. However, a more scientific approach will focus on a detailed discounted cash flow (DCF) model that provides a net present value (NPV) of future cash flow streams, based on certain assumptions regarding the gold price and the miner’s cost base. The more mature gold producers may also pay a dividend so yield could be another valuation metric.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 25/04/2025 - 14:52

- Wed, 23/04/2025 - 14:22

- Tue, 22/04/2025 - 10:44

- Thu, 17/04/2025 - 16:01

- Fri, 11/04/2025 - 17:57