Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Health campaigners and investors who run strict environmental, social and governance (ESG) screens may be frustrated by it, but income investors will be pleased to see shares in Imperial Brands trading near five-year highs after the company’s full-year trading update, which offers the tantalising prospect of an increased dividend and a further hefty share buyback in the company’s next financial year.

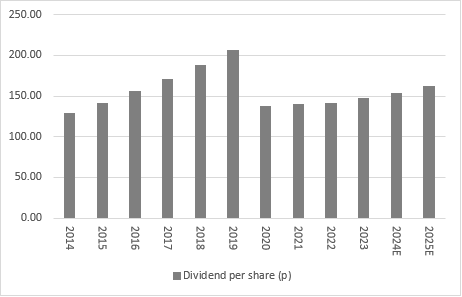

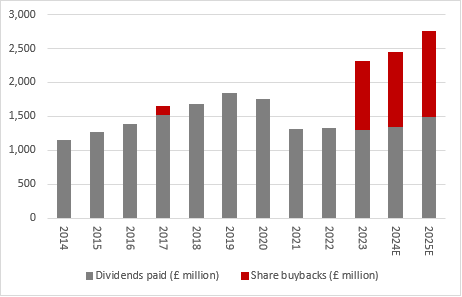

For the year to September 2025, analysts expect a fifth consecutive hike in Imperial Brands’ annual dividend, to a figure that equates to a yield of nearly 8%, with a £1.25 billion buyback on top of that, to take the total cash yield on the FTSE 100 firm’s shares to more than 14%.

The shares’ fat dividend yield and lowly valuation – the forward dividend yield is only a fraction below the forward price/earnings ratio of just under 9.0 times, according to consensus estimates – still suggest that investors remain concerned about the long-term future of smoking, thanks to how regulatory pressure and health campaigns continue to weigh on volumes. However, Imperial Brands remains highly profitable and cash generative thanks to efficiency drives and pricing power.

That pricing power comes from the FTSE 100 firm’s array of key brands, which includes JPS, Davidoff and Gauloises, despite regulatory intervention on issues such as packaging and advertising.

Pricing power is always valuable, but it is all the more so when inflation is running strongly, and firms face margin pressure from rising input costs. Pricing power protects lofty profit margins, lofty profit margins support cash flow and cash flow funds dividends and it is telling that chief executive Stefan Bomhard refers to ‘strong pricing’ in the trading update.

Source: Company accounts, Marketscreener, Vuma, management guidance alongside October 2024 trading update, consensus analysts' estimates.

The dividend cut of 2020 is now fading from memory, as Imperial increases its full-year dividend by 4.5%, runs its £1.1 billion buyback and promises further cash returns in the year to September 2025.

The target of a total dividend payment worth £1.5 billion implies a much higher dividend in 2025, especially as the next buyback, worth another £1.25 billion, will further reduce the share count. Even if some of this dividend hike is down to a shift in the mix of quarterly payments to make them more equal and less weighted toward the second half of the fiscal year, it is unlikely that management would sanction such an advance unless it thought the payment could be sustained (and presumably further enhanced) going forward.

Source: Company accounts, Marketscreener, Vuma, consensus analysts' estimates.

Again, this is possible because of strong cash flow, which comfortably covers the dividend. It even – just – covered the dividend in 2019 before the swingeing cut, but Mr Bomhard and the board wisely took the view back then that long-term investment in the business was a better option than clinging to the millstone of an extremely high yield, for which the firm was getting no credit from investors anyway, judging by how the share price was sliding ever lower.

This is the fourth year of chief executive Mr Bomhard’s five-year turnaround plan, with the fifth about to begin, and he and the board can take satisfaction from how earnings, cashflow, cash distributions and ultimately the share price are responding.

Currency movements remain a headwind, as they have shaved some 4% off profits in the year just ended, but lower losses from next-generation products (NGPs) should help to compensate for that.

Even so, investors are clearly yet to be totally convinced that Imperial Brands can weather the regulatory storm, where a proposed round of legislation in the UK on the issue of smoking outside is just one example of the ongoing pushback against a large percentage of Imperial Brands’ products.

Shareholders are therefore demanding the high yield (with the buyback cash on top) to compensate themselves for the perceived risks involved. The higher the share price goes (and the lower the yield goes) the more comfortable investors are that Imperial can meet these challenges and keep on churning out cash and hefty cash returns.

For the moment, however, the forward earnings multiple is a discount to the FTSE 100 and the yield a premium. That at least partly reflects the modest growth trend in profits, regulatory threats, including in the UK, and the need to invest in next generation products (NGPs) such as blu, Pulze and iD, where sales rose by between 20% to 30% in the year just ended. This rate of advance compares to a growth rate of one sixth in the first half, to suggest momentum accelerated in the final six months of the fiscal year to September 2024, a further potential positive for the company’s earnings and cash flow if that trend is maintained.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Thu, 26/09/2024 - 15:45