Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Equity markets are buoyant, fixed income markets seem more nervous judging by yields on government bonds rising in the UK and USA and commodity prices continue to march to their own beat, as gold and silver surge, industrial metals largely flat line and oil and gas are well down over the past year.

Weak hydrocarbon prices are helping to cool inflation and thus allow equity markets’ preferred narrative of a soft economic landing (if there is a landing at all) and lower interest rates to play out as expected, but any spike in oil and gas therefore remains a potential risk to this rosy scenario.

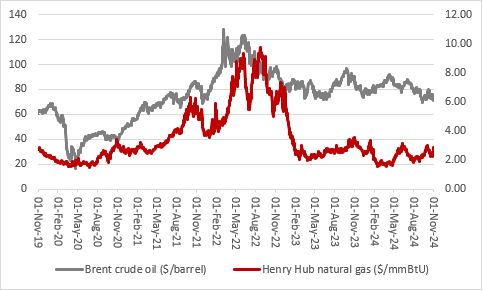

In many ways, weakness in oil and gas prices is as surprising as it is welcome, given the ongoing war in Ukraine and Russia’s role as a top-three supplier worldwide, as well as heightened tensions in the Middle East. Brent crude is down by 14% over the past year and natural gas, as benchmarked by US Henry Hub, is down by 23%.

Source: LSEG Refinitiv data

The lack of a geopolitical risk premium in hydrocarbons suggests markets do not fear a repeat of the 1970s, when sanctions after the 1973 Arab-Israeli war and then the fall of the Shah of Iran in 1979 prompted sharp spikes in the price of oil, multiples waves of inflation and ever-higher interest rates, to the point where cash and bonds were rotten investments, equities struggled in real terms and only gold and precious metals really shone.

The CBOE’s OVX index, the oil market’s equivalent of stock market’s VIX, or fear index, stands at 48, some way above its long-run average of 37. This suggests oil traders remain wary of fresh gyrations in oil and gas prices, amid elevated tensions between Tehran and Tel Aviv.

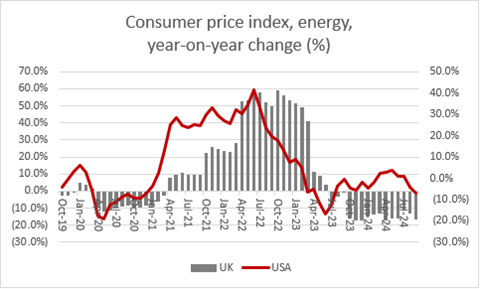

This caution contrasts markedly with the more optimistic approach taken by stock market investors, and it is to be hoped that such complacency does not lead to shocks further down the road, since lower oil prices are helping to boost consumers’ spending power, ease energy input costs for many industries and cool inflation and therefore give central bankers the chance to cut interest rates.

Source: ONS, US Bureau of Labor Statistics, LSEG Refinitiv data

That combination helps to explain why headline equity indices such as the S&P 500 and NASDAQ Composite in the US, DAX and MIB-30 in Europe and even the benighted FTSE 100 trade at or very close to multi-year or even all-time highs.

Any resurgence in hydrocarbon prices could therefore lead to an upset and investors must continue to keep an eye on the key sensitivities here, as part of any risk management process.

Near-term sentiment toward oil and gas prices remains broadly negative for three reasons:

- The International Energy Agency (IEA) continues to assert that demand growth remains anaemic, thanks to China in particular. It argues demand will increase by less than one million barrels per day, on average, in 2024, a marked slowdown from the two-million-plus pace seen post-pandemic in 2022 and 2023. OPEC has also just cut its demand growth forecasts for this year and next, although it is more optimistic than the IEA with a forecast of 1.4 million barrels a day for 2024 and 1.6 million for 2025.

- The IEA also argues that supply is plentiful, even allowing for tensions in the Middle East and output disruptions in Libya, thanks to the febrile political situation there. OPEC+ continues to restrain capacity, too, so there is scope for increased supply here. Meanwhile, American output continues to surge and stands near record highs of 13.2 million barrels a day, thanks to shale, to mean that OPEC+ is not the only game in town.

- Israel has promised not to target Iranian oil facilities in any attacks. The Kharg Island terminal there is particularly important, as it ships 1.6 million barrels of oil a day, or just under 1.5% of total global demand.

Overlaying of all of this remains the long-term issue of the global transition toward more renewable sources of energy and away from hydrocarbons which should, in theory, dampen demand for oil in particular.

Central bankers, politicians and consumers will doubtless all be hoping this prognosis proves correct and energy prices remain contained, as may environmental campaigners.

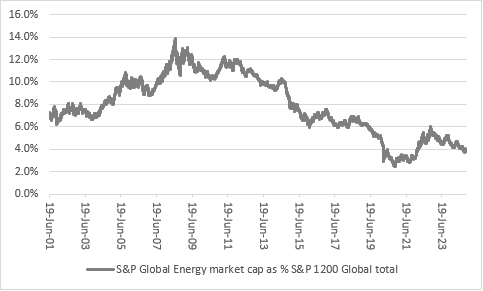

Only oil company executives and shareholders may be less pleased, and in the case of the latter they will note the S&P Global 1200 Energy sector is back down to just 3.8% of the S&P Global 1200’s market capitalisation. Indeed, the Energy sector’s entire market cap of $2.7 trillion is less than that of each of Apple, Nvidia or Microsoft.

Source: LSEG Refinitiv data

Oil stocks are therefore deeply out of favour once more, but contrarians may be tempted to have another look, also for three reasons:

- Demand continues to grow. Even if the IEA and OPEC expect less growth than before, the globe continues to rely heavily on hydrocarbons.

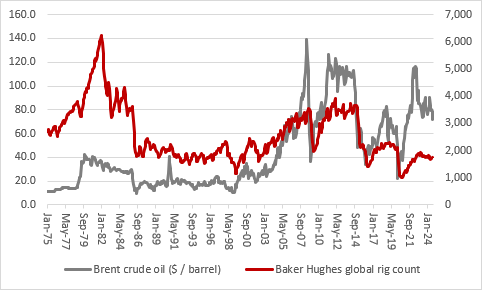

- Even though we continue to consume more oil and gas, drilling activity remains subdued, thanks to the pricing environment and the combination of political and public pressure. If demand does stay more robust for longer than expected, then supply may not be as adequate as we would like to hope.

- The US Strategic Petroleum Reserve (SPR) is still diminished, at 385 million barrels, way below its 714-million-barrel capacity, after the Biden administration’s liquidation of assets to try and cap fuel and gasoline prices for US consumers. At some stage it would make sense to top this back up, especially at a time when energy supply could be a matter of national security.

Source: Baker Hughes, LSEG Refinitiv data

It may not take much for oil and gas to start rising again, boosting oil majors’ profits and cashflow in the process.

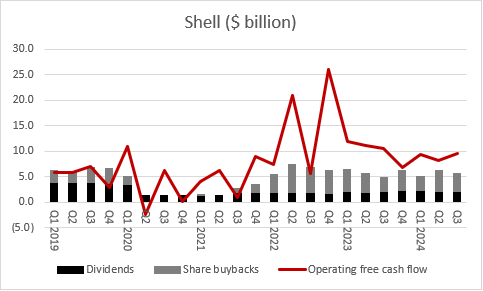

Shell is already on track to return 11% of its current $206 billion stock market capitalisation to shareholders in 2024, via dividends ($8.7 billion) and share buybacks ($13.8 billion), and cash flow is more than sufficient to fund such largesse.

Source: Company accounts

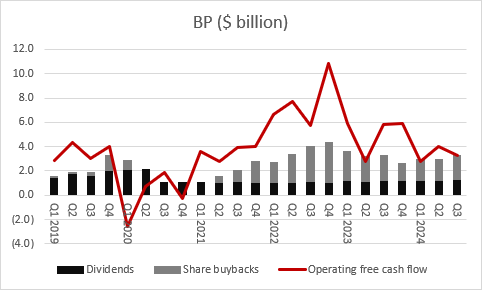

It is a closer call at BP, admittedly, and the FTSE 100 member is planning to reassess its capital allocation and cash return plans in early 2025 as part of a wider strategic review under new boss Murray Auchincloss. For 2024, however, BP is set to return 16% of its current market capitalisation to its investors, via $5 billion in dividends and $7.3 billion in buybacks.

Source: Company accounts

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17

- Thu, 26/09/2024 - 15:45