Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The FTSE 100 was up by almost 6% in 2024 and is offering a forecast dividend yield of some 3.6% on top of that, to provide a steady double-digit percentage return. Analysts expect £78.5 billion in dividends from the FTSE 100 in 2024, before a 6.5% increase in 2025 to £83.6 billion.

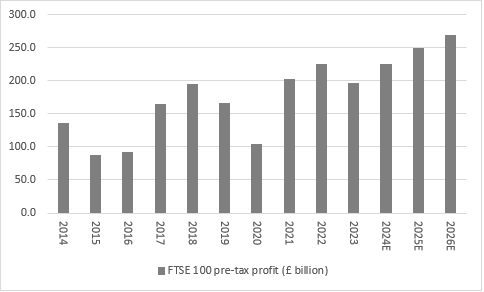

The FTSE 100’s forecast aggregate dividend payment for 2024 lies within 10% of prior all-time highs, and total pre-tax income is expected by analysts to set a new peak in 2025, at £248.8 billion. However, that figure, and the estimate for 2024, have both slipped in the past three months, thanks mainly to weakness in oil and metals prices and their effect in turn upon estimates for the oil producers and miners.

It may be that stronger global economic growth and upgrades to earnings and dividend forecasts are required before the UK really catches investors’ imagination once more, despite its potential yield appeal.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Ordinary dividends only

That appeal rests primarily on its forecast forward yield of 3.6% for 2024 and 3.9% for 2025, based on ordinary dividend payments, with £3.3 billion in special dividends on top from HSBC, Associated British Foods and Berkeley. Further cash returns come in the shape of share buybacks, which are nearing prior-peak levels, and takeover activity, with almost 50 UK-listed firms on the receiving end of a closed or live approach.

This matters, if you believe the old adage that bull markets only end when the money runs out, because investors are currently receiving more in cash than they are being asked to pay out, given the relative paucity of new floats and the limited number of big cash raisings. Data from the London Stock Exchange group states that companies had tapped investors for just £16.3 billion as of the end of November, via either primary or secondary offerings.

Profit forecasts slip lower (yet again)

Analysts no longer expect the FTSE 100 to set a new all-time high for aggregate pre-tax profit in 2024, after a meaty 5% downgrade in the past three months and a 13% cut from a year ago to £224.4 billion. That figure is a fraction below the £225.1 billion record of 2022. Downgrades at oils and miners cover nearly all of the £12.8 billion downgrade of the past three months, thanks to lower commodity prices, themselves the result of soggy economic numbers from China, Germany, France and Japan – four of the world’s seven biggest economies.

Hopes for political stability in some of those, and fiscal or monetary stimulus from all of them, underpin forecasts of better global growth and thus higher earnings in 2025, when analysts do foresee a fresh high in aggregate FTSE 100 earnings of £248.8 billion. Even that is 8% below forecasts for 2025 from a year ago, though, and miners, industrials and oil and gas are expected to generate more than half of the increase between them.

This seems to reaffirm the UK’s status as a geared play on global growth, so it may be the stimulus offered by governments in Beijing, Berlin, Paris and Tokyo have as much say on the FTSE 100’s earnings as events in Barry, Belfast, Perth or Telford.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

The UK does come with some defensive ballast, even if oils, miners and financials may ultimately determine its financial fortunes. Healthcare, consumer staples, utilities and telecoms are expected to generate just over a quarter of earnings in 2024 and 2025. Such a relatively dependable contribution could be valuable if GDP growth proves hard to come by, but for the moment company boardrooms seem confident in the outlook and that profits will indeed continue to flow. No fewer than 45 current members of the UK’s elite stock market index have already sanctioned share buyback programmes in 2024, compared to 42 across the whole of 2023 and 45 in 2022.

The value of the buybacks announced in 2024 stands at £56.5 billion at the time of writing, to perhaps give the FTSE 100 a platform for a crack at 2022’s all-time high of £58.2 billion. Add together ordinary dividends, special dividends and buybacks and FTSE 100 firms are expected by analysts to return £138.3 billion to their shareholders in 2024. That beats the prior all-time high figure of £137.5 billion in 2022.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Ordinary dividends only. *Announced in aggregate as of 6 December

Merger and acquisition activity is also boosting investor returns and shining a spotlight on how the UK equity market may be cheap after a long period in the doldrums. Two FTSE 100 firms are the current target of bids, DS Smith and Hargreaves Lansdown, while Rightmove and Anglo American have fended off approaches and Darktrace has been acquired. Non-life insurer Hiscox was the subject of a rumoured approach, although such chatter seems to have dissipated.

Add in the forecast £10 billion in dividends from the FTSE 250 and £48.3 billion in successful or ‘live’ takeover offers and investors could be set for a £196.6 billion inflow from the FTSE 350 overall in 2024, thanks to the combination of dividends, buybacks and takeovers. That figure equates to 8.3% of the FTSE 350’s current £2.4 trillion market valuation, a ‘cash yield’ which compares favourably to the prevailing Bank of England base rate, yield on a 10-year UK government gilt and headline rate of inflation (4.75%, 4.31% and 2.3% respectively, at the time of writing).

Dividend growth still very concentrated

The FTSE 100 forms the bedrock of those figures and investors must be aware of the relative degree of concentration risk within the UK’s headline index. Just 10 companies are forecast to pay out 54% of the forecast total for 2024, at £42.7 billion, while the top 20 are expected to chip in £55.7 billion, or 71% of the total.

Vodafone’s well-trailed, £1 billion-plus dividend cut for 2024 weighs heavily and the biggest forecast increases, expected to come from International Consolidated Airlines, Rolls-Royce, AstraZeneca, Berkeley and Admiral pale by comparison. The forecast drop in HSBC’s payment is not a cut, but the result of a lower share count and a near-4% total decrease in the FTSE 100’s share count, thanks to buybacks, which must be considered when assessing the overall trends in aggregate dividend payments.

| 2024E | |||

|---|---|---|---|

| Ten biggest forecast | Ten biggest forecast | ||

| Dividend increases | £ million | Dividend decreases | £ million |

| Rolls Royce | 445 | WPP | (13) |

| International Consolidated Airlines | 300 | Imperial Brands | (16) |

| AstraZeneca | 180 | St James's Place | (33) |

| Admiral Group | 166 | Antofagasta | (33) |

| Berkeley | 162 | Mondi | (40) |

| LondonMetric Property | 131 | Rio Tinto | (80) |

| GSK | 115 | Barratt Redrow | (164) |

| Associated British Foods | 111 | Anglo American | (237) |

| National Grid | 106 | Vodafone | (1,123) |

| 3i | 86 | HSBC | (1,169) |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Ordinary dividends only

Dividend cover is slipping, too

One potential area of concern when it comes to the UK equity market’s appeal as a source of income is the drop in forecast dividend cover back below the two times threshold. Earnings cover for forecast dividend payments is still stronger than it was ahead of the mid-cycle growth bump of 2015-2016 that promoted a rash of dividend cuts and, for that matter, the entire stretch from 2014 to 2020 when earnings never once covered payouts by a factor of two or more.

However, the drop below two, thanks to the ongoing slide in earnings forecasts, could lead some investors to question the reliability of dividend estimates, especially if there is a nasty surprise awaiting the global economy and markets in 2025, or even 2026. That said, cover is seen rising nicely above two times in both of the next two years and it also seems reasonable to assume that share buyback programmes will be halted before dividends are cut.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

Many dividend yields compare well to gilts

At the time of writing, Phoenix Group is the highest-yielding stock in the FTSE 100, followed by asset manager M&G and fellow life insurer Legal & General and Phoenix Group, with British American Tobacco, another life insurer in the form of Aviva and then housebuilder Taylor Wimpey next on the list.

BAT has never cut its dividend and can even point to a streak of increases in its annual dividend payment that stretches back to 1998. The fat yield at the tobacco giant may raise the question of whether that streak is about to end, even if its cashflow remains robust and the firm is even cannily selling assets in India to buttress its finances.

There have been 135 dividend cuts across the current crop of FTSE 100 members in the past decade and, even if 73 of those came in the Covid-blighted years of 2019 and 2020, there were still eight in 2023. There are 13 more are on the cards for 2024, if analysts’ forecasts are correct, thanks mainly to the miners and housebuilders, alongside Vodafone, as well as the effect of a stronger pound on dollar-denominated payments.

| Company | Dividend yield (%) | Dividend cover (x) | Pay-out ratio (%) | Cut in last decade? |

|---|---|---|---|---|

| Phoenix Group | 10.5% | 0.05 x | 2137% | 2019, 2020 |

| M&G | 9.8% | 0.75 x | 134% | No |

| Legal & General | 8.9 % | 0.86 x | 116% | No |

| British American Tobacco | 8.1% | 1.58 x | 63% | 2019 |

| Aviva | 7.5% | 1.16 x | 86% | 2019 |

| Talyor Wimpey | 7.5% | 0.82 x | 123% | 2019 |

| Schroders | 6.9% | 1.20 x | 83&% | No |

| Land Securities | 6.8% | 1.72 x | 58% | 2019 |

| LondonMetric Property | 6.4% | 1.41 x | 71% | 2015 |

| HSBC | 6.3% | 2.06 x | 49% | 2019, 2020 |

| Average | 7.9% | 1.16 | 86% |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, LSEG Datastream data. Ordinary dividends only

A further rule of thumb states that any dividend yield which exceeds the risk-free rate by a factor of two may turn out to be too good to be true. The 10-year gilt yield is a good proxy for the risk-free rate. For the record, just four FTSE 100 firms currently offer a forecast dividend yield of 8.62% or more, or twice the 4.31% 10-year gilt yield that prevails at the time of writing.

Serial dividend growers

A really fat dividend yield is not necessarily a good sign anyway, as it can mean that investors are demanding such a juicy return to compensate themselves for what they see as substantial risks at a company, either in terms of its business model, balance sheet or boardroom acumen.

If anything, history suggests that it is dividend growth that is the real secret sauce for a share price, as a growing pay-out will drag it higher over time.

In 2024, Diploma and SEGRO have joined the list of FTSE 100 firms who have increased their annual dividend payment every year for a least a decade. This group has, on average, premium capital returns and total returns relative to the FTSE 100. Only five of the 19 have underperformed the FTSE 100 over the past decade in capital terms and just five have also done so in terms of total returns (including dividend reinvestment).

Even those few misses show that careful research is still needed, while only 10 of the 20 were in the FTSE 100 a decade ago. Any investor looking for the next generation of dividend growth winners may need to dig into the FTSE 250 (or below). To back up this point, the three firms nearest to joining the 10-up club are Coca-Cola HBC, Severn Trent and LondonMetric Property, with growth streaks of eight years. After that, no current FTSE 100 member is managing more than five years, owing to the damage wrought by the pandemic.

Source: LSEG Datastream data, company accounts, Marketscreener, consensus analysts’ forecasts. Ordinary dividends only. Data to 6 December 2024

Dividend dashboard explained

Each quarter, AJ Bell takes the forecasts for the FTSE 100 companies from all the leading City analysts and aggregates them to provide the dividend outlook for each company and the entire index. The data relates to the outlook for 2024 and in some cases 2025. Data is correct as of 19 September 2024.

These articles are for information purposes only and are not a personal recommendation or advice. Past performance isn't a guide to future performance, and some investments need to be held for the long term.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52