Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

In 2024 it looks like shareholders and boardrooms once more showed more patience than football club executives and supporters, even if the FTSE 100 index made relatively modest progress compared to many of its major international peers.

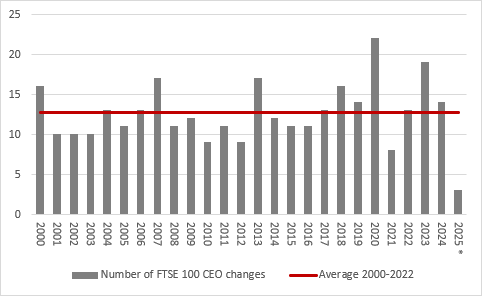

A total of 14 FTSE 100 firms saw a change in chief executive, just above the post-2000 average of 13, while a new manager pitched up at no fewer than 50 of the 92 Premiership and Football League clubs in 2024, with five of those 50 getting in a new man (and they were all men) on two occasions and two seeing three changes.

Source: Company accounts. *2025 changes as already announced, as of 2 January.

Again, the FTSE 100 showed more stability here, as just one interim boss stepped aside – Stella David at Entain – and no stop-gap appointments were made. That said, of the three firms to have already announced a change in 2025, DS Smith and SSE have yet to anoint a successor. The third, EasyJet, will see Kenton Jarvis step up from the role of chief financial officer (CFO) to the top job in late January. But just these three changes are already in chain for this year, compared to seven at the same stage in January 2024.

| Announced and effective in 2024 | |||

|---|---|---|---|

| Company | In | Out | Date |

| Legal & General | Antonio Simoes | Sir Nigel Wilson | 01-Jan-24 |

| Unite | Joe Lister | Richard Smith | 01-Jan-24 |

| Endeavour Mining | Ian Cockerill | Sebastien de Montessus | 04-Jan-24 |

| Pearson | Omar Abbosh | Andy Bird | 08-Jan-24 |

| Spirax Group | Nimesh Patel | Nick Anderson | 16-Jan-24 |

| BT | Allison Kirkby | Philip Jansen | 29-Jan-24 |

| Melrose Industries | Peter Dilnot | Simon Peckham | 07-Mar-24 |

| Smiths Group | Roland Carter | Paul Keel | 26-Mar-24 |

| Airtel Africa | Sunil Taldar | Olesegun Ogunsanya | 01-Jul-24 |

| Burberry | Joshua Shulman | Jonathan Akeroyd | 15-Jul-24 |

| HSBC | Georges Elhedery | Noel Quinn | 02-Sep-24 |

| Entain | Gavin Isaacs | Stella David (interim) | 02-Sep-24 |

| Darktrace | Jill Popelka | Poppy Gustafsson | 06-Sep-24 |

| Schroders | Richard Oldfield | Peter Harrison | 08-Nov-24 |

| Announced but only effective in 2025 | |||

| Company | In | Out | Date |

| EasyJet | Kenton Jarvis | Johan Lundgren | 20-Jan-25 |

| DS Smith | Miles Roberts | 30-Nov-25* | |

| SSE | Alistair Phillips-Davies | 2025 | |

Source: Company accounts.*At the latest. As of 2 January 2025.

A quieter year for changes in CEO was perhaps to be expected after a very busy 2023, when 19 FTSE 100 members appointed a new leader, the second-highest figure this century, behind only the 22 changes of 2020.

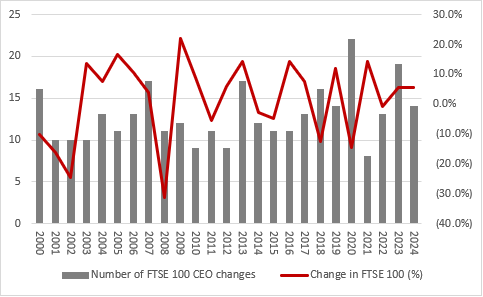

The FTSE 100 returned 5.7% in 2024 but that trailed the 20%-plus returns from America’s NASDAQ and S&P 500, as well as high-teens percentage gains from Germany’s DAX and Hong Kong’s Hang Seng (even if the last two hail from countries perceived to have deep-rooted economic problems).

Source: Company accounts, LSEG Refinitiv data.

Perhaps a few FTSE 100 bosses will feel the heat in 2025 if the UK market continues to lag, either from an activist investor or a predator. Three members of the elite index received successful takeover bids – DS Smith, Darktrace and Hargreaves Lansdown – while Rightmove and Anglo American managed to fend off unwanted attentions from suitors and Hiscox was the subject of ultimately unsubstantiated rumours.

In most cases, however, the change in FTSE 100 leaders was pretty smooth in 2024. Six of last year’s changes – Legal & General, Unite, Pearson, Spirax Group, BT and Melrose Industries – had been announced in 2023 and all six companies had already identified and selected their new leader before 2024 began.

That said, some leaders did not necessarily depart of their own volition, or at least at a time of their choosing, as Sebastien de Montessus was sacked by Endeavour Mining and Jonathan Akeroyd left Burberry very abruptly after yet another profit warning.

As a result of all of these changes, the average tenure of a FTSE 100 CEO is now 57 months, or just over five-and-a-half years.

Roland Carter at Smiths, Sunil Taldar at Airtel Africa, Gavin Isaacs at Entain, Georges Elhedery at HSBC and Richard Oldfield at Schroders have all been in their post for nine months or less. By contrast to these newbies, 18 bosses have been in charge for more than a decade. One of those – Next’s Lord Simon Wolfson – has been in charge for more than 20 years. Another three bosses – Intertek’s Andre Lacroix, Standard Chartered’s Bill Winters and Barratt Redrow’s David Thomas – could join this list as they are due to reach their 10-year landmark in 2025.

DS Smith’s Miles Roberts and SSE’s Alistair Phillips-Davies will drop out of this list, however, as they are stepping down in 2025 (and DS Smith will also be taken over by International Paper and thus drop out of the FTSE 100).

| The 18 FTSE 100 bosses to have served for at least 10 years* | |||

|---|---|---|---|

| Company | CEO | Started | Years in charge |

| Next | Simon Wolfson | May-2001 | 23.7 |

| Associated British Foods | George Weston | Apr-2005 | 19.8 |

| Berkeley | Rob Perrins | Sep-2009 | 15.3 |

| RELX | Erik Engstrom | Nov-2009 | 15.2 |

| LondonMetric Property | Andrew Jones | Mar-2010 | 14.9 |

| DS Smith | Miles Roberts | May-2010 | 14.7 |

| SEGRO | David Sleath | Apr-2011 | 13.7 |

| Croda | Steve Foots | Jan-2012 | 13.0 |

| Experian | Brian Cassin | Apr-2012 | 12.7 |

| 3i | Simon Borrows | May-2012 | 12.6 |

| Fresnillo | Octavio Alvidrez | Aug-2012 | 12.4 |

| AstraZeneca | Pascal Soriot | Oct-2012 | 12.3 |

| SSE | Alistair Phillips-Davies | Jul-2013 | 11.5 |

| Rentokil Initial | Andy Ransom | Oct-2013 | 11.3 |

| Informa | Stephen Carter | Jan-2014 | 11.0 |

| Severn Trent | Liv Garfield | Apr-2014 | 10.7 |

| Pershing Square | Anne Farlow (chair) | Oct-2014 | 10.3 |

| Games Workshop | Kevin Rountree | Jan-2015 | 10.0 |

Source: Company accounts. *As of 2 January 2025.

The average FTSE 100 leader’s tenure must make football managers green with envy.

Only three of the 92 gaffers across the Premiership, Championship, League One and League Two can beat the average FTSE 100 CEO’s tenure of 5.6 years and their average time in the dugout is just 18.3 months, or 1.5 years. Only 12 football bosses can point to just three years or more in their position.

| The 12 longest-serving British football club managers* | |||

|---|---|---|---|

| Club | Manager/coach | Started | Years in charge |

| Harrogate Town | Simon Weaver | 21-May-09 | 15.6 |

| Manchester City | Pep Guardiola | 01-Jul-16 | 8.5 |

| Brentford | Thomas Frank | 16-Oct-18 | 6.2 |

| Arsenal | Mikael Arteta | 20-Dec-19 | 5.0 |

| Bolton Wanderers | Ian Evatt | 01-Jul-20 | 4.5 |

| Mansfield Town | Nigel Clough | 06-Nov-20 | 4.2 |

| Wrexham | Phil Parkinson | 01-Jan-21 | 4.0 |

| Bromley | Andy Woodman | 29-Mar-21 | 3.8 |

| Fulham | Marco Silva | 01-Jul-21 | 3.5 |

| Stockport County | Dave Challinor | 02-Nov-21 | 3.2 |

| Newcastle United | Eddie Howe | 08-Nov-21 | 3.2 |

| Ipswich Town | Kieran McKenna | 16-Dec-21 | 3.1 |

Source: Utilita Football Yearbook, club websites, BBC Sport website. *As of 3 January 2025.

Nor are football bosses getting any more time to get results on the pitch. The average tenure of 1.5 years is the same as it was in 2022, when six managers could match the average term of a FTSE 100 boss.

| Average tenure, years | ||||||||

|---|---|---|---|---|---|---|---|---|

| FTSE 100 | Football managers | Number of football managers who have served longer than the average FTSE 100 CEO | ||||||

| 02-Jan | CEO | CFO | All | Prem | Champ | League1 | League2 | |

| 2020 | 5.1 | 4.8 | 1.6 | 2.6 | 1.7 | 1.4 | 1.5 | 5 |

| 2021 | 5.8 | 5.1 | 1.7 | 2.2 | 1.4 | 2.1 | 1.3 | 5 |

| 2022 | 5.2 | 5.2 | 1.5 | 1.9 | 0.9 | 1.8 | 1.5 | 6 |

| 2023 | 5.2 | 3.9 | 1.5 | 2.3 | 1.0 | 0.9 | 2.0 | 6 |

| 2024 | 5.6 | 4.0 | 1.5 | 2.1 | 0.9 | 1.4 | 1.8 | 3 |

Source: Utilita Football Yearbook, club websites, BBC Sport website. *As of 2 January 2025.

The Championship is proving particularly cut-throat, as the riches of the Premier League lie tantalisingly within view and the danger of the drop to League One and some serious economic hardship is a real concern for many.

| Average tenure for current incumbents* | |||

|---|---|---|---|

| Days | Months | Years | |

| FTSE 100 | 2,034 | 66.9 | 5.6 |

| Premier League | 755 | 24.8 | 2.1 |

| Championship | 331 | 10.9 | 0.9 |

| League One | 512 | 16.8 | 1.4 |

| League Two | 642 | 21.1 | 1.8 |

| AVERAGE | 556 | 18.3 | 1.5 |

Source: Company accounts, Utilita Football Yearbook, club websites, BBC Sport website. *As of 2 January 2025.

Granted, not all clubs change boss voluntarily. Some managers jump ship to go elsewhere, as happened at Leicester City, when Enzo Maresca elected to join Chelsea, Roberto de Zerbi left Brighton & Hove Albion and Ruben Selles left Reading to accept the top job at Hull City. That left their former employers looking for a new manager.

Nevertheless, the usual fate of a manager is the sack and 17 clubs in the Championship changed manager in 2024, compared to 12 in League One and League Two and nine in the Premier League. Five clubs changed manager twice in the course of the year and two managed it three times (Swindon Town and Burton Albion).

As a result, the average Premier League manager seems to get the longest chance to prove their worth, at 2.1 years on average, compared to 1.8 years in League Two, 1.4 in League One and a frightening 0.9 years in the Championship. The overall average tenure for a football manager of just 1.5 years is already being matched or bettered by 81 bosses within the FTSE 100.

Two seasons was all Cherie Lunghi got in the 1980s series The Manager where she played Gabriella Benson, the manager of a team in the men’s Second Division (as it was then, Championship as it is now).

That is one glass ceiling which women have yet to break in the UK, even if 11 FTSE 100 firms have female chief executives or chairs of the board, in the case of two investment trusts.

| Company | CEO/chair | Started | Years in charge* |

|---|---|---|---|

| Severn Trent | Liv Garfield | 11-Apr-14 | 10.7 |

| Pershing Square Inv. Trust | Anne Farlow (chair) | 01-Oct-14 | 10.3 |

| GlaxoSmithKline | Emma Walmsley | 01-Apr-17 | 7.8 |

| F&C Inv. Trust | Beatrice Hollond (chair) | 01-Jan-20 | 5.0 |

| Aviva | Amanda Blanc | 06-Jul-20 | 4.5 |

| Admiral Group | Milena Mondini de Focatiis | 31-Dec-20 | 4.0 |

| Taylor Wimpey | Jennie Daly | 26-Apr-22 | 2.7 |

| Vodafone | Margherita Della Valle | 01-Jan-23 | 2.0 |

| United Utilities | Louise Beardmore | 31-Mar-23 | 1.8 |

| Diageo | Debra Crew | 05-Jun-23 | 1.6 |

| BT | Allison Kirkby | 29-Jan-24 | 0.9 |

| Average tenure | 4.7 | ||

Source: Company accounts. *As of 2 January 2025.

That remains a low hit rate, but the post of CFO is seeing more progress. Thirty-three members of the FTSE 100 have a female CFO, and that total will become 34 when Alison Dolan takes on the role at Marks & Spencer this month.

| Company | CFO | Started | Years in charge* |

|---|---|---|---|

| NatWest Group | Katie Murray | 01-Jan-19 | 6.0 |

| Pearson | Sally Johnson | 24-Apr-20 | 4.7 |

| Smith & Nephew | Anne-Francoise Nesmes | 03-Aug-20 | 4.4 |

| Land Securities | Vanessa Simms | 01-Jun-21 | 3.6 |

| Diageo | Lavanya Chandrashekar | 01-Jul-21 | 3.5 |

| AstraZeneca | Aradhana Sarin | 01-Aug-21 | 3.4 |

| Hargreaves Lansdown | Amy Stirling | 21-Feb-22 | 2.9 |

| Shell | Sinead Gorman | 31-Mar-22 | 2.8 |

| Barclays | Anna Cross | 22-Apr-22 | 2.7 |

| Smiths Group | Clare Sherrer | 29-Apr-22 | 2.7 |

| M&G | Kathryn McLeland | 03-May-22 | 2.7 |

| F&C Investment Trust | Julie Tankard (audit) | 01-Aug-22 | 2.4 |

| Aviva | Charlotte Jones | 05-Sep-22 | 2.3 |

| Sainsbury’s | Blathnaid Bergin | 06-Mar-23 | 1.8 |

| WPP | Joanne Wilson | 19-Apr-23 | 1.7 |

| Croda | Louisa Burdett | 26-Apr-23 | 1.7 |

| GSK | Julie Brown | 01-May-23 | 1.7 |

| Scottish Mortgage Inv. Trust | Sharon Flood (audit) | 27-Jun-23 | 1.5 |

| Severn Trent | Helen Miles | 01-Jul-23 | 1.5 |

| Burberry | Kate Ferry | 17-Jul-23 | 1.5 |

| Rolls-Royce | Helen McCabe | 04-Aug-23 | 1.4 |

| BP | Kate Thomson | 19-Sep-23 | 1.3 |

| RS Group | Kate Ringrose | 02-Oct-23 | 1.3 |

| Reckitt Benckiser | Shannon Eisenhardt | 31-Mar-24 | 0.8 |

| British American Tobacco | Soraya Benchikh | 30-Apr-24 | 0.7 |

| Beazley | Barbara Plucnar Jensen | 21-May-24 | 0.6 |

| Spirax Group | Louisa Burdett | 08-Jul-24 | 0.5 |

| Haleon | Dawn Allen | 01-Nov-24 | 0.2 |

| Alliance Witan | Jo Dixon (audit) | 01-Mar-20 | 4.8 |

| Games Workshop | Liz Harrison | 18-Sep-24 | 0.3 |

| St James's Place | Caroline Waddington | 16-Sep-24 | 0.3 |

| Schroders | Meagan Burnett | 01-Jan-25 | 0.0 |

| HSBC | Pam Kaur | 01-Jan-25 | 0.0 |

| Average tenure | 2.1 | ||

Source: Company accounts. *As of 2 January 2025.

That said, the rate of progress did slow last year. Just six of the 22 CFO jobs that came up for grabs went to female candidates across the FTSE 100 and just two of the 14 CEO posts (Alison Kirkby at BT and Jill Popelka at the subsequently acquired Darktrace).

At least 2025 is off to a faster start in this respect. Meagen Burnett and Pam Kaur took on the role of CFO at Schroders and HSBC respectively on 1 January and Alison Dolan is poised to take the financial reins at Marks & Spencer, to cover three of the eight changes in head number cruncher already announced for this year.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52