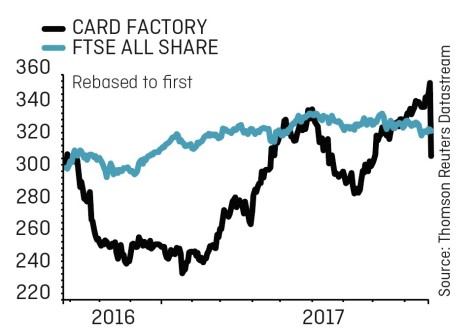

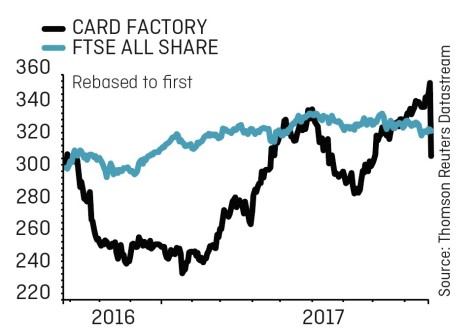

Card Factory (CARD) 303.6p

Gain to date: 11.2%

Original entry point: Buy at 273.1p, 9 March 2017

A modest first half profit miss and a more cautious second half outlook have wiped out some of the gains we previously made on greeting cards seller Card Factory (CARD). It doesn’t change our view that this is a great business and should be a winning investment over the long term.

The main culprit behind the share price decline on 26 September was an increase in costs. This was driven by the impact of the National Living Wage and a currency hit as weaker sterling impacts

Card Factory’s buying power on products sourced in US dollars.

The company also makes reference to ‘the decline in footfall seen across the high street’ as context for the results.

Ultimately margins are down from 20.2% to 18.3% and this fed through to a 14% year-on-year drop in pre-tax profit to £23.2m.

These headwinds are mitigated by a 3.6% increase in the first half ‘normal’ dividend to 2.9p and the announcement of a 15p special dividend. This generosity reflects a strong balance sheet and continuing excellent cash flow.

Liberum stays at ‘buy’ with a 365p price target. It comments: ‘The key positive is the £51m special dividend, which we believe gives a potential total dividend yield of c.7%, and strong cash generation.’

‹ Previous2017-09-28Next ›

magazine

magazine