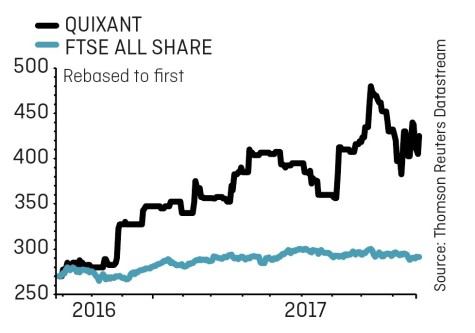

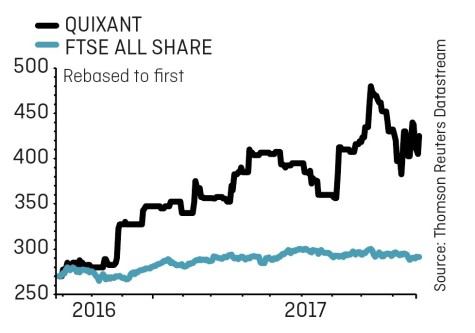

Quixant (QXT:AIM) 425p

Gain to date: 49.1%

Original entry point: Buy at 285p, 20 October 2016

Half year results were once again excellent from gaming technology supplier Quixant (QXT:AIM).

Revenue jumped 38% to $56.9m driven by a quite exceptional 78% organic jump from its core Gaming division to $37.8m. Pre-tax profit soared 98% to $8.7m.

Even management were surprised by the level of demand, which also explains the slightly weaker cash flow performance in the period (more hardware ordered and paid upfront by Quixant).

Those numbers are impressive enough but, arguably, the most positive news is the company’s increasing project work with the world’s five tier 1 gaming machine manufacturers (IGT, Aristocrat, Novomatic, Scientific Games and Gauselman). This is a fantastic way to gain their trust and demonstrate the quality of Quixant’s products in real world situations.

Talk of a mildly quieter second half by typical standards looks to us like sensible expectation management by the company. There’s also promising gaming regulation developments in Japan, where legislation has been passed for land-based casinos to operate. Another emerging growth market to add to the list.

‹ Previous2017-09-28Next ›

magazine

magazine