Making investment decisions is fraught with difficulties as there are many factors that can impact potential returns.

Sometimes investors just want to put their money into an investment fund and let the fund manager do the hard work. Yet even picking the right fund can be a headache.

It is easy to plump for an all-round global income fund, but there is a high chance such a product is dominated by equities (individual company shares) and lacks the asset diversification required by a good portfolio.

One solution might be to invest in a multi-asset fund. That’s a specific type of fund which is considered by many experts to be a ‘one-stop-shop’. A single multi-asset fund can contain a vast array of asset classes such as shares, bonds, property and commodities.

While likely to be more expensive than plain equity funds, it is cheaper to build a diversified portfolio with one or two multi-asset funds than it would be to invest in a range of different funds.

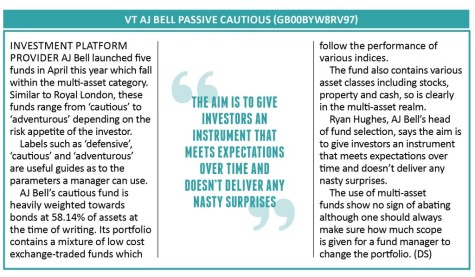

To give you some ideas of the types of investment choices, we now look at products from fund houses Pictet Asset Management and Royal London as well as AJ Bell’s range of multi-asset funds.

‹ Previous2017-09-28Next ›

magazine

magazine