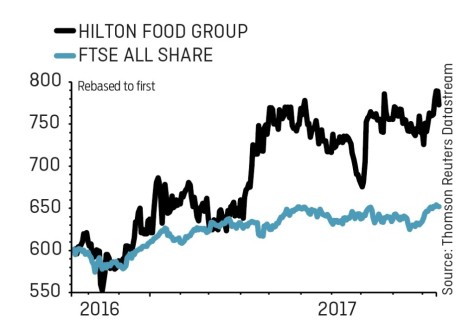

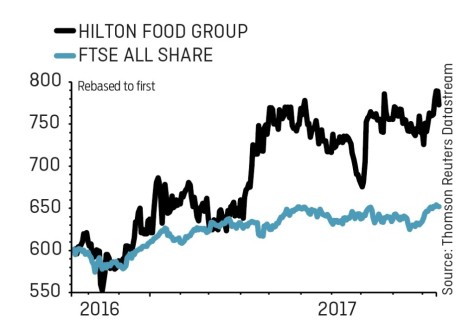

Our positive call on retail meat packing specialist Hilton Food (HFG) is so far 10.4% in the money. We’re running this winner for further upside, as the £571.5m cap is growing its volumes with supermarkets around the world and exporting its cash generative business model to additional territories with existing and new retail customers alike.

Supplying the likes of Tesco (TSCO), Ahold Delhaize and Coop Danmark from state-of-the-art plants that use automation and advanced robotics, Hilton’s recent deals include tie-ups with Portugal’s leading food retailer Sonae, Woolworths Australia and Tesco Central Europe.

It recently announced plans to expand its retail meat packing capabilities into New Zealand. It will construct a new facility in Auckland, an extension of an existing site, in order to supply Countdown Supermarkets, a subsidiary of existing customer Woolworths.

The company has also raised £55.9m by placing new shares with institutional investors to help fund the £80.8m acquisition of Seachill, a leading chilled fish processor in the UK. The deal is expected to be earnings enhancing in the first full year of ownership.

‹ Previous2017-10-19Next ›

magazine

magazine