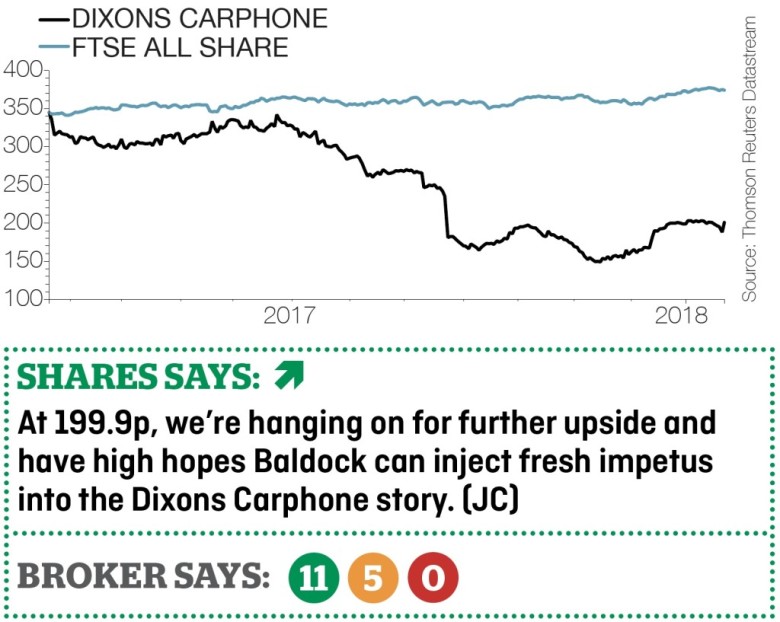

DIXONS CARPHONE (DC.) 199.9p

Gain to date: 5%

Our bullish call on electricals-to-telecoms retailer Dixons Carphone (DC.) is 5% in the money. There’s much more to come as the shares emerge from last summer’s profit warning-induced doldrums.

Dixons Carphone delivered news of healthy Christmas trading on 22 January. Group like-for-like sales grew 6% in the 10 weeks to 6 January 2018, buoyed by strong performances in the Nordics and Greece, while UK & Ireland like-for-likes were up 3% despite the disposable income squeeze.

However, the top end of the £2.32bn cap’s full year profit before tax guidance is lower, downgraded to a £365m-to-£385m range from £360m-to-£400m previously.

We welcome the appointment of Shop Direct boss Alex Baldock, who brings digital expertise, as Dixons Carphone’s new CEO. He succeeds Sebastian James who is moving to join Boots later this year after six years in the hot seat.

Numis forecasts profit before tax of £370m (2017: £489m) for the year to 30 April 2018, ahead of £375m in 2019. Based on a flat 11.3p dividend this year and next, Dixons Carphone is grudgingly valued on a 5.7% dividend yield.

‹ Previous2018-01-25Next ›

magazine

magazine