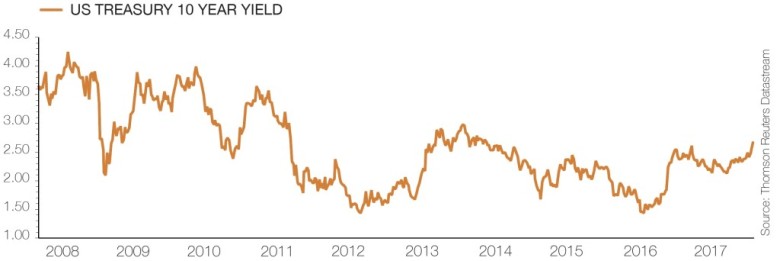

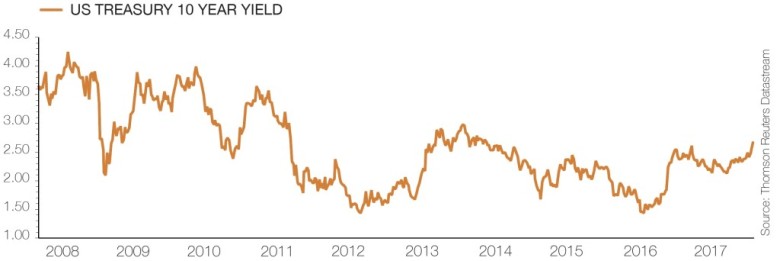

Rising US Treasury yields could reflect waning market faith in the Trump administration amid continuing political ructions in Washington as well as expectations for further rate hikes from the Federal Reserve. Yields rise as bond prices fall.

After climbing for a third consecutive week, the yield on the 10-year US Treasury bond has hit its highest level since 2014 at more than 2.6% amid a US government shutdown.

Although a short-term deal was reached to end the impasse on 22 January, just before that event the two-year bond at 2.07% eclipsed the dividend yield on the S&P 500. This key crossing point is seen in some quarters as a sign that a US stock market correction could be looming.

If the income on offer from low-risk government bonds is higher than more risky equities, then investors may begin to trim their exposure to the latter in favour of the former.

Capital Markets chief markets economist John Higgins reckons 10-year treasury yields will continue to rise in 2018 as the Federal Reserve increases rates at a faster-than-expected rate, but that they will peak at 3% before falling in 2019. (TS)

‹ Previous2018-01-25Next ›

magazine

magazine