Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Kore Potash to rival Sirius Minerals with ‘world class’ mining project

Fans of British mining stock Sirius Minerals (SXX) may be interested in another potash company called Kore Potash (KP2:AIM) which has just listed on the UK stock market.

Analysts reckon it has a world class project which is likely to have some of the lowest operating costs in the industry, implying scope to make healthy profit margins if potash prices hold up.

Later this year Kore will have to raise a very large amount of money. Current estimates suggest its Kola project in the Republic of Congo will cost $1.8bn to build.

Chief executive Sean Bennett believes one third of the money will have to be raised from investors, adding up to $600m (£427m). That’s more than four and a half times its current market cap (£90.2m). The remaining $1.2bn will come from debt finance.

‘Our big investors know we have to raise a lot of money once our definitive feasibility study is out at the end of the second quarter or in the third quarter this year,’ explains Bennett. ‘They wouldn’t have backed us if they weren’t willing to help with the costs of the mine build.’

Kore (when known as Elemental Minerals) received a $123m takeover offer from Asian investor Dingyi Group in 2013 but the deal fell through for technical reasons linked to red tape around a stock market listing in Hong Kong.

Dingyi now owns 8.82% of Kore and is the fourth largest shareholder. Other big investors include SGRF (Oman’s state general reserve fund) at 19.06%, Chile lithium producer SQM at 17.55%, and Harlequin Investments at 12.55%.

Bennett says Kore will look to switch listings from AIM to London’s Main Market when it raises money for the mine build, similar to the route followed by Sirius Minerals.

He hopes to start construction next year and begin production in 2022, meaning it is just behind Sirius which is already building and eyeing a 2021 start-up for its potash project in Yorkshire.

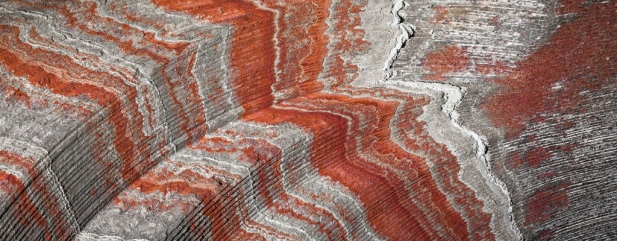

Kore has an advantageous position thanks to its ore body being relatively shallow compared to many potash mines at 190m to 340m deep. In comparison, Sirius is sinking a shaft to a depth of 1,500m.

Kore will produce MOP which is the most common potassium source used in agriculture, accounting for approximately 95% of all potash fertilisers used worldwide. Sirius plans to produce polyhalite which has an unproven market.

Kore is at a disadvantage to Sirius from a financing perspective. The latter has already raised its mine money and arguably operates in a lower risk geography from an investment perspective.

The pair could soon be joined on the London stock market by another potash miner, Danakali. It has a joint venture in Eritrea on the Colluli project which could start production in 2020 via open pit mining. (DC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine