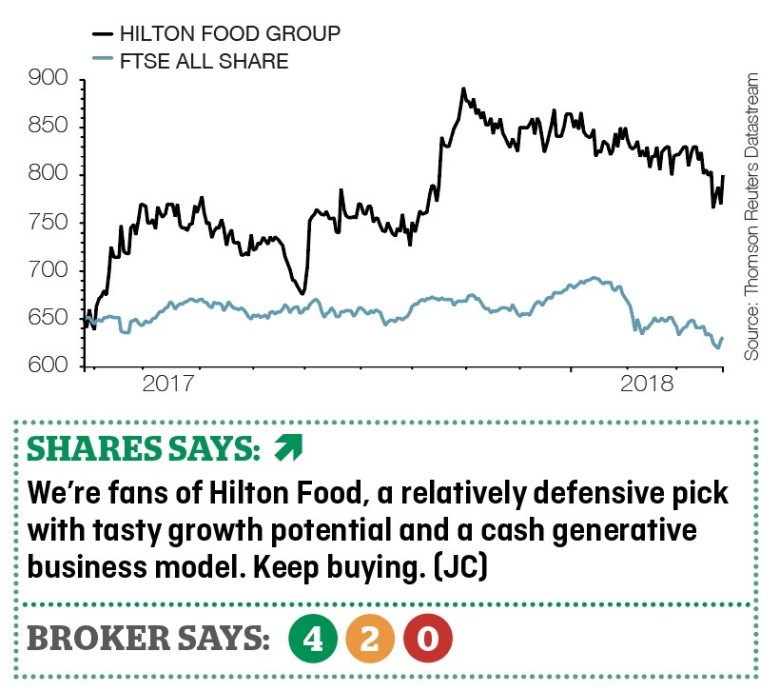

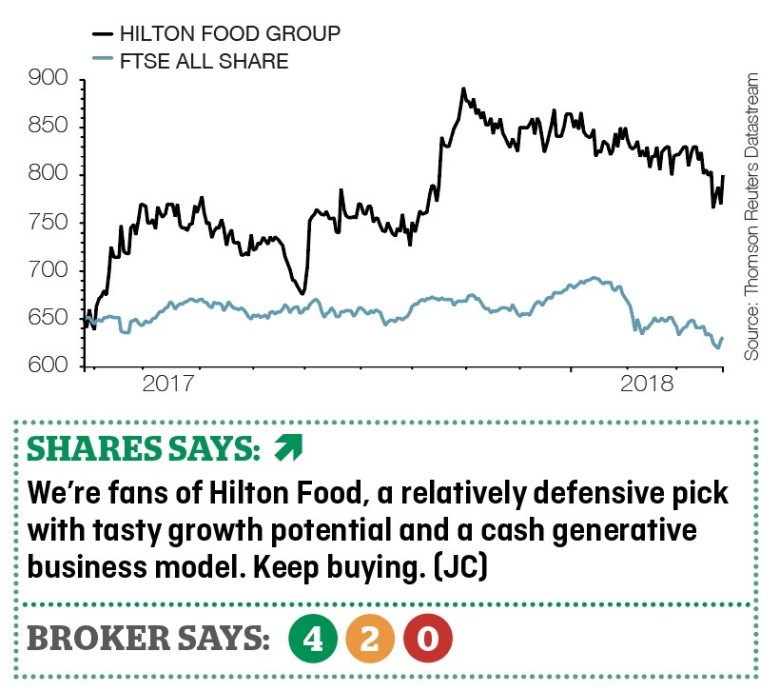

Hilton Food (HFG) 800p

Gain to date: 12%

Our bullish call on meat packing specialist Hilton Food (HFG) is 12% in the money. We remain positive on the investment case given its visible growth pipeline, progressive shareholder reward and an ungeared balance sheet providing firepower to fund new expansion opportunities.

Cash-generative Hilton supplies the likes of Tesco (TSCO), Coop Danmark, Woolworths and Ahold from state-of-the-art plants that use automation and advanced robotics.

Full year results (28 Mar) were better than expected with adjusted pre-tax profit up 12.7% to £37.4m on volumes up 10.4% to 303,811 tonnes and the total dividend raised 11.1% to 19p.

Encouragingly, the £81m acquisition of Seachill has provided a low risk entry into the growing fish protein category and strengthened Hilton’s ties with Tesco, while exciting investments in Australia, New Zealand and Central Europe are all progressing to plan.

Stockbroker Numis forecasts pre-tax profit of £43.3m in 2018 and £45.6m in 2019.

‹ Previous2018-04-05Next ›

magazine

magazine