US stocks are experiencing renewed volatility after several of Apple’s suppliers warned on profit (12 Nov). This has raised concerns over the growth rate at the consumer electronics giant and several of its big technology peers, sending shares in Apple and other tech companies into reverse.

Worries over Apple’s growth prospects are nothing new and arguably it is already making the transition from growth stock to a mature cash generating machine.

This has been reflected in its valuation for some time, with an earnings multiple of 15-times much lower than those enjoyed by the likes of Amazon or Google’s owner Alphabet.

So why is the tech sell-off relevant? The stock market ructions add some fuel to the debate over whether shares are entering a bear market. It is often the sector driving shares in a bull market (technology) which drags stocks lower in a bear market.

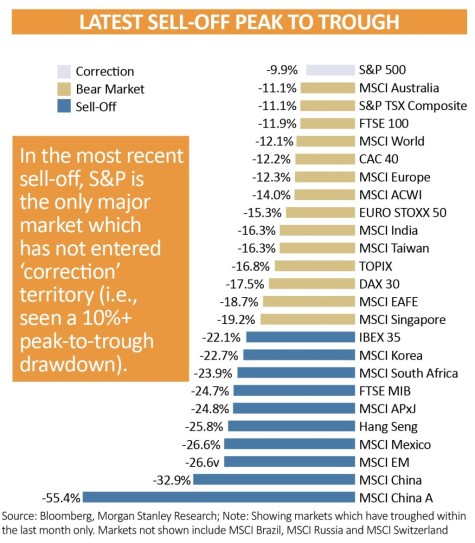

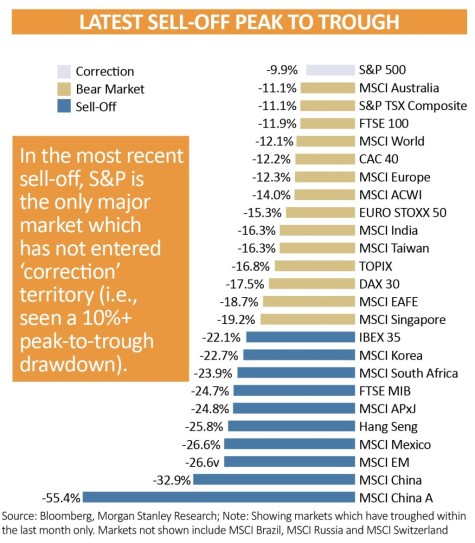

Investment bank Morgan Stanley has examined more than 900 big sell-offs across 28 markets to determine if we are indeed in a bear market, characterised as when equities fall by 20% or more from their peak.

A bull market is a rising market characterised by optimism, investor confidence and expectations that strong results will continue. A bear market is the opposite with prices falling, a generally pessimistic outlook and increased fear of losses.

Morgan Stanley says that while the US might be experiencing a correction within an ongoing bull market, the rest of the developed world is heading for a bear market, with ‘the degree to which valuations have repriced’ leaning ‘more towards the latest sell-off being a bear market’. Emerging markets are already in bear market territory in its view.

Investors should be interested in these trends. You must not ignore what is happening in the wider market and if you plan to dip into your investment pot sooner rather than later, reducing your equity exposure might be a sensible consideration.

Hasty action is definitely to be avoided for someone who is looking to stay invested for the long-term. Our main feature this week examines the power of compounding and how staying invested in a stock, particularly if it pays dividends, can be really lucrative, even if the share price is moving up and down. (TS)

‹ Previous2018-11-15Next ›

magazine

magazine