A new report from consultant PwC suggests the UK economy could remain on a modest growth path in the years ahead but highlights some key pressure points including rising levels of debt.

While a reduction in government borrowings is expected, households and companies are expected to borrow at faster rate than economic growth. As a result, an increase in the overall ratio of debt-to-GDP from 252% in 2017 to 260% in 2020 is forecast.

Despite the mounting borrowings, the researchers expect the Bank of England to boost interest rates from 0.75% to 1% in mid-2019. Under the assumption that the Bank of England gradually increases rates back to 2% by 2023, total debt servicing costs could rise from 7.7% of GDP in 2017 to around 9.6% in 2023.

This could have implications for banks, if the situation results in a higher proportion of bad debt, as well as consumer-facing businesses if households are forced to rein in spending to get on top of their finances. Investors in these sectors should therefore be watching these trends closely.

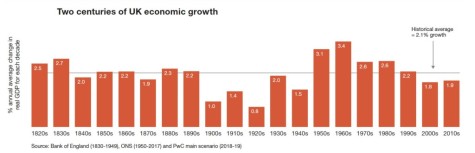

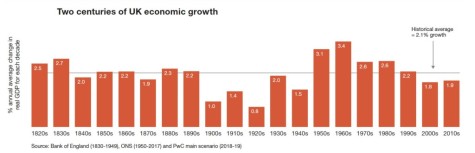

PwC notes that its projections mean average levels of growth will be comfortably below 2% in each of the first two decades of this century.

This represents the weakest performance in any decade since the Second World War and longer-term into the 2020s the consultant expects UK growth to remain at around 1.75% thanks to the effects of an older population.

PwC believes growth could be pushed back up towards the historical average of 2.1% through supporting the application of artificial intelligence, more efficient tax and regulatory systems, encouraging older people to remain in the workforce and maintaining ‘open trading relations with the EU and the rest of the world’.

This final point could be crucial as these estimates all have the caveat that they depend on the outcome for Brexit which still remains uncertain. (TS)

‹ Previous2018-11-15Next ›

magazine

magazine