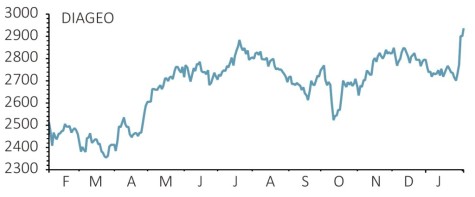

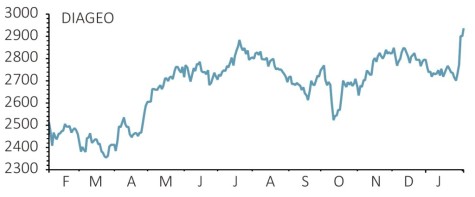

Diageo (DGE) £29.39

Gain to date: 4.9%

After a period of languishing in the red, our August 2018 ‘buy’ call on drinks maker Diageo (DGE) is refreshingly in the black.

Our patience with the Johnnie Walker whisky-to-Smirnoff vodka maker has thus been rewarded.

Forecast-beating first half results (31 Jan) and an increase in the share buyback from £2.34bn to £3bn for the year ending 30 June 2019 provided catalysts for the latest upward share price movement.

Organic net sales growth of 7.5% and organic operating profit growth of 12.3% were both ahead of consensus estimates with the beat driven by the emerging market regions of Latin America, Africa and Asia.

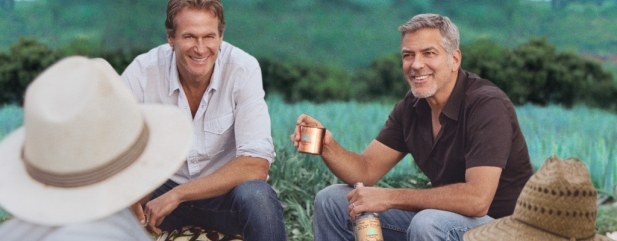

Diageo also grew sales by 4.7% in the US, where management is optimistic the Captain Morgan-to-Casamigos brands owner can continue to serve up growth in line with or ahead of the market.

This is a high-quality company with global scale and brand power, defensive characteristics including strong free cash flow and long term growth potential in emerging markets including China and India.

SHARES SAYS:

We’re sticking with Diageo for its globally-diversified earnings, cash generation and capital returns.

‹ Previous2019-02-07Next ›

magazine

magazine