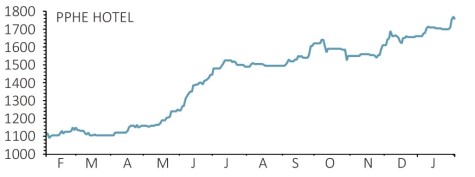

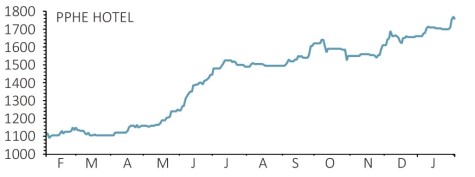

PPHE Hotel (PPH) £17.74

Gain to date: 25.8%

PPHE Hotel (PPH) has continued to enjoy strong share price gains, driven by positive trading updates and bullish broker comment.

It has reported 6.7% growth in like-for-like total room revenue for 2018, driven by improved trading across all its operating regions. The good performance also benefited from a site in Amsterdam being renovated and having its full room inventory available once more, plus the benefits of refurbishment at two London hotels which were completed in 2017.

FinnCap analyst Guy Hewett says there is potential to ‘significantly enhance’ asset values in Amsterdam and Croatia via investment, helping to attract more tourists and drive up room rates.

Berenberg analyst Ned Hammonds is also positive, saying: ‘PPHE stated that its EPRA net asset value per share was £24.21 at the end of June. We think it will have increased slightly over the remainder of 2018, partly due to the extension of Park Plaza London Riverbank.

‘In addition, we believe the current refurbishment projects and the development of art’otel London Hoxton have the potential to create further value over time. On top of this, PPHE continues to focus on acquisition opportunities that could drive additional growth and create value.’

SHARES SAYS:

We remain optimistic about PPHE’s prospects thanks to its pipeline and strategy to boost the value of its assets by refurbishing existing properties.

‹ Previous2019-02-07Next ›

magazine

magazine