Renishaw (RSW) £43.68

Gain to date: 14.8%

Half year results from precision engineer Renishaw (RSW) were well received by the market despite pre-tax profit dipping 6.9%

to £61.6m.

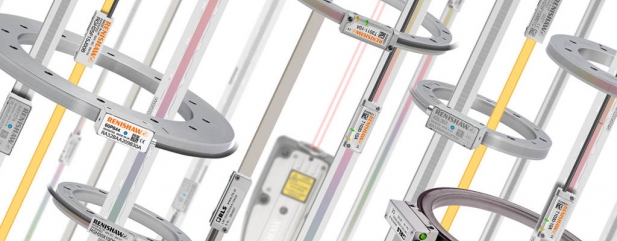

The business is doing very well in all of its geographic territories apart from the Far East where revenue slipped 1% in the six-month period. It attributes this weakness to a slowdown in demand for encoder products and from large end-user manufacturers of consumer electronic products.

Fortunately Renishaw is a diverse business in terms of customers. Its metrology business has seen ‘strong growth’, so too its healthcare operations.

The company has a strong balance sheet with a £100.5m net cash balance at the end of 2018. Inventory balances rose by about 10% in the second half of last year amid increased trading levels, expected future demand and stockpiling in case of Brexit-related supply chain delays.

SHARES SAYS:

We’re pleased with Renishaw’s progress and aren’t worried by the profit slip. The market should have already expected weakness in its consumer electronic products given negative news from that industry of late.

Renishaw is a strong, well-invested business which has a track record of delivering superior returns. We have upmost faith in it being able to navigate tougher market conditions. Keep buying.

‹ Previous2019-02-07Next ›

magazine

magazine