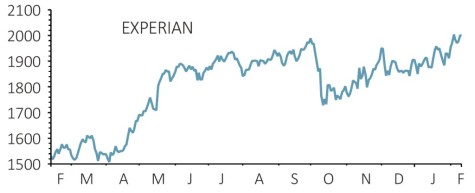

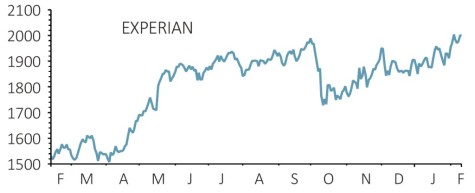

Experian (EXPN) £20.00

Gain to date: 7%

Credit data expert Experian (EXPN) is one of those companies which quietly gets on with the job. For investors that means it is a stock you can comfortably own and not worry about on a daily basis.

Having said to buy the shares last August at £18.69, Experian now trades 7% higher. In fact, last week the shares hit an all-time high of £20.04.

A trading update on 17 January showed a continuation of its strong performance with 9% organic revenue growth in the third quarter at constant exchange rates. That was slightly better than analyst forecasts of 8% growth. Investment bank UBS says the 9% growth rate in the third quarter was Experian’s best since 2013.

North America trading was very good with new products being a hit with customers. There was also strong credit volumes in its business-to-business arm. And it looks as if the outlook is getting better for its Latin American operations, judging by the commentary in its trading update.

The next big catalyst for the share price will be full year results on 15 May. Analysts expect $1.2bn pre-tax profit for the year, rising to $1.33bn in 2020 and $1.48bn in 2021.

SHARES SAYS: This is one to tuck away for the long-term.

Keep buying.

‹ Previous2019-02-14Next ›

magazine

magazine