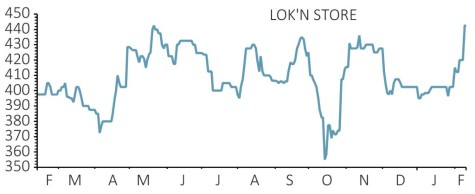

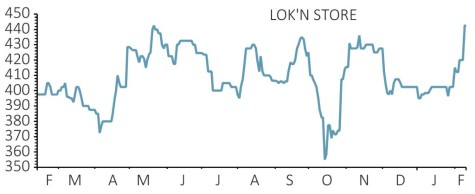

Lok’n Store (LOK:AIM) 447p

Gain to date: 10.4%

Storing people’s excess stuff when they move seems a simple business model. Sure enough, self-storage play Lok’n Store (LOK:AIM) has delivered a solid return since we added it to the Great Ideas portfolio in April 2018.

On 11 February it reported a robust first half trading performance, with sales up 9.2%, the fastest rate of growth since 2015. Occupancy was up 8% and prices were up 1.4%.

The company also announced the £7.6m sale of its document storage business at the beginning of February which will allow the company to focus on its self-storage expansion plans.

Its recently-opened stores in Dover and Cardiff are performing well and as chief executive Andrew Jacobs observes the fixed cost nature of these stores means revenue growth will drop through on the earnings side and help support dividends.

Broker FinnCap observes: ‘Self-storage peers are valued at a 40% premium to latest historic net asset value (NAV). Lok’nStore is valued at a 12% discount to its July 2018 NAV.

‘Alongside our forecast of faster EBITDA (earnings before interest, tax, depreciation and amortisation) growth than its peers, we continue to view this as a very attractive buying opportunity’.

SHARES SAYS: We remain fans of the company and its growth strategy. Keep buying.

‹ Previous2019-02-14Next ›

magazine

magazine