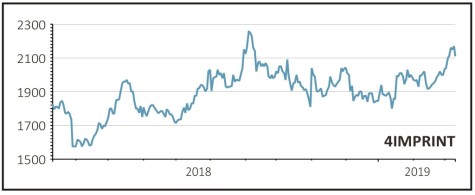

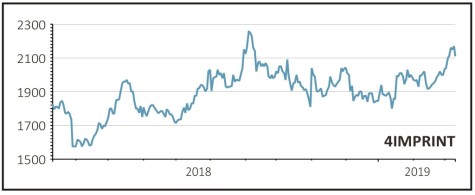

4imprint (FOUR) £21.90

Gain to date: 11.6%

Promotional products group 4imprint (FOUR) is trading well, as illustrated by a robust set of full year numbers on 5 March.

The company posted revenue up 19% to $738.4m, putting it comfortably on course to hit its 2022 turnover target of $1bn. This was backed by a 17% increase in orders, with the acquisition of 279,000 new customers and ‘stable’ retention rates suggesting the company’s recent marketing investment is paying off.

In a show of confidence in the prospects for the business the dividend was also hiked 20% to 70c. The balance sheet looks strong with cash of $27.5m at the year end. Further marketing spend is planned and the company will also put $5m towards an upgrade of its Oshkosh distribution centre.

WH Ireland analyst Nick Spollar says: ‘Given the success of the brand awareness campaign, and new capacity at Oshkosh, we feel that this is another year which has good potential for further upside (and with a relatively modest rating by historical standards of this company).’

SHARES SAYS: We are encouraged by these results and believe investors should keep buying.

‹ Previous2019-03-14Next ›

magazine

magazine