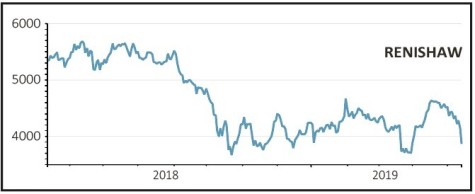

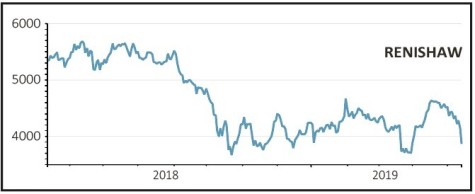

Renishaw (RSW) £39.32

Gain to date: 3.4%

Just as precision measurement kit maker Renishaw (RSW) was beginning to regain some momentum following its profit warning in March, it promptly warned again (14 May).

The market appears to have largely taken the news in its stride, with the stock falling 15% at the open on the news but recovering quickly to trade only 6% lower by the middle of the trading day.

Slowing demand from consumer electronics markets in Asia look to be the culprit again and the current trade tensions between the US and China are unlikely to be helping in this area.

The company downgraded its guidance for the 12 months to 30 June after its profit for the first nine months of its financial year fell 19%. Pre-tax profit for the nine months through to March dropped to £84.8m, down from £104.4m a year earlier.

Revenue inched up 0.3% to £431.1m; Renishaw says it now expects full-year revenue to be in the range of £580m to £600m, down from previous guidance of £635m to £665m.

Pre-tax profit is now seen in the range of £111m to £126m, down from previous guidance of £146m to £166m.

SHARES SAYS: Renishaw is a quality company and notwithstanding these recent mis-steps, we remain positive. We will however be watching the guidance which accompanies full year numbers closely. Sit tight.

‹ Previous2019-05-16Next ›

magazine

magazine