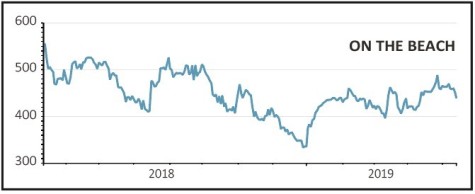

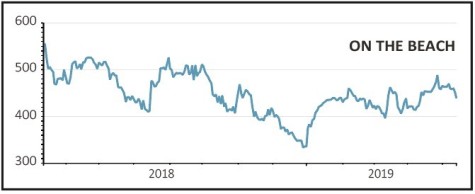

On The Beach (OTB) 438p

Gain to date: 21%

In a battered market where bookings have shrunk 10% in 2019, online beach holiday retailer On The Beach (OTB) has stormed ahead of its competition with a 12% rise in pre-tax profit to £11.9m and a 41% jump in revenue to £63.5m in the six months to 31 March.

And with Brexit still uncertain – putting off some holidaymakers from booking – the company has sounded a more cautious note for the remainder of the year.

Chief executive Simon Cooper says: ‘Whatever upset we face in the market, it affects our competitors too, and it will affect them more than us. Unlike tour operators we don’t have any fixed inventories we need to sell at a discount to protect sales,’ he says.

While the outlook remains cloudy until Brexit is resolved, Cooper adds that group will start to feel the benefit later this year from its acquisition of operator Classic Collection as it looks to break into the offline market, which is worth around £7bn a year, according to investment bank Liberum.

SHARES SAYS: On the Beach is holding up well in a tough market and its acquisitions could supercharge growth. Keep buying.

‹ Previous2019-05-16Next ›

magazine

magazine