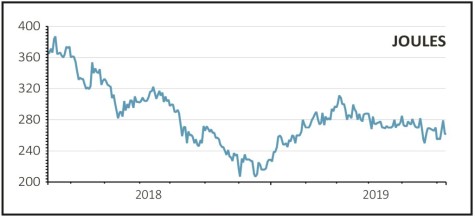

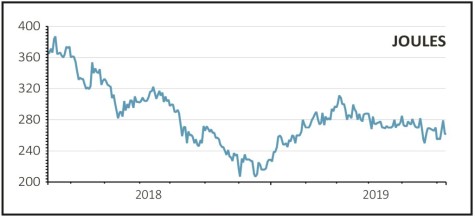

Gain to date: 8.1%

Our bullish January call on premium British lifestyle brand Joules (JOUL:AIM) is a pleasing 8.1% in the money and we remain positive with the retailer continuing to confound the wider sector doom and gloom.

In a positive pre-close trading update, the clothing, accessories and homewares seller guided full year pre-tax profit to be at the upper end of the £14.8m-to-£15.3m consensus range following a year of strong sales momentum and disciplined cost management.

In an earnings upgrades cycle since its May 2016 IPO, Joules grew sales by 17.2% to £218m in the 52 weeks to 26 May with especially strong growth in the e-commerce channel.

Delivering solid growth in retail at a time when sector rivals are floundering, Joules’ distinctive brand is also gaining traction overseas. Within the wholesale business, the US and Germany now speak for half of sales thanks to growth with the likes of Dillards and Nordstrom.

Investment bank Berenberg argues the e-commerce opportunity remains undervalued and sees potential for further upgrades from Joules’ flourishing licensing business, which is on a growth tear.

SHARES SAYS: We remain very excited about the long-term global growth potential of the Joules brand and believe the retailer can continue to outperform sector peers. Keep buying.

‹ Previous2019-06-13Next ›

magazine

magazine