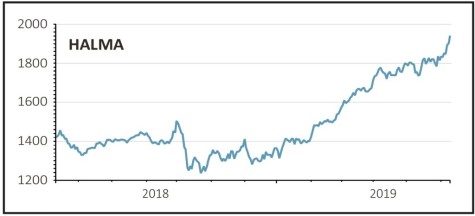

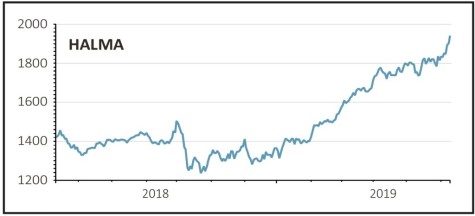

Halma (HLMA) £19.41

Gain to date: 53.8%

Shares in electronics equipment maker Halma (HLMA) hit a new all-time high of £19.42 this week after the company reported record revenue and profit for the 16th consecutive year.

Revenue for the 12 months to 31 March grew by 13% to £1.2bn thanks to strong performances in the US and UK and ‘solid’ growth in Asia Pacific.

Thanks to tight cost control, adjusted pre-tax profit rose by 15% to £245.7m meaning a return on sales of 20.3%, also a record.

With strong cash generation and a robust balance sheet, the dividend has been lifted by 7% to 15.7p making Halma one of the few companies to have raised its dividend 40 years in a row.

The firm’s focus on health, safety and environmental markets continues to drive long-term growth and pleasingly order intake since the start of April is higher than both orders and revenue in the same period last year.

On almost 40 times 2020 earnings the shares can’t be described as cheap and given their rapid ascent there is likely to be profit-taking if the market wobbles. However it remains a high-quality investment and we would buy more on a sell-off.

SHARES SAYS: Although the valuation is demanding this is another record performance. Hold on to the stock and buy more if the market wobbles.

‹ Previous2019-06-13Next ›

magazine

magazine