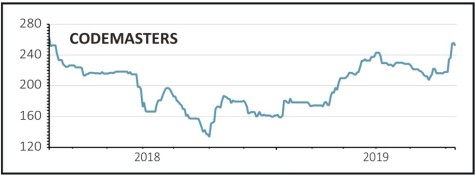

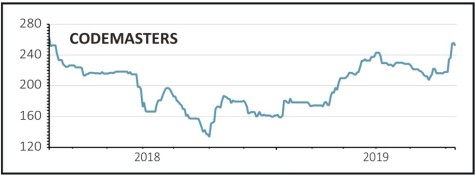

Codemasters (CDM:AIM) 251p

Gain to date: 37.5%

We correctly anticipated that Codemasters’ (CDM:AIM) shares would regain their momentum after a period of poor performance. After a near-40% return it’s time to lock in those gains.

The shares have benefited from deals announced with Chinese giant NetEase, with the prospect of selling into a market with 600m gamers, worth an estimated $25bn a year.

The company’s F1 game GRID was one of only a few sports games to be selected for Google’s new cloud streaming service, Stadia, due to launch in November.

The service is expected to attract a wider audience of gamers, is competitively priced at $9.99 per month and can be played across different platforms, with no need for hardware. Because the games run in the cloud, initial downloads will not be necessary, removing frustration among players.

The share price has moved to reflect these exciting new developments. There is now arguably a news vacuum, creating uncertainty before the financial benefits start to flow through.

Broker Liberum doesn’t expect material revenues from the NetEase partnership until 2020 or 2021. Codemasters has already booked most of the $8m in guaranteed three-year revenues from the venture.

Without the contribution from the NetEase venture, recently reported full year revenue growth of 12% to £71.2m would have been only 3%.

SHARES SAYS: We think the market will be more circumspect until evidence of traction from the two growth initiatives start to emerge. Time to cash out.

‹ Previous2019-06-13Next ›

magazine

magazine