Investors are excited about the potential of increased earnings and substantial costs savings after Avon Rubber (AVON) unveiled a long-mooted US acquisition.

On 7 August the £535m defence technology company announced plans to acquire the ballistic protection business from US specialist materials conglomerate 3M, including the rights to the Ceradyne brand, which makes body armour and helmets for the US military.

The acquisition will cost $91m with up to an extra $25m payable depending on the outcome of various legacy product contract tenders. The deal will be funded out of existing cash and borrowing facilities.

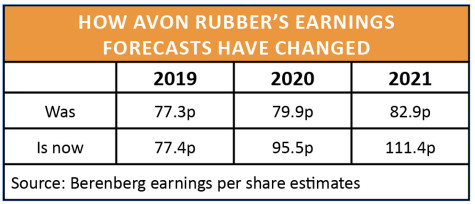

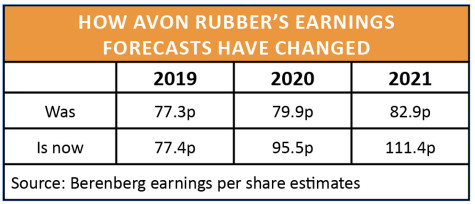

This is a deal that some analysts have been watching and waiting for 18 months to happen, but it is only during the past week that the full scope for financial benefits to Avon Rubber have appeared in updated forecasts.

‘This is a quality acquisition that surpasses our expectations both strategically and financially, and drives our 20% to 34% earnings upgrades,’ said Berenberg’s capital goods and engineering team.

Berenberg’s analysis runs along twin lines. They see the deal widening Avon’s product range, bolstering average content per soldier, deepening its already strong relationship with the US Department of Defence and strengthening its own research and development capability.

But stripping out duplicated costs form a second line of value for Avon Rubber and its’ shareholders down the line. Estimates suggest up to $5m a year of savings can be delivered over the next couple of years from a $10m upfront investment, creating value for investors beyond 2020.

Beyond these calculations there is also thought to be considerable scope to cross-sell Ceradyne products to Avon’s customers outside of the US, where Ceradyne currently earns more than 90%

of its revenues.

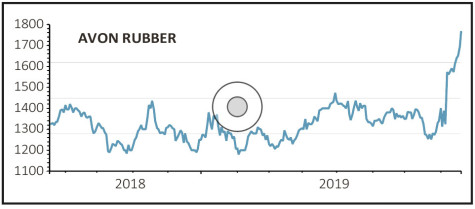

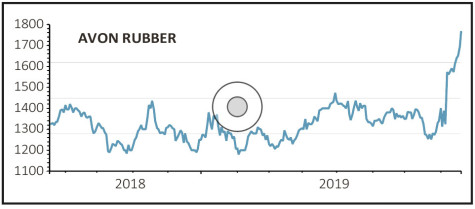

The market was quick to react to the implied benefits to the Avon investment case, with the company’s share price jumping 19% from £13.24 to £15.72 on the day that the acquisition was announced. In the days since then the stock has continued to rally strongly, hitting a record £17.26 on 20 August.

This implies a 31 December 2020 price to earnings multiple of 18.1, falling to 15.5 for the 2021 calendar year.

Berenberg believes that acquisitions are likely to remain a significant part of Avon Rubber’s strategic roadmap in the near-term.

‹ Previous2019-08-22Next ›

magazine

magazine